Data Point

Strong December Fleet Sales Reflect Huge Gain in Rental Sector

Friday January 5, 2024

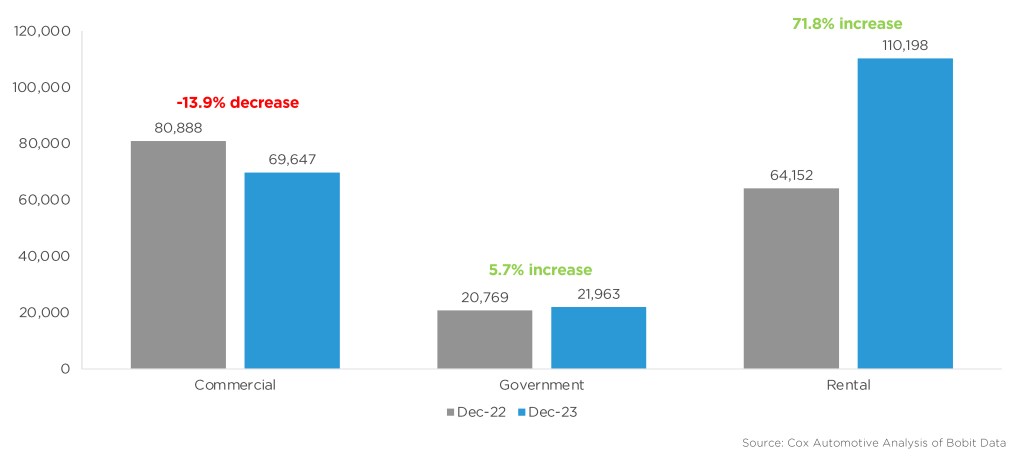

In December, sales into large rental and government fleets increased compared to the previous year, with rental having a particularly strong month. Commercial sales decreased year over year but were up month over month.

An analysis of Bobit’s data by Cox Automotive revealed that there was a 21.7% increase in sales to large fleets (excluding dealer and manufacturer fleets) in December, with 230,484 units sold. Sales to rental fleets increased by 71.8%, reaching 110,198 units, and government fleets increased by 5.7% compared to December 2022. However, commercial fleets decreased by 13.9% year over year.

According to Cox Automotive Senior Economist Charlie Chesbrough, “The key question for 2024 is how much increase can there be over 2023’s big gain. Some of the pent-up demand from fleet is now satiated, so further growth will likely be more challenging.”

December 2023 Fleet Sales

Some new key players emerged with Nissan, Toyota and Hyundai reporting much more fleet activity. Although less than half of what the Detroit Three average, fleet sales for Nissan and Hyundai are up over 100% and Toyota is up almost 80% compared to December last year.

Among the largest manufacturers, General Motors had the largest year-over-year decline while Nissan had the largest increase.

Fleet Sales Outperform Retail in December

Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 12.9% from last year, leading to an estimated retail SAAR of 13.4 million, up 2.0 million from last year’s 11.4 million pace, and up slightly from November’s 13.0 pace. Fleet share was estimated to be 16.1%, unchanged from last year.