Data Point

CPO Sales Up 24% in December and End Year Down 7%

Friday January 15, 2021

Article Highlights

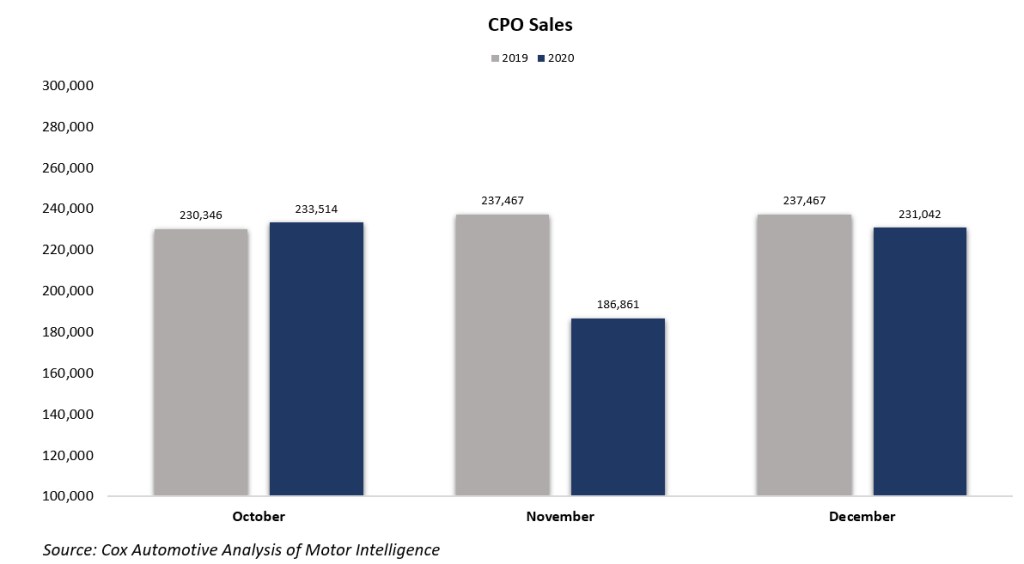

- Sales of certified pre-owned (CPO) vehicles declined 2% year over year in December with 231,042 CPO units sold.

- CPO sales were up 24% month over month compared to November, reflecting a normalizing market coming off of a resilient performance in the summer and fall months.

- The CPO market in December normalized from its November drop that was attributed to a combination of factors including, seasonality, the ongoing pandemic, broader economic conditions and supply/demand.

Sales of certified pre-owned (CPO) vehicles declined 2% year over year in December and were up 24% month over month compared to November, reflecting a normalizing market coming off of a resilient performance in the summer and fall months. For December, 231,042 CPO units were sold.

The CPO market has been one of the strongest performing segments within the auto retail market despite the ongoing pandemic. The CPO market in December normalized from its November drop that was attributed to a combination of factors including, seasonality, the ongoing pandemic, broader economic conditions and supply/demand.

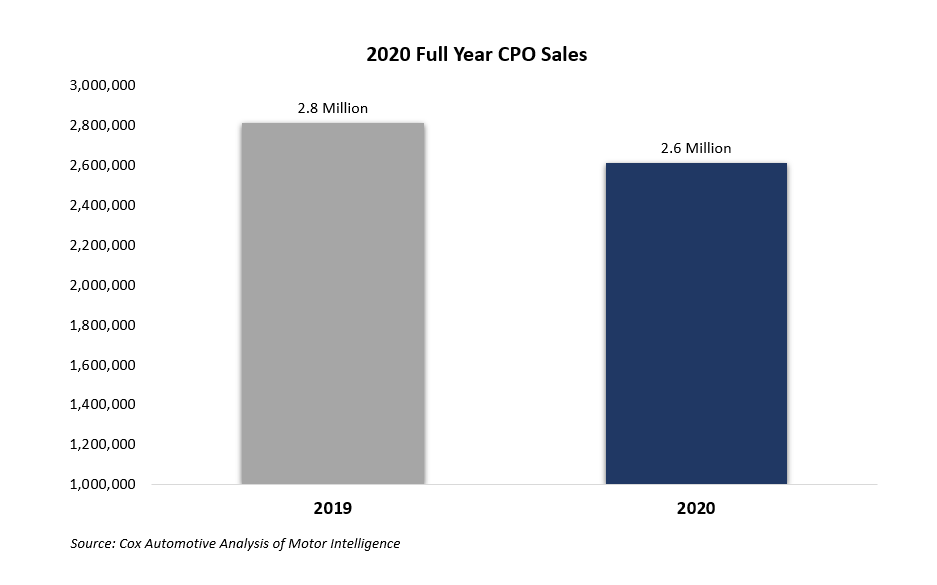

Full year CPO sales are down 7% in 2020 versus 2019 while the total used market is estimated to be down between 8-9% in 2020. Through December, the CPO market is down more than 200,000 units below last year. The Cox Automotive CPO sales forecast for 2021 is 2.7 million, up from 2.6 million sold in 2020.

In 2020, Toyota, Honda and Chevy continued to be the biggest players in the CPO market, collectively selling nearly 800,000 units and representing 30.5% of all CPO sales. Those three plus Ford and Nissan account for 45% of CPO sales in 2020. In 2019 Toyota, Honda and Chevy accounted for 32% of CPO sales reflecting that those brands maintained fairly consistent CPO sales share year over year.

According to Cox Automotive estimates, total used vehicle sales volume was down 5% year over year in December. We estimate the December used SAAR to be 38.0 million, down from 40 million last December but up compared to November’s 37 million rate. The December used retail SAAR estimate is 20.2 million, down from 20.8 million last year but up month-over-month from November’s 19.6 million rate.