Data Point

Cox Automotive Analysis: Nissan Quarterly U.S. Market Performance

Monday November 7, 2022

Article Highlights

- Nissan’s quarterly sales – combined Nissan and Infiniti brand sales – fell 23% from a year ago for a 4.5% market share.

- Nissan slashed incentives by 44% to an average of $1,345 per vehicle.

- Nissan’s average transaction price rose 10% to $37,138.

Nissan has warned continued supply chain constraints will impact its earnings, and access to computer chips will be key to its growth. Nissan reports financial results on Tuesday, November 8, for the July-to-September period, Nissan’s second quarter of its fiscal year that ends March 31, 2023.

In July, Ashwani Gupta, Nissan’s chief operating officer, spoke at a briefing where he said that 2022 would be driven by how many cars Nissan can make rather than how many the automaker can sell. Nissan has been making more money per car because it has not had to spend as much on incentives.

In the U.S., one of Nissan’s most important markets, sales dropped 23%, but transaction prices rose 10%, and incentives were slashed by 44%.

Here are some data points from Cox Automotive on Nissan’s quarterly market performance in the U.S.

Sales in the U.S. Down 23% Year Over Year, Market Share Below 5%

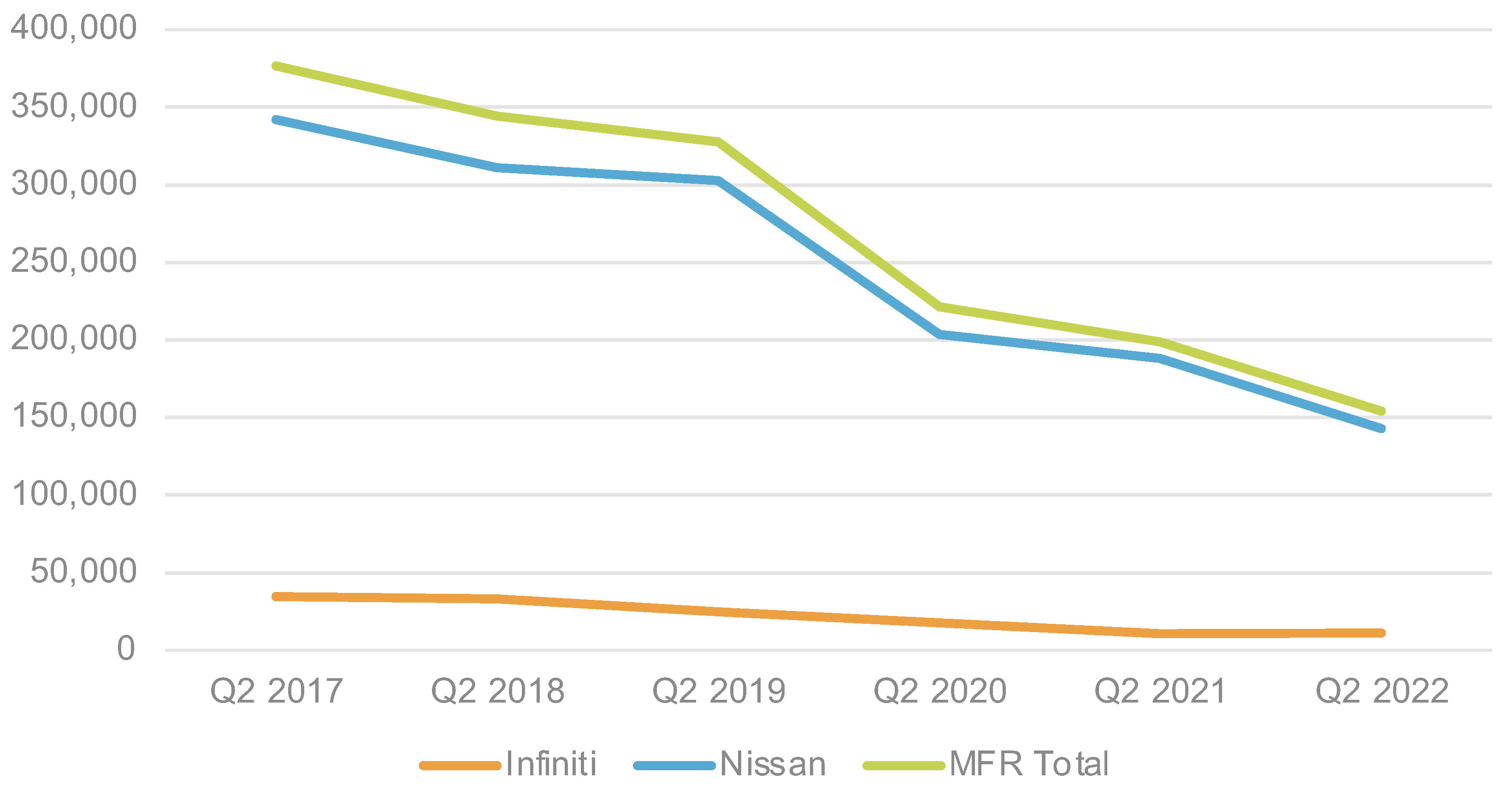

Nissan’s U.S. sales – combined Nissan and Infiniti brand sales – totaled 154,086, down 23% from a year ago and far below the 300,000-plus level of the same quarters of 2017, 2018 and 2019. Nissan’s total market share dropped to 4.5%, down 1.3 percentage points from the year before.

