Data Point

Cox Automotive Analysis: Nissan Quarterly U.S. Market Performance

Tuesday May 9, 2023

Article Highlights

- Nissan Motor Corp.’s quarterly sales in the U.S., combined Nissan and Infiniti brand sales, rose 17% from a year ago for a 6.6% market share.

- Overall incentives were inflated by 8.6% to an average of $2,006 per vehicle.

- Nissan Motor Corp.’s average transaction price rose nearly 11% to $38,340.

The most recent quarter was an eventful one for Nissan Motor Corp., as it altered its alliance with French automaker Renault and began charting a new direction. Nissan Motor Corporation, the third-largest automaker in Japan, reports financial results on Thursday, May 11, for the January-March period, Nissan’s fourth quarter of its fiscal year 2022, which ended March 31, 2023.

In the U.S., Nissan saw sales rise in the quarter, driven by its popular SUVs as well as Nissan’s old method of increasing sales – higher incentives and a boost in fleet sales. Inventory, a problem that has plagued the automaker since the pandemic, grew to above the industry average by March, which helped increase sales. However, Nissan is still struggling with producing products such as the new Ariya EV, the first of its latest foray into EVs beyond the Leaf.

Here are some data points from Cox Automotive on Nissan Motor Corp.’s quarterly market performance in the U.S., one of its most important regions.

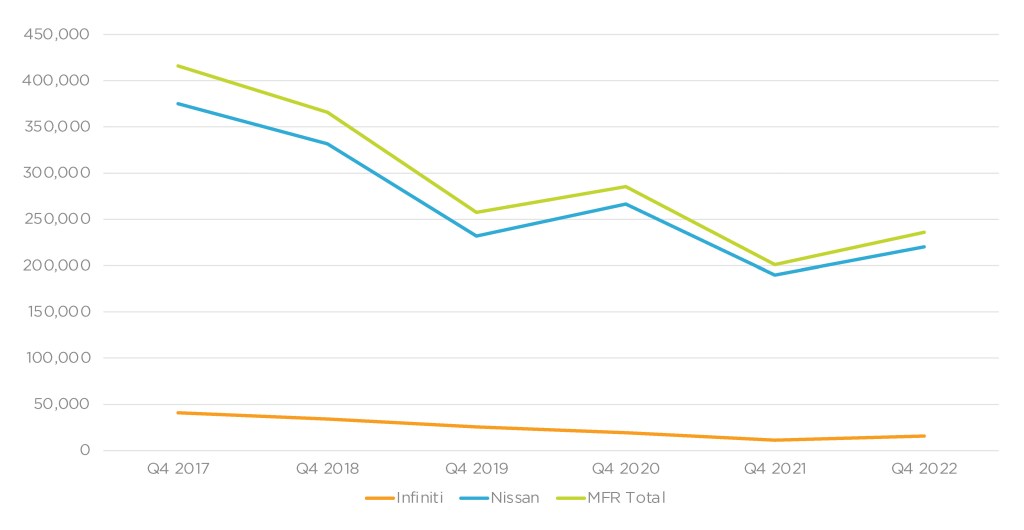

Nissan and Infiniti Sales Improve, up 17%

Nissan Motor Corp.’s U.S. sales – combined Nissan and Infiniti brand sales – totaled 235,818 for the quarter, up a healthy 17% from a year ago and above the industry’s gain of 8%. Still, it was below Nissan’s pre-pandemic sales volumes in 2018 and 2019.

Nissan U.S. Sales Performance for Q4 Fiscal Year 2022

With increased sales, Nissan’s total market share rose to 6.6%, up 0.5 percentage points from the year before. Both brands saw increases in market share for the quarter. Nissan now holds a 6.14% market share, and Infiniti is at 0.44%, up 0.1% from the previous year.

Nissan brand sales totaled 220,061 vehicles, up a robust 16%. Nissan’s quarterly sales bump was mainly driven by strong sales of its SUV lineup. Murano sales increased by 32% to 12,444 units, while the Pathfinder SUV made significant gains showing a 165% sales increase to 23,770 units. Rogue sales were up 69% to 76,499 units. Armada sales soared by 343% to 7,272 units. The compact Versa increased sales to 3,902 units, a 67% increase. The new Ariya EV sold 2,860 units for the quarter.

Infiniti sales were up a healthy 40% to 15,757 units. Infiniti had three models with higher sales from the year before – the redesigned QX60 SUV with sales of 7,139 units, a 182% increase, the QX55 with a gain of 8% to 1,463 units, and the QX80 saw a major sales gain of 199% to 3,183 units.

