Data Point

Fleet Sales Rise in December, Trend Expected to Continue in 2023

Friday January 6, 2023

Article Highlights

- Sales into large fleets, not including sales into dealer and manufacturer fleets, increased 3.0% month over month in December to 165,809 units, according to an early estimate from Cox Automotive.

- Combined sales into large rental, commercial, and government fleets were up 47% year over year in December, the sixth consecutive month of double-digit, year-over-year increases.

- The Cox Automotive fleet sales forecast for 2023 is 2.2 million units.

Sales into large fleets, not including sales into dealer and manufacturer fleets, increased 3.0% month over month in December to 165,809 units, according to an early estimate from Cox Automotive.

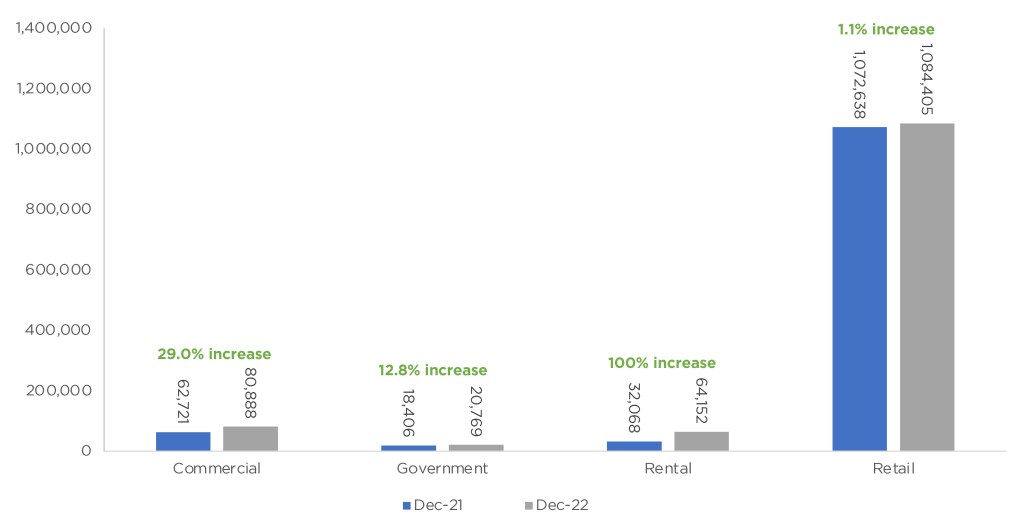

Combined sales into large rental, commercial, and government fleets were up 47% year over year in December, the sixth consecutive month of double-digit, year-over-year increases. Sales into rental fleets were up 100%, while sales into commercial fleets were up 29% year over year and government fleets were up nearly 13%.

December 2022 Fleet Sales

Fleet Share of Retail Sales Increases

Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 1.1% year over year in December, leading to an estimated retail sales pace, or seasonally adjusted annual rate (SAAR), of 12.0 million, down 0.5 million from last month’s pace, or down 4.7%, but up 0.8 million from last year, or 7.2%. The fleet share of 14.2% was down 1.5% from last month and was up 3.3% from last year.

“Sales into fleet are gaining some momentum and are expected to contribute to an uptick in new-vehicle sales in 2023,” said Charlie Chesbrough, senior economist at Cox Automotive. “After fleet sales staying significantly lower than historical averages for the last three years, we expect an increase in 2023. However, we won’t be anywhere close to returning to the 3-million-unit range we saw before 2020.”

Among large manufacturers, Stellantis, followed by GM, had the largest increase in fleet volume over last year. Nissan was the only large automaker with a decline in December fleet sales compared to last year.

Manufacturers’ Sales by Fleet Channel Change

Interesting changes are seen when comparing the manufacturers’ fleet sales by channel. GM has overtaken Ford as the leader in the commercial channel with a 35.4% share. Ford remains ahead of GM in government fleet sales with a 61.8% share, while Stellantis’ share dropped from over 21% to only 9.6% in 2022. Stellantis barely beat out Toyota to take the No. 1 spot in sales into rental fleets by increasing its 2022 fleet share to 24.4%, up from 14.3% in 2021. Toyota’s share of sales into rental fleet was 24.2% in 2022, a modest decrease from 26.0% in 2021 but a substantial increase from before the pandemic when its rental fleet share was only 10.9% in 2019.

FLEET SALES EXPECTED TO INCREASE IN 2023

Fleet sales are expected to improve in 2023 and contribute to modest growth in new-vehicle sales. The Cox Automotive fleet sales forecast for 2023 is 2.2 million units.