Data Point

CPO Sales Drop in August, Remain Down 9% Overall

Tuesday September 15, 2020

Article Highlights

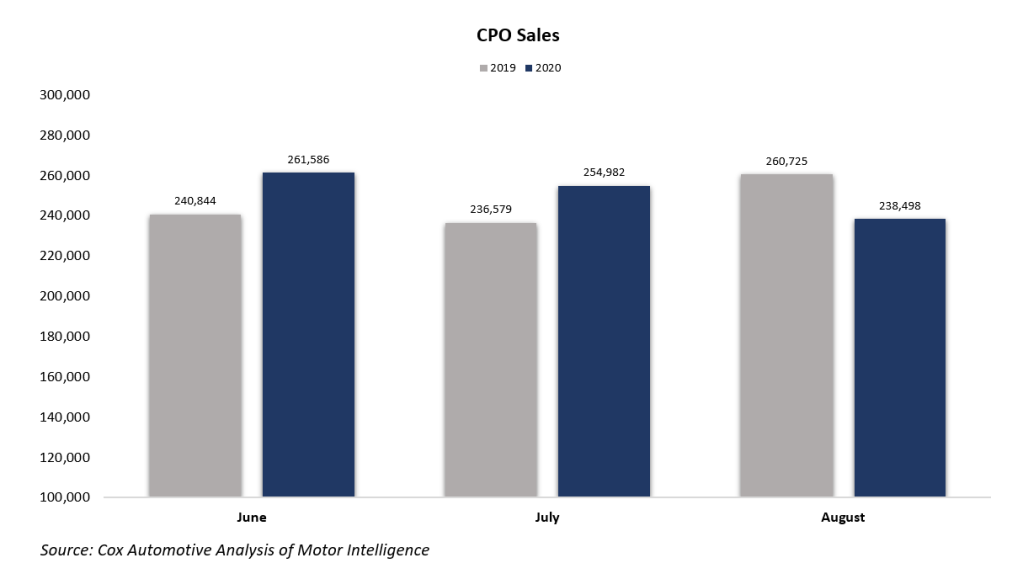

- Sales of certified pre-owned (CPO) vehicles decreased 9% year over year in August and were down 6% month over month compared to July.

- For August, 238,498 CPO units were sold.

- For August, Toyota, Honda and Chevy continue to be the biggest players in the CPO market.

Sales of certified pre-owned (CPO) vehicles decreased 9% year over year in August and were down 6% month over month compared to July. For August, 238,498 CPO units were sold.

CPO sales were on the rise for the past two months. Reflecting huge decreases in March and April and the impact of COVID-19, CPO sales are down 9% year to date versus the same time in 2019. In the first eight months of 2020, the CPO market is more than 165,000 units below last year, which finished at 1,553,901 units sold. The revised 2020 Cox Automotive CPO sales forecast, which is subject to change, is 2.6 million units, down from 2.8 million sold in 2019.

For August, Toyota, Honda and Chevy continue to be the biggest players in the CPO market, collectively representing a third of all CPO sales. Those three plus Ford and Nissan account for 44% of CPO sales so far in 2020. Last year, Toyota, Honda and Chevy accounted for 32% of the total industry CPO sales reflecting that brands are maintaining consistent CPO sales share this year compared to 2019.

Coming off of two strong months, CPO sales in August show impacts of the ongoing pandemic and the Labor Day holiday being included in last year’s monthly sales. According to Cox Automotive estimates, total used-vehicle sales volume was down 4% year over year in August. We estimate the August used SAAR to be 38.0 million, down from 39.7 million last August and flat compared to July. The August used retail SAAR estimate is 20.3 million, down from 20.7 million last year and slightly down month over month from July’s 20.4 million rate.