Data Point

Cox Automotive Analysis: Toyota’s Quarterly U.S. Market Performance

Tuesday November 1, 2022

Article Highlights

- Toyota’s quarterly sales fell 7% from a year ago for a 15.4% market share.

- Toyota slashed incentives by 62% to an average of $759 per vehicle.

- Toyota’s average transaction price rose 4% to $40,635.

Toyota has posted financial results for the July-to-September quarter, the automaker’s second quarter of its fiscal year. Like its Japanese competitors, Toyota has had one of the lowest inventory levels in the U.S. for the past year, including the third quarter. Fewer vehicles on the lot and high interest rates might be compressing the company’s sales.

In the U.S., one of Toyota’s most important markets, sales were down for both Toyota and Lexus as the brands had among the lowest supplies in the industry for the past year. Toyota should benefit from lower incentive spending, which was slashed by 62% to well under $1,000 per vehicle for the first time ever in the third quarter, and a higher average transaction price (ATP) that was over $40,000.

Here are some data points from Cox Automotive on Toyota’s quarterly market performance in the U.S.

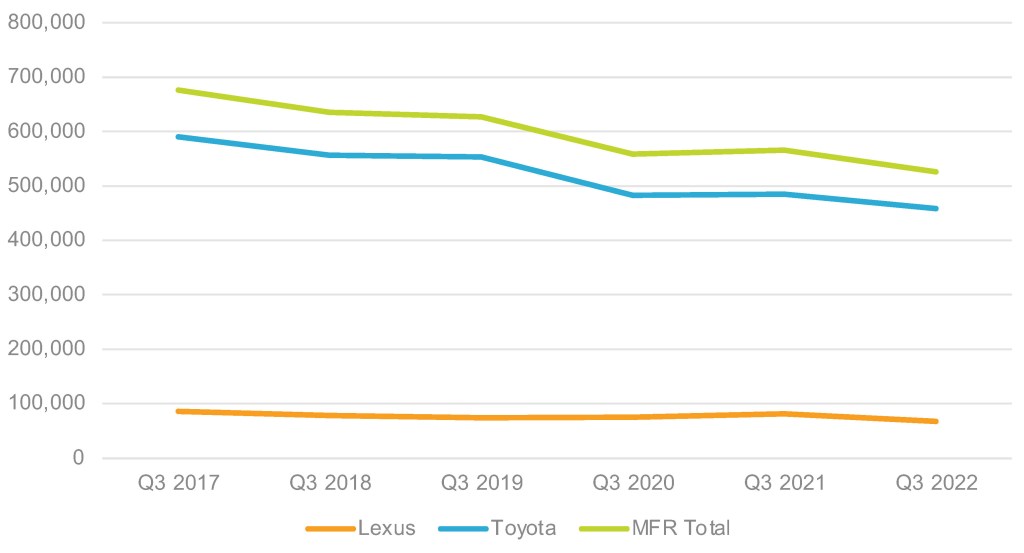

U.S. Sales and Market Share Decline for Toyota in Third Quarter

Toyota’s U.S. sales totaled 526,020, down 7% from a year ago and over 150,000 below the more than 676,000 of the third quarter of 2017, the peak of sales. With industry-wide sales about flat year over year, Toyota’s total market share dropped to 15.4%, down 1.2 percentage points. However, this is the second-highest market share in the past six years, only behind the third quarter of last year.

TOYOTA U.S. SALES FOR Q2 FISCAL YEAR 2023

Toyota brand sales totaled 458,496 vehicles, down 5%. Toyota had only four models on the plus side of sales. The 86 sports car saw aa significant increase, with 3,514 sales this quarter versus 10 units a year ago when sales all but stopped during the changeover to the next-generation model. The popular RAV4 SUV saw an 11% sales bump, with 102,456 units sold for the quarter. Toyota’s trucks, the Tacoma and Tundra, also had sales gains, with the Tacoma selling 67,224 units, an almost 10% increase, and the Tundra selling 30,203 units, a 43% increase. Other models saw declines, such as the popular Camry and Corolla models, which were down 0.8% and 18% for the quarter due to low inventories. Prius hybrid sales were down nearly 45%.

