Data Point

December CPO Sales Rise, 2022 Totals Hit Forecast

Thursday January 12, 2023

Article Highlights

- Certified pre-owned (CPO) sales in December rose 13.6%, nearly 27,000 units, from November to finish at 225,241.

- CPO sales finished 2022 at nearly 2.47 million units, a decline of nearly 280,000 units, or 10.2% from 2021 CPO sales.

- Cox Automotive forecasts CPO sales to decline 11% in 2023 to 2.2 million units, which will be the lowest CPO volume in 10 years.

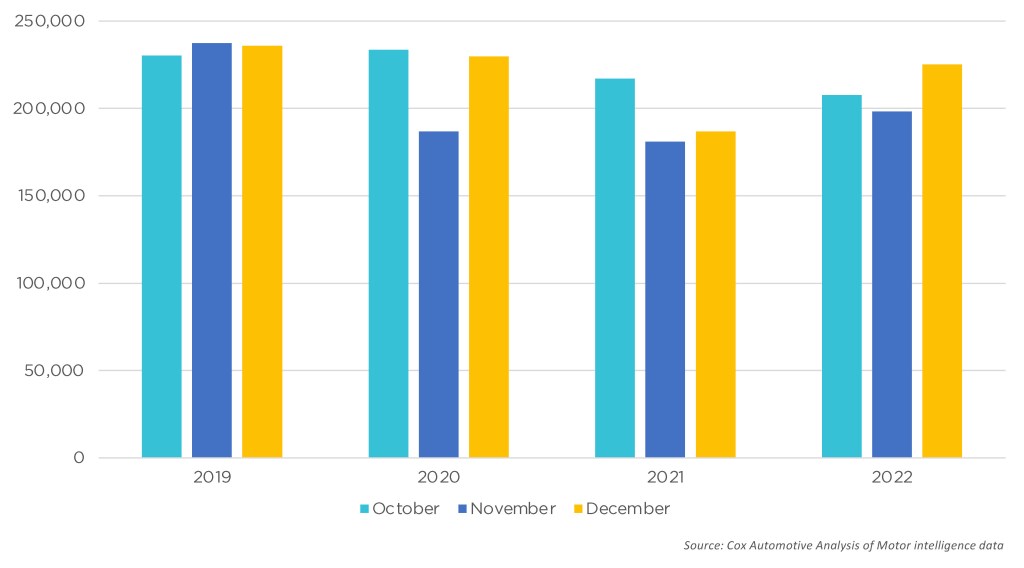

Certified pre-owned (CPO) sales in December rose 13.6%, nearly 27,000 units, from November to finish at 225,241. This total is up 20.6%, or nearly 40,000 units from December 2021. CPO sales finished 2022 at nearly 2.47 million units, a decline of nearly 280,000 units, or 10.2% from 2021 CPO sales.

December CPO Sales

Leveraging a same-store set of dealerships selected to represent the country from Dealertrack, we initially estimate that used retail sales declined 7% in December from November and that used retail sales were down 10% year over year, which was the same as November’s performance.

Chris Frey, senior manager of economic and industry insights at Cox Automotive, notes: “December’s total CPO sales of 225,000 were the highest all year and were about 4,000 units shy of the 2021 monthly average of 229,000. Still, 2022’s monthly average of 206,000 has a long way to go to get back to 2019’s 234,000 monthly average when the market was considered more normal. The call last month to match or exceed 160,000 sales to hit our 2.4 million unit target occurred, by a big 65,000. Shares of CPO sales were consistent over the last 3 months with the Asian brands again at 51%, European makes steady at 19%, and the Detroit 3 at 31% in December. The shares total just over 100% from rounding.”

Lack of New-Vehicle Supply Negatively Impacts CPO Market

While demand can support more CPO, the market will ultimately be limited because of supply constraints. In 2023, the used market and CPO will likely decline further. Interest rates are expected to be at levels not seen in more than 20 years. The economy is expected to slow because of higher rates and tighter credit conditions. And, maybe most importantly, the supply of younger vehicles that can be certified will be down dramatically as the large declines in sales and leases since March 2020 factor into the available used-car supply. After seeing a 10% drop in 2022, Cox Automotive forecasts CPO sales to decline 11% in 2023 to 2.2 million units, which will be the lowest CPO volume in 10 years.