Data Point

Cox Automotive Analysis: Nissan Quarterly U.S. Market Performance

Wednesday February 7, 2024

Article Highlights

- Nissan and Infiniti sales gained 6%, but market share slips.

- Nissan raised incentives to an average of $2,823 per vehicle.

- Nissan’s average transaction price dropped by 4% to $36,597.

Nissan Motor in Japan reports financial results for the October-to-December quarter February 8 and hopes to repeat the previous quarter’s performance, which featured a sharp 25% increase in profits on sales growth in most markets. The results exceeded analysts’ projections and prompted the Japanese automaker to raise its forecast for the full fiscal year that ends on March 31.

In the U.S., in the final quarter of calendar 2023, Nissan and Infiniti combined had sales up a modest 6% and that lagged the industry gain of 8%. Affordable models, the bestseller Rogue and the Titan, kept humming along at the close of 2023, but the close-out of the Maxima and lower sales of the aging Murano and Leaf EV limited overall sales performance.

Incentives continued to climb, as they did for the industry overall, and transaction prices softened. However, there is optimism for the next fiscal year, which begins April 1. Vinay Shahani has returned to the automaker as the new senior vice president of U.S. marketing and sales, and Nissan has set goals for higher sales and market share.

Here are some data points from Cox Automotive on Nissan Motor Corp.’s quarterly market performance in the U.S., one of its most important regions.

Nissan and Infiniti Sales Improve, up 6%

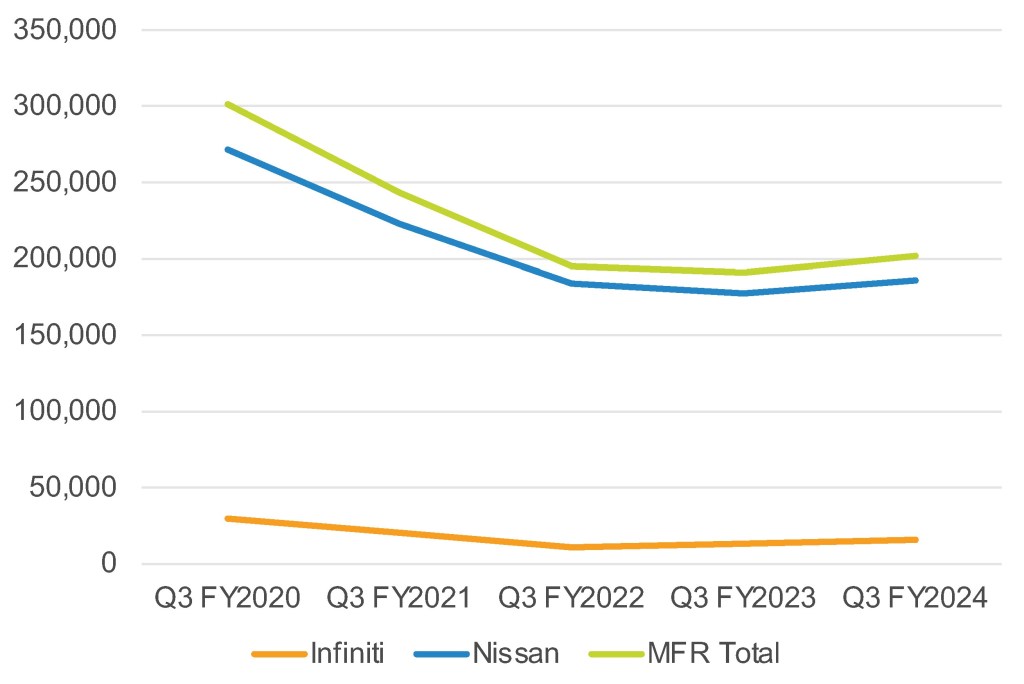

In the October to December quarter, Nissan Motor Corp.’s U.S. sales – combined Nissan and Infiniti brand sales – totaled 201,747, up a modest 6% from a year ago and below the industry’s gain of 8%, according to Cox Automotive calculations. Additionally, this total was approximately 100,000 units below Nissan’s pre-pandemic sales in 2019.

