Data Point

Cox Automotive Analysis: Ford Motor Company’s Q4 2023 U.S. Market Performance

Monday February 5, 2024

Article Highlights

- Ford’s fourth-quarter sales rose a scant 1%.

- Ford beefed up incentives to an average of $3,145 per vehicle.

- Ford’s ATP slipped less than 1% to $55,614.

The impact of the six-week UAW strike against the Detroit automakers will be the focus of Ford’s fourth-quarter and full-year financial results when they are posted after the stock market closes on Tuesday, Feb. 6. The strike began late in the third quarter and continued well into October, so the fourth quarter saw the biggest hit.

Among the first Ford strike targets was the Michigan plant that builds the popular Ford Bronco SUV and Ranger pickup truck. Sales of both plummeted due to the strike that caused inventory depletion. The UAW then struck Ford’s Chicago plant that produces the Ford Explorer, Lincoln Aviator and Ford police vehicles. Most damaging was when the UAW expanded its strike to include Ford’s most important truck assembly complex in Louisville, Ky., where Ford builds the high-profit-margin Ford Super Duty pickup trucks alongside the revenue-generating Ford Expedition and Lincoln Navigator.

In the fourth quarter, Ford managed to squeeze out a 1% sales increase in the U.S. compared to the previous year, though it underperformed the market, which was up 8%. That caused Ford’s market share to fall to among the lowest levels in recent history. Ford beefed up incentives substantially at year-end, like the rest of the industry. Ford’s average transaction price edged up 1% as growth in ATPs generally slowed through 2023.

Here are some data points from Cox Automotive on Ford Motor Company’s Q4 market performance in the U.S., the automaker’s most important market.

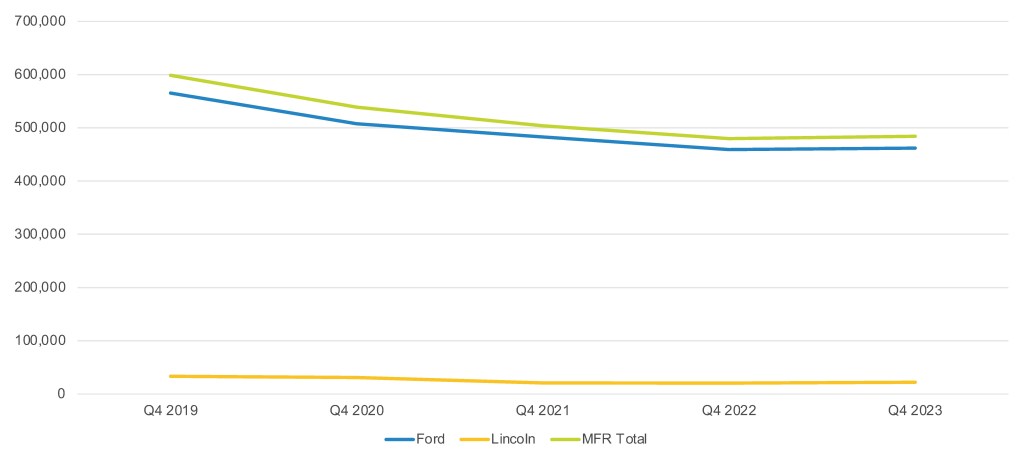

Ford’s Q4 Sales Rose a Scant 1% From the Year-Earlier Quarter

Ford Motor Co. sold 484,458 Ford and Lincoln vehicles in the fourth quarter, an increase of only1% from the year-earlier quarter, according to Cox Automotive calculations. Ford Motor remains well off its pre-pandemic sales levels when it typically sold 500,000 to nearly 600,000 units in the fourth quarter during the 2019 to 2021 timeframe. The Ford brand sold 462,081 units in the latest fourth quarter, eking out only a 0.6% increase, marking its second-lowest fourth-quarter sales in at least five years.

