Data Point

Cox Automotive Analysis: Stellantis’ Q2 2023 Market Performance

Tuesday July 25, 2023

Article Highlights

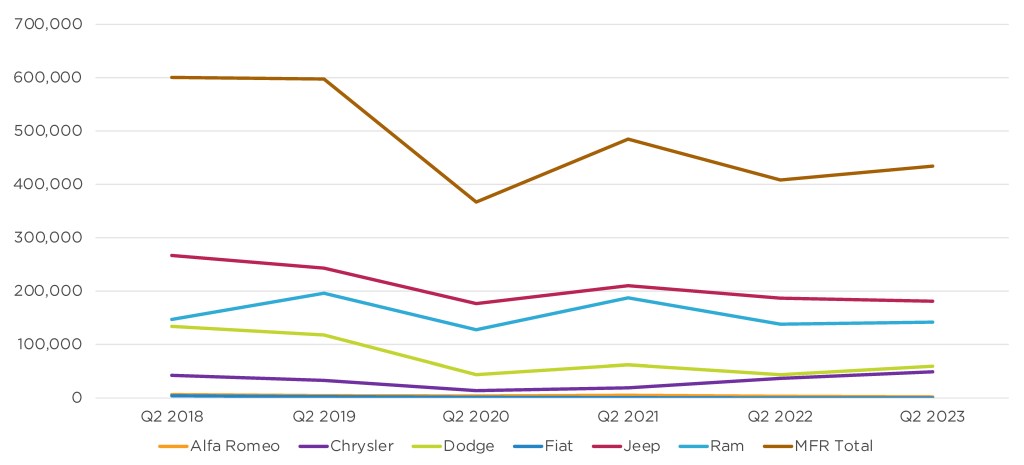

- Stellantis broke its sales slump in Q2 but barely, with sales up 6% to 434,531.

- Stellantis’ U.S. market share fell to 10.56%, its lowest in at least six years.

- Stellantis boosted incentives to an average of $3,134 per vehicle.

Stellantis posts financial results before the stock market opens Wednesday, July 26. Unlike other automakers that report quarterly earnings, Stellantis provides an update every six months.

As Cox Automotive’s Industry Insights team provided quarterly updates on sales, pricing and incentives for the largest automakers each quarter, we are including Stellantis’ numbers for the second quarter in the U.S. for comparison.

Stellantis broke its sales slump in Q2 – but barely, with year-over-year sales up only 6% when the total market was up 17%. This was the first quarter since Q2 2021 that Stellantis posted a year-over-year increase in volume. Its volume-leading Jeep brand has struggled with sales down 3% in the quarter and only two Jeep models posting higher sales than the year earlier. Stellantis was outsold in Q2 in the U.S. by Hyundai Motor, which includes the Hyundai, Kia and Genesis brands.

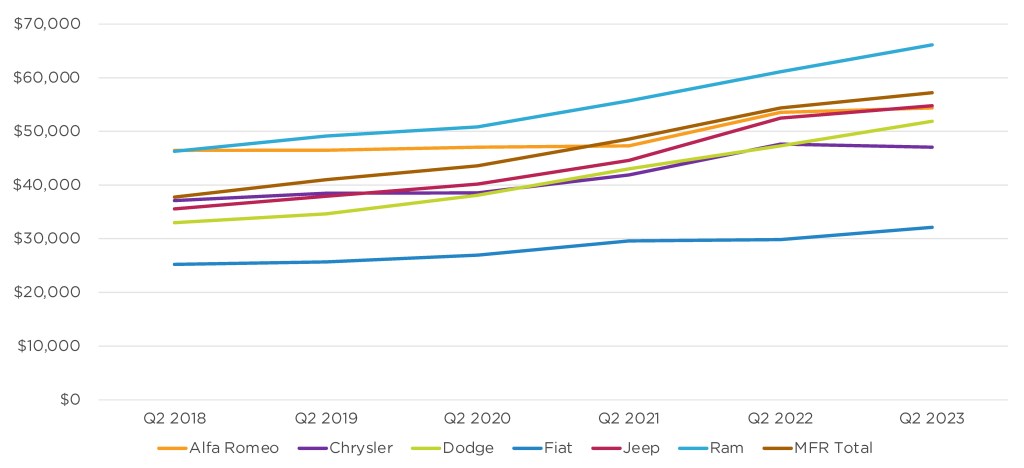

Like most other automakers, Stellantis boosted incentives after cutting them throughout 2022. Stellantis increased incentives by a hefty 64% in the quarter compared to the year-earlier quarter. At the same time, Stellantis’ average transaction price (ATP) climbed by 5% to $57,210, a high for the second quarter.

The U.S. and Europe are Stellantis’ most important markets. Here are some data points from Cox Automotive on Stellantis’ U.S. Q2 market performance.

Stellantis Broke its Sales Slump but Barely, with Sales Up 6%

According to Cox Automotive calculations, Stellantis broke its losing streak by reporting 434,531 vehicles sold in the second quarter, up 6% from the year-earlier quarter. Stellantis sales had been down year over year for seven straight quarters. Despite the improvement, Stellantis fell behind Hyundai Motor, which includes the Hyundai, Kia and Genesis brands, in the sales rankings and market share.

STELLANTIS U.S. SALES PERFORMANCE FOR Q2 2023

Results were mixed for Stellantis’ volume brands. Ram was up 3%. Jeep was down 3%.

Only two Jeep models reported sales gains. The Grand Cherokee posted sales up 19% to more than 70,000 units, the highest sales volume in at least six years for the quarter. Compass sales rose 28% to more than 28,000 units, the highest sales since 2019.

