Data Point

Cox Automotive Analysis: Honda Motor Company’s Quarterly U.S. Market Performance

Wednesday February 1, 2023

Article Highlights

- Honda’s quarterly sales fell 11% from a year ago for a 7.1% market share.

- Honda slashed incentives by 35% to an average of $1,000 per vehicle.

- Honda’s average transaction price rose 7% to $38,324.

Honda Motor Company reported lower combined Honda and Acura U.S. sales in December, marking 17 straight months of decline. Sales for Honda’s third quarter of fiscal year 2023 – the October-December quarter – also dropped, making it the sixth consecutive quarter of declines.

For the past year, Honda had the lowest inventory of any automaker in the U.S. Honda attributes the drop in sales to a lack of inventory and ongoing supply issues. Even though supply issues are not completely resolved, the company is optimistic that higher sales volumes will be achieved in 2023.

In the U.S., Honda – the nation’s fuel-efficiency leader – saw sales in the quarter fall 11% year over year, despite relatively strong demand in the face of elevated gas prices. Inventory of Honda’s hybrids and most fuel-efficient models was among the lowest of the low. Honda hopes that increased inventory will bring back consumers.

On the plus side, Honda was able to slash incentives by 35% to $1,000 per vehicle for the first time in years and increase its average transaction price (ATP) by 7% to $38,324. Popular models in short supply had the biggest increases.

Here are some data points from Cox Automotive on Honda’s quarterly market performance in the U.S.

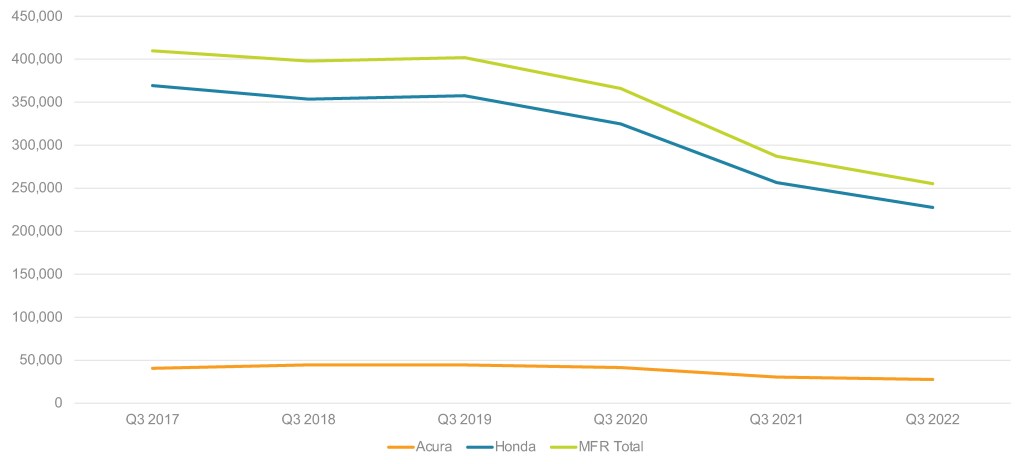

Sales and Market Share Down from Year-Ago Levels

American Honda’s U.S. sales totaled 255,250, down 11% from a year ago and almost 150,000 below the 401,000-plus of the same quarter in 2019 and down just over 30,000 from the same quarter in 2021. Honda’s total market share dropped to 7.1%, down 1.6 percentage points. In 2021, Honda owned more than 8% of the market.

Honda U.S. SALES PERFORMANCE FOR Q3 FISCAL YEAR 2023

Honda brand sales totaled 227,596 vehicles, down 11%. That pushed its market share down 1.5 percentage points to 6.3%. Most of Honda’s models were down by double digits in quarterly sales – Accord -1%, HR-V -30%, Civic -20%, CR-V -16% and Pilot -10%. Ridgeline was flat.

Acura sales dropped by 9% to 27,654 units. Its market share fell to 0.8%. Acura had only two models post gains – the limited-production NSX sports car and the volume-leading MDX SUV. Acura’s core mode, the popular MDX, was up 8%, selling 13,211 units. Acura sold nearly 7,000 units of the newly resurrected Integra, which was not in the lineup last year. And the soon-to-retire NSX sold 87 units in the quarter, as fans ensured they did not miss the opportunity to purchase this now-discontinued Japanese high-performance car. All other models saw double-digit declines, the biggest being the RDX, with a decrease of 61%.