Ford Motor Company U.S. Sales Performance for Q4 2023

The toll was evident in models made at plants that went on strike. Ranger sales were a measly 831 units, down 92% from the year earlier. Typically, Ranger sales reach at least 20,000 to 30,000 units in any fourth quarter. Bronco sales plummeted 54% to just over 14,000 units when 25,000 to 30,000 has been normal the past couple of years. F-Series sales slipped by 5% to 177,419 units, the lowest for any fourth quarter in at least five years. Expedition sales fell 17% to under 17,000 units. Explorer, which had plenty of inventory as the strike started, suffered only a 5% sales decline.

Offsetting the declines, the Bronco Sport had a sales surge of 59% to more than 31,000 units, the highest for a fourth quarter since before the pandemic. Thanks to strong fleet orders, sales of E-Series commercial vans were up 26%, reaching their highest level since 2019. The electric Mustang Mach-E had sales up 5% to just under 12,000 units, its best performance in any fourth quarter since it was introduced three years ago. The Maverick, which comes standard as a hybrid, also had its best sales since its introduction three years ago, up 22%.

Lincoln finally turned things around, posting sales of 22,377 units, up 9% from the year-earlier quarter. Though Lincoln sales were the best in the past two years, they remained below the 30,000-plus sales for the quarter that was achieved in 2019 and 2020.

Likely helped by richer incentives, all Lincoln models but one – the Corsair – posted sales above last year’s fourth quarter. The revenue-rich Navigator posted a 3% increase to 4,164 units. The volume-leading Aviator had sales up 11% to 5,875. Nautilus sales soared by 42% to 5,437 units. Corsair sales fell 7% to just under 7,000 units.

Ford’s Market Share Falls Well Below 13%

Underperforming the industry, which had sales up 8% in the quarter, Ford Motor Co.’s market share closed the fourth quarter at 12.41%, down 0.87 percentage points, according to Cox Automotive data. That was the automaker’s lowest market share in at least the past five years. Its share typically is above 13%.

Ford brand’s market share was 11.84%, its lowest in at least five years. Lincoln’s share was flat at 0.57% compared to a year ago but below 2019 to 2021 levels.

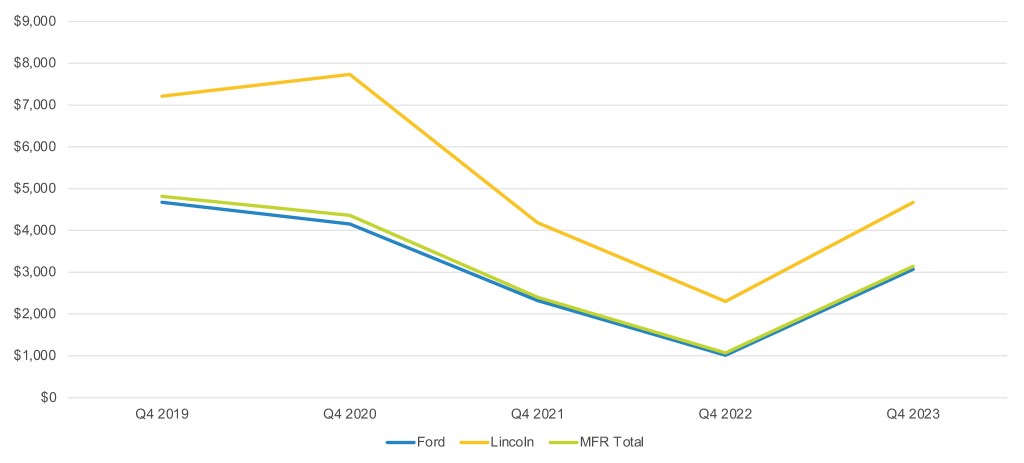

Ford Beefed Up Incentives to an Average of $3,145 per Vehicle

Ford Motor Co. increased incentives in the fourth quarter to an average of $3,145, up 195% from the year earlier, according to Cox Automotive calculations. Year-ago incentives were unusually low across the industry due to tight inventories caused by the global computer chip shortage.