Lexus sales dropped by 17% to 67,524 units. Its market share was 2.0% in the third quarter, down from 2.4% in the same quarter last year, as the industry saw luxury vehicle sales drop. The LX saw a 76% gain, selling 912 units versus 519 units in 2021. The GX saw an almost 1% increase, with all other models showing declines from 5.2% (RX) to 59.6% (UX).

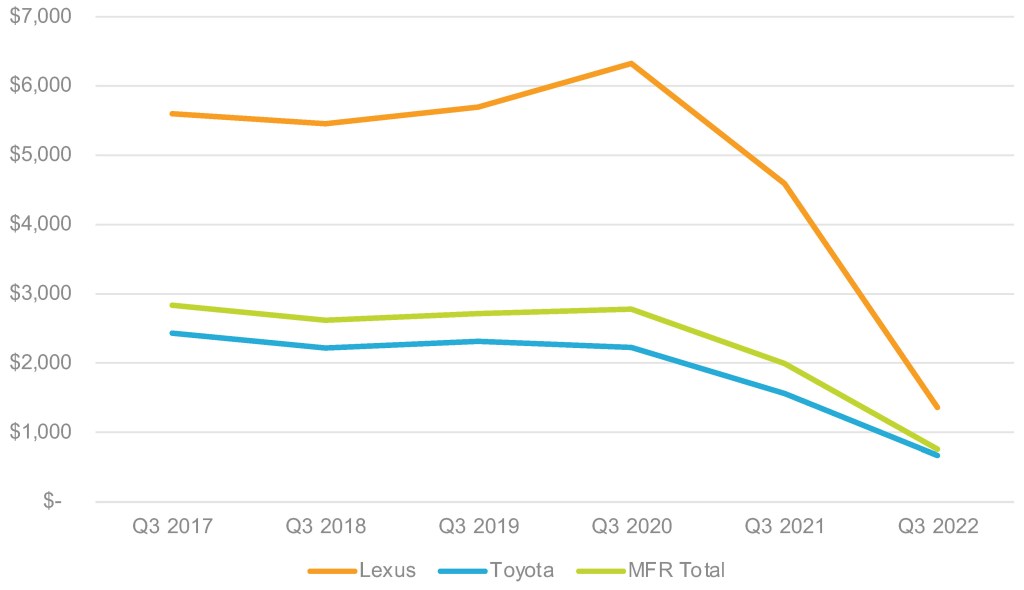

Toyota Slashed Incentives by 62% to Less Than $800 per Vehicle

Toyota slashed incentives as demand was high. In total, Toyota cut incentives by 62% to an average of $759 per vehicle, according to Cox Automotive calculations. It was the first time since 2017 that incentives averaged below $1,000 per vehicle for the quarter. Industry-wide, incentives were just over $1,000 per vehicle.

TOYOTA U.S. INCENTIVE SPENDING FOR Q2 FISCAL YEAR 2023

Toyota brand incentives were slashed by 57% to an average of $670 per vehicle, the first time in the quarter it fell below $1,000 per vehicle. Lexus incentives were reduced by 70% to an average of $1,359 per vehicle, though for the past five years, Lexus incentives averaged more than $4,000 per vehicle.

Toyota Average Transaction Price Tops $40,000

Toyota’s overall average transaction price (ATP) rose 4% to $40,635. For the Toyota brand, the ATP was $38,313, up 4%. Popular models such as the Tundra saw an ATP increase of 21% and Corolla rose 8%. The Lexus brand ATP was $55,709, up 8%. Almost all Toyota and Lexus models saw quarter-over-quarter ATP increases.

Rebecca Rydzewski is a research manager for economic and industry insights for Cox Automotive.