Gladiator sales fell by a third, closing at under 14,000 units, the lowest sales volume since the midsize truck was introduced in 2019. Wrangler sales fell by 14% to 46,671, the first time its sales fell below 50,000 units in Q2 in at least six years. The Wagoneer and Grand Wagoneer had sales fall by 21% and 18%, respectively.

Ram 1500 sales were roughly flat at 117,699 units. Strong fleet sales led to the Ram Promaster commercial van posting a 27% sales increase to more than 20,000 units, a record by a wide margin for the quarter.

Dodge and Chrysler posted beefy increases of 36% and 33%, respectively.

The Chrysler Pacifica minivan had a 40% gain to nearly 45,000 units, a record by a wide margin.

Dodge Durango sales also soared to 19,642 units versus about 6,000 a year ago, nearing 2019’s second-quarter high. Dodge Challenger sales were down 11%. Dodge Charger sales rose 7%. Both muscle cars are making their farewell tour as they will be discontinued in their current form and replaced by EVs. Dodge sold 2,597 of the just-introduced Hornet.

In contrast, Alfa Romeo and practically extinct Fiat reported hefty sales declines of 29% and 42%, respectively. Fiat sold a mere 144 vehicles in the quarter – all were the 500X model except one.

Jeep, Ram Share Drops Cause Stellantis’ Market Share to Decline

Though Stellantis finally reported a sales increase after several quarters of declines, it still underperformed the market, which had sales up 17% versus Stellantis’ 6% gain. That caused Stellantis to lose market share. Stellantis closed the second quarter with a market share of 10.56%, off almost a percentage point from the year-ago quarter, according to Cox Automotive calculations. It was Stellantis’ lowest market share for the quarter in at least six years. For comparison, Stellantis’ market share in the second quarter of 2019 was 13.45%.

Stellantis’ volume brands accounted for most of the drop. Jeep’s market share fell by .89 percentage points to 4.41%, its lowest market share for at least six years. Ram was down .46 percentage points to 3.45%, its lowest share for the quarter since 2018.

The remaining brands had roughly flat market share.

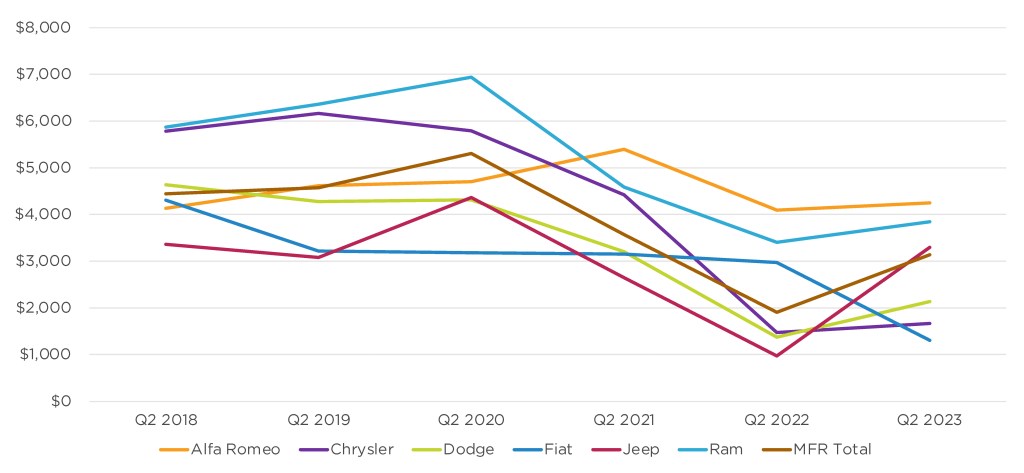

Stellantis Boosted Incentive Spending to an Average of $3,134 per Vehicle

After cutting incentives, Stellantis reversed direction and boosted incentive spending by 64% to an average of $3,134 per vehicle, according to Cox Automotive calculations. That is up from $2,355 in the first quarter.

STELLANTIS U.S. INCENTIVES FOR Q2 2023

While Stellantis’ incentive spending is up, it remains lower overall and by brand than in the past when the former Fiat Chrysler had the reputation of being one of the biggest incentive spenders.

Jeep incentives got a stunning 239% boost to an average of $3,294 per vehicle compared with a year ago and up from $2,236 in the first quarter. It appears those incentives helped increase Compass and Grand Cherokee sales but did not help other Jeep models. Grand Wagoneer, notably, was the single outlier with lower incentives year over year.

Dodge incentive spending got a hefty 55% boost to an average of $2,133 per vehicle. Ram had a 13% bump to an average of $3,842 per vehicle. Chrysler’s spending rose 13% to an average of $1,668 per vehicle. Alfa Romeo’s spending climbed by 4% to an average of $4,245. Fiat, which appears to be mostly out of business, cut spending in half to $1,306 per vehicle.

Stellantis’ Average Transaction Price Climbs to $55,210

Stellantis’ average transaction price (ATP) increased by 5% to $57,210, its highest in any second quarter in at least six years, according to Cox Automotive calculations. All brands but Chrysler saw higher ATPs.

STELLANTIS U.S. AVERAGE TRANSACTION PRICES FOR Q2 2023

Due to the final special editions of the Charger and Challenger, Dodge saw the biggest boost in ATP, up 10% to $51,888. Ram had the next highest increase in ATP, up 8% to $66,132. Jeep’s ATP edged 4% higher to $54,787.

Chrysler’s ATP slipped 1% to $47,033, but it was still the quarter’s second-highest ATP in the past six years. Alfa Romeo and Fiat had ATPs of $54,372 and $32,124, respectively.