FORD MOTOR COMPANY U.S. INCENTIVE SPENDING FOR Q4 2023

Ford brand’s incentives were ramped up by 203% to an average of $3,071 per vehicle. Lincoln’s incentives got a 103% boost to an average of $4,670.

While Ford and its brands had significantly higher incentives this year than last, they still have not reached the levels seen before the pandemic. Ford Motor Co., in total, had incentives averaging well above $4,000 per vehicle before 2020. Ford brand incentives typically were above $4,000 per vehicle. Lincoln incentives averaged a hefty $7,000 plus per vehicle in 2020 and earlier.

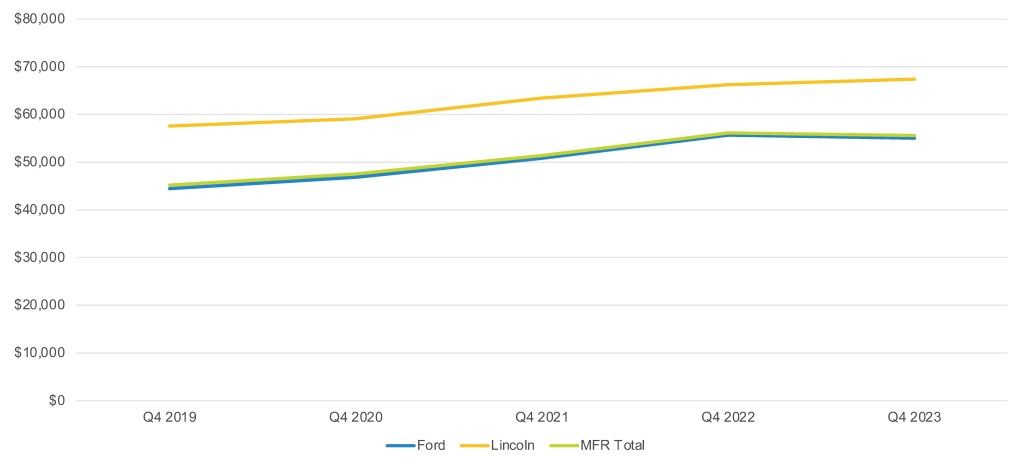

Ford’s ATP Increased Less Than 1% to $55,614

Ford Motor Co.’s average transaction price (ATP) in the fourth quarter was $55,614, up almost 1% from the year earlier, according to Cox Automotive calculations. The U.S. auto industry in total closed December with an ATP of $48,759, down 2% from the year earlier, according to Kelley Blue Book.

FORD MOTOR COMPANY U.S. AVERAGE TRANSACTION PRICE FOR Q4 2023

Ford brand’s ATP slipped 1% to $55,043, with the brand having mostly gainers and only a few that lost ground. Vehicles in short supply caused by the strike saw strong ATPs. The Bronco’s ATP surged by 15% to $64,120, its highest ever. A 9% hike pushed the Ranger’s ATP beyond $42,000 for the first time.

Also affected by the strike, the Expedition, Ford brand’s priciest model, had a 4% increase in ATP to $76,976. The F-Series had a 1% gain to $67,010.

An illustration of the competitive and price-cutting EV market, the Mustang Mach-E saw its ATP drop 4% to $56,995, its lowest price for any fourth quarter since it was introduced three years ago and likely one of the reasons sales got a bump. In contrast, the Maverick got a 7% bounce, pushing its ATP to more than $30,000 for the first time in any fourth quarter. At $31,793, the Maverick has the lowest ATP of any Ford Motor Co. model.

Lincoln’s ATP edged 2% higher to $67,412, well above the ATP for the luxury segment, which fell across the industry by 9% to $62,523 in December, according to Kelley Blue Book. Most Lincoln models had ATPs about even compared to a year ago. The Navigator, Lincoln’s most expensive model, had a 3% gain in ATP to $105,538.