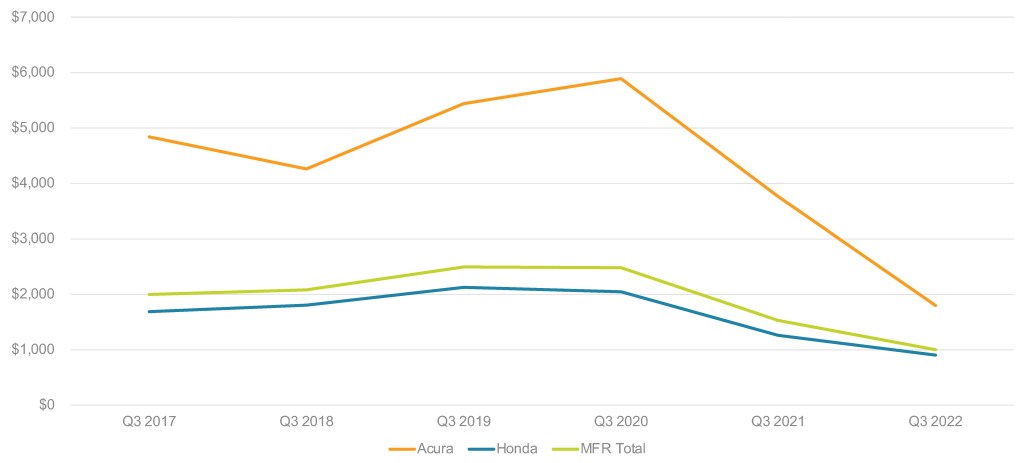

Incentives Slashed to Below $2,000 per Vehicle for First Time in Six Years

Honda drastically slashed incentives for the final quarter of 2022. In total, Honda cut incentives by 35% to an average of $1,000 per vehicle, according to Cox Automotive calculations. It was the first time in the past six years for the quarter that incentives averaged below $2,000 per vehicle.

Honda U.S. INCENTIVE SPENDING FOR Q3 FISCAL YEAR 2023

Honda brand incentives were slashed by 28% to an average of $903 per vehicle, the first time in the quarter it fell below $1,000 per vehicle. Acura incentives were reduced by 52% to an average of $1,799 per vehicle, though the past five years, Acura incentives averaged more than $3,000 per vehicle.

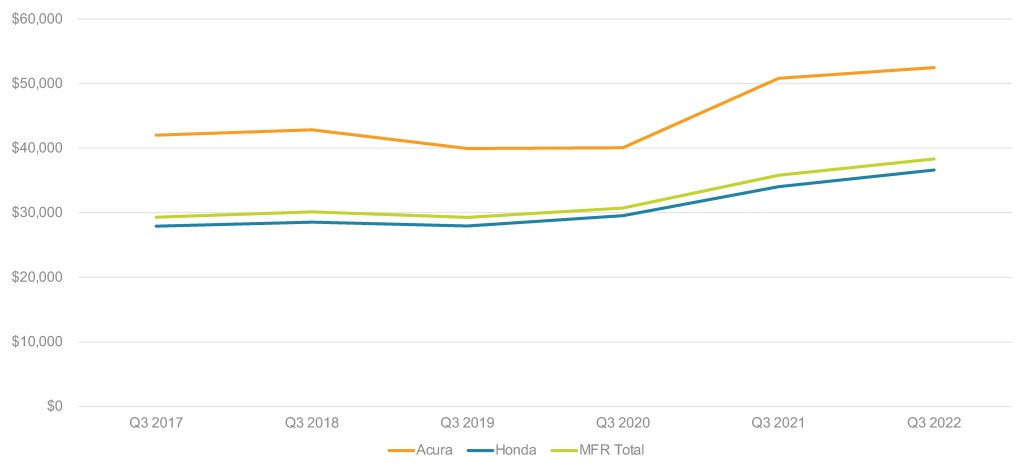

Honda’s Average Transaction Price Remain Over $39,000

Honda’s overall ATP rose 7.1% to $38,324 compared to the same quarter in 2021, according to Cox Automotive calculations. Popular models such as the Accord and Civic rose 2% and 8%, respectively. The highest increases were for the newly redesigned HR-V, up 9% to $29,882, and the Insight, also up 9% to $31,656.

Honda U.S. AVERAGE TRANSACTION PRICE FOR Q3 FISCAL YEAR 2023

Acura models mostly showed increases, with the biggest being the NSX, which saw ATP rising 53% for the quarter to an impressive $220,476. The TLX showed a 0.8% decline to $48,713. The new Integra had an ATP of $36,895.

Rebecca Rydzewski is a research manager for economic and industry insights for Cox Automotive.