Nissan U.S. Sales Performance for Q3 Fiscal Year 2024

Underperforming the industry, Nissan Motor’s total market share was down 0.12 percentage points from the year before to 5.17%. While Infiniti saw a slight increase to 0.41% market share, up from 0.38% last year, Nissan brand saw its market share drop to 4.76%.

For the final quarter of calendar year 2023, Nissan brand sales totaled 185,878 vehicles, up a modest 5% year over year. The attractively priced Versa, Sentra, and Kicks models each improved by 71%, 42%, and 71%, respectively, helping to carry the increase overall by selling a total of 43,771 units. The popular Rogue saw a year-over-year increase of 7% or 60,367 units. The Nissan Titan pickup truck saw a sales gain of 47% to 3,782 units.

However, the Frontier, Maxima, Murano and Pathfinder dragged on sales. The Maxima, which is being discontinued, was down 53% to 981 units, and the Pathfinder was down 25% to 15,268 units. Nissan’s newest EV entrant held onto an increase in sales with 3,765 sold in the quarter, while the Leaf dropped dramatically to 1,348 units sold, down by 57%.

Nissan brand’s U.S. executives told their dealers attending the recent NADA show that it plans to retail 756,000 vehicles in the next fiscal year, which starts April 1, for a 6.1% retail market share. For the full calendar year 2023, Nissan’s share was 4.8%

Proving that luxury marques are still enjoying steady business, Infiniti sales were up 17% to 15,869 units. The Infiniti QX60 SUV continues to enjoy an increase in sales, up 12%, with 6,959 units. At the same time, the Q50 saw a 114% increase in sales to 1,179 units. The QX80 also increased by 36%, with 3,471 units sold. The QX50 was up 9% to 2,788 units.

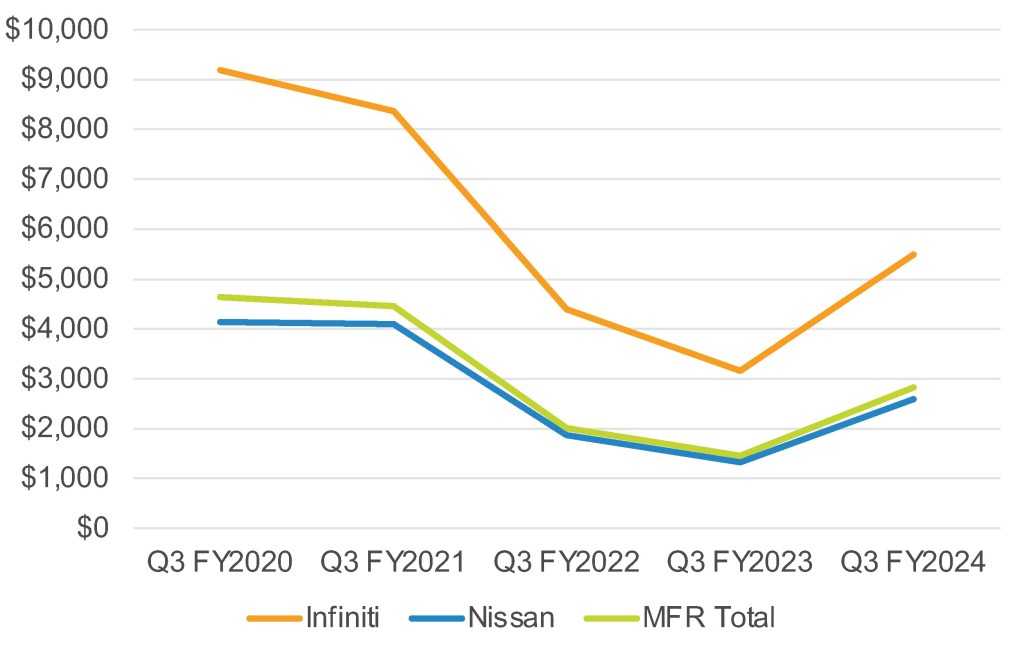

Nissan Raised Incentives to an Average of $2,823 per Vehicle

Nissan Motors raised incentive spending, which is already generally high for the industry. In total, incentive spending year-over-year was boosted by 94% to an average of $2,823 per vehicle, according to Cox Automotive calculations. Industrywide, automakers spent, on average, $2,511 per vehicle.

Nissan U.S. Incentive Spending for Q3 Fiscal Year 2024

Nissan brand incentives increased by 96% to an average of $2,594 per vehicle, up from last year’s average of $1,326 in the same quarter.

Infiniti incentives in the quarter were up 74% to an average of $5,503 per vehicle, still below pre-pandemic numbers in 2018 and 2019 but on the rise.

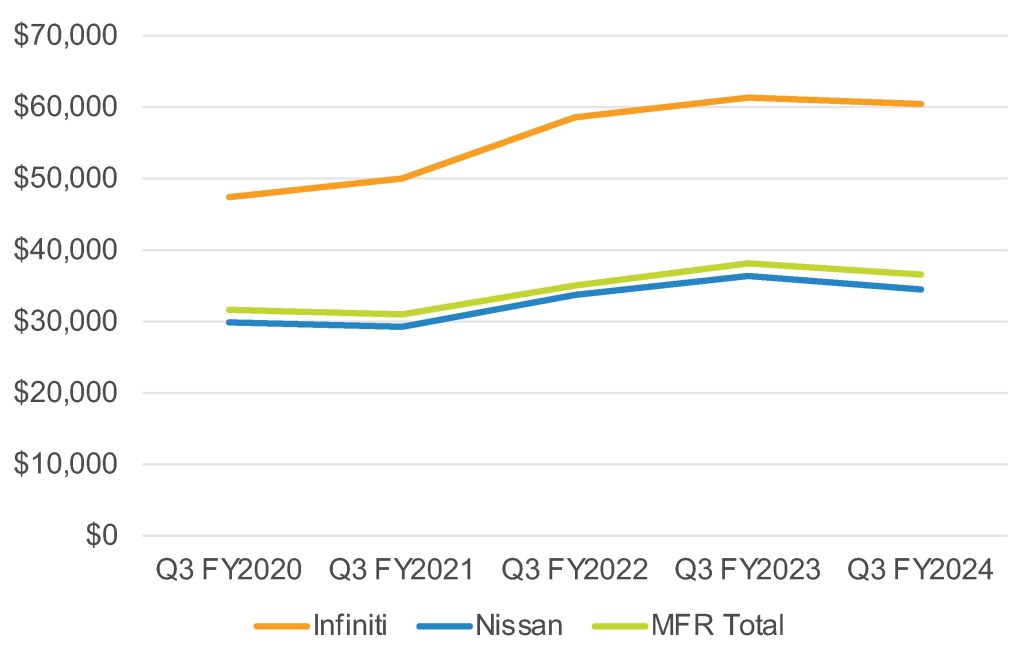

Nissan’s Average Transaction Price Dropped by 4% to $36,597

The Nissan brand’s average transaction price (ATP) in the final quarter of 2023 was down 5.1% year over year to $34,564. Most of Nissan’s models showed ATP decreases, from the Versa at 0.4% lower to the Leaf off 4.1%, according to Cox Automotive calculations.

Nissan U.S. Average Transaction Price for Q3 Fiscal Year 2024

Infiniti’s ATP was also down by more than 1.5% to $60,418. Almost all models saw ATP drop between 1% to 9%. Only one model, the Q50, was up only 0.3%.

Erin Keating, Executive Analyst, Senior Director, Economics and Industry Insights, Cox Automotive