Commentary & Voices

Despite Strong Performance By Ram Pickups, FCA Reports Lower Q1 Results

Friday May 3, 2019

Article Highlights

- While the news is not all bad, it was not great either.

- Jeep and Ram are the engine that power the company’s revenue performance.

- Ram brand saw transaction prices up nearly 6% versus year-ago level.

FCA released Q1 financial results today, Friday, a day often saved for bad news. And while the news is not all bad, it was not great either. Ford and General Motors shared Q1 results during the past week and both delivered solid numbers in tough conditions. Ford even surprised a few analysts.

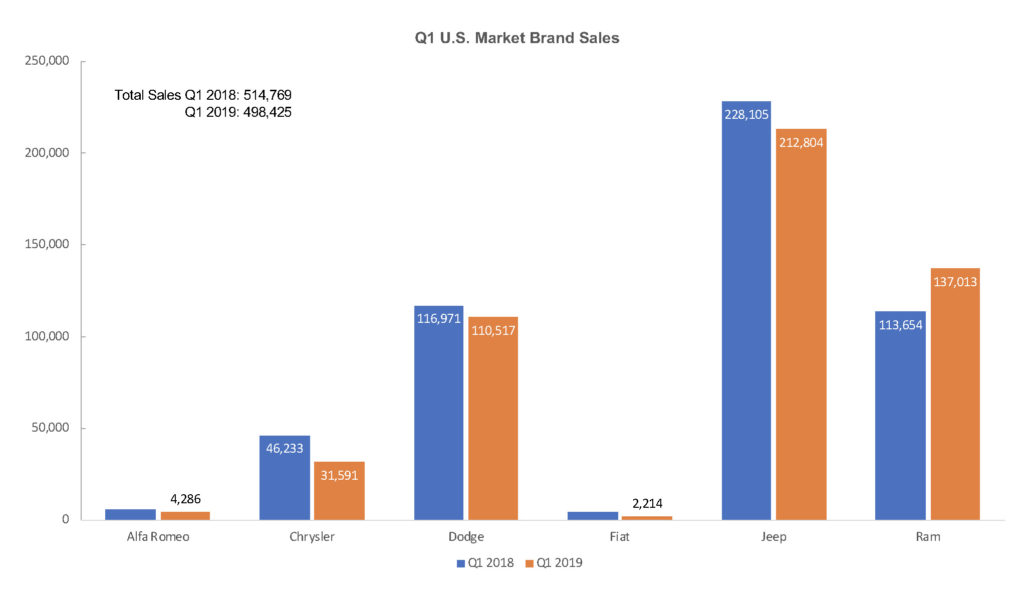