Nissan U.S. Sales Performance for Q2 Fiscal Year 2022

Nissan brand sales totaled 142,845 vehicles, down 24%. That pushed its market share down 1.3 percentage points to 4.2%. Nissan had only three models on the plus side of sales. Sales of the updated Altima were up by 103% to 27,512. Frontier sales increased by 13% to 13,187 units. The Armada large SUV also made gains showing an 8% sales increase to 4,089 units. Titan truck sales were down almost 75 percentage points to 1,275 units. This is largely due to a recall of 2020-2023 models for faulty parts in the transmission.

Infiniti sales were up a respectable 5% to 11,214 units. Its market share remained unchanged year-over-year at 0.3%. Infiniti had only one model with higher sales from the year before – the redesigned QX60 SUV, with sales rising more than 6,500%. All of Infiniti’s other models showed sales decreases ranging from the QX50 with a 7.9% decline to the Q50 at -82%.

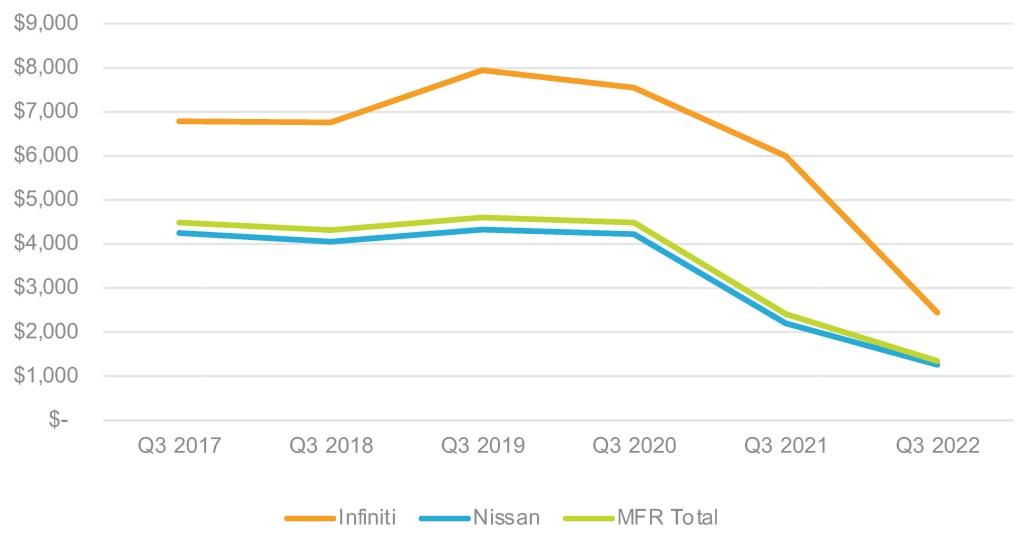

Incentives Drop Below $2,000 For First Time in Six Years

Nissan slashed incentives, which are generally high for the industry. In total, Nissan cut incentives by 44% to an average of $1,345 per vehicle, according to Cox Automotive calculations. It was the first time in the past six years for the quarter that incentives averaged below $2,000 per vehicle. The automaker is still above the industry average for incentives. Industry-wide, the average incentive in Q3 was $1,079.

Nissan U.S. Incentive Spending for Q2 Fiscal Year 2022

Nissan brand incentives were drastically reduced by 43% to an average of $1,259 per vehicle, the first time in the quarter it fell below $2,400 per vehicle.

Infiniti incentives were down by 60% to an average of $2,443 per vehicle. It was the first time ever that the brand’s incentives were below $5,000.

Average Transaction Price Pushed Up 10% Mostly by Infiniti

Nissan’s overall average transaction price (ATP) rose 10% to $37,318.

The Nissan brand’s ATP was up 8% to $35,316. All of Nissan’s models showed ATP increases apart from the Leaf, which declined by 4% to $37,398, according to Cox Automotive calculations. The Frontier and Versa showed double-digit ATP increases of 13% and 10%, respectively. The Altima, which doubled its sales this quarter, was up 2% to $30,977.

Infiniti’s ATP climbed 15% to $60,292. It pulled up price gains of all models sold, especially the QX80 at $81,003 and the QX60 at $63,292, a 41% increase.

Rebecca Rydzewski is a research manager of economic and industry insights for Cox Automotive.