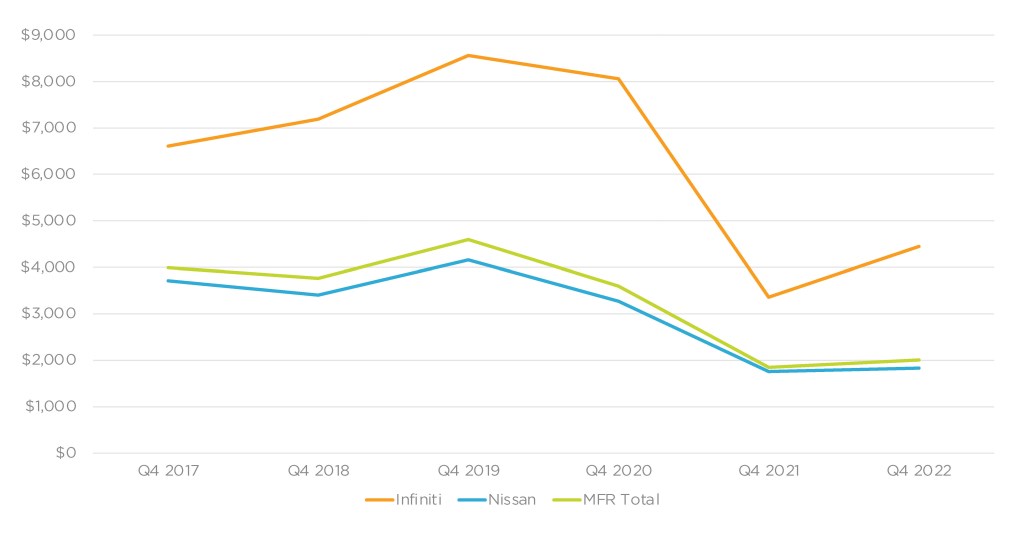

Nissan Raised Already Above-Average Incentives

Nissan Motor Corp. raised incentive spending, which is already generally high for the industry. In total, incentives were boosted by 8.6% to an average of $2,006 per vehicle, according to Cox Automotive calculations. The automaker is still above the industry average for incentives. Industry-wide, the average incentive for the January-March quarter was $1,516.

Nissan U.S. Incentive Spending for Q4 Fiscal Year 2022

Nissan brand incentives were increased by 4% to an average of $1,831 per vehicle, up from last year’s average of $1,758.

Infiniti incentives were up a whopping 32% to an average of $4,446 per vehicle, still far below pandemic-level incentives, which reached as high as $8,000 per vehicle.

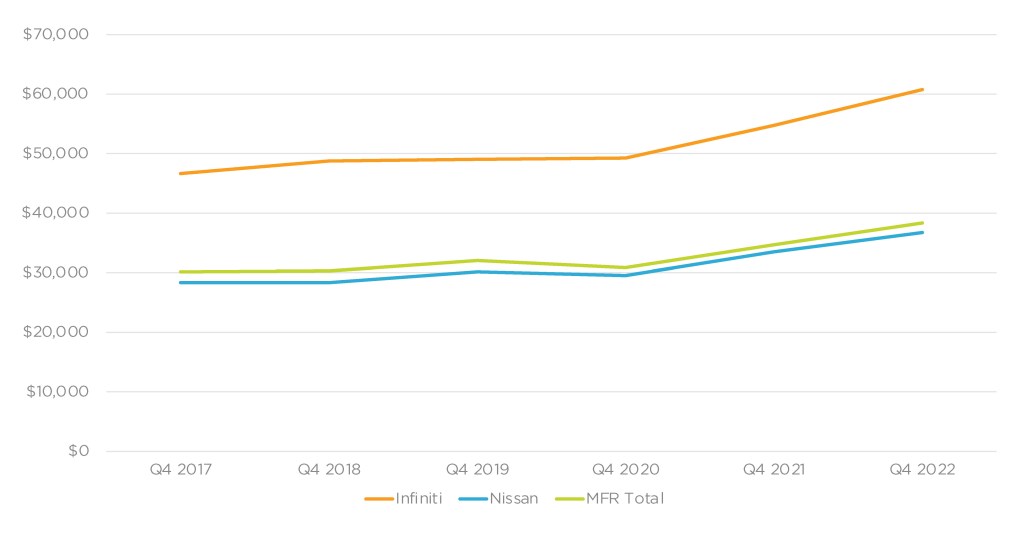

Nissan Motor Corp.’s Average Transaction Price Rose Nearly 11% to $38,340

Nissan Motor Corp.’s overall average transaction price (ATP) rose nearly 11% to $38,340.

Nissan U.S. Average Transaction Price for Q4 Fiscal Year 2022

The Nissan brand’s ATP was up 10% to $36,735. Most of Nissan’s models showed ATP increases, from the Sentra at 2% to the Altima at 5%. The Leaf was the biggest decliner, with its ATP dropping 6% for the quarter, according to Cox Automotive calculations.

Infiniti’s ATP rose by 11% to $60,754. The QX50 had the biggest gain, up 4% to $48,093. The Q60’s ATP slipped 3% to $60,668.

Rebecca Rydzewski

Rebecca Rydzewski is an automotive analyst with over 20 years of experience in the industry. She supports Cox Automotive’s OEM clients as well as the Mobility and Fleet Services business, focusing on Class 4-8 trucks and the freight market. Rydzewski joined Cox Automotive in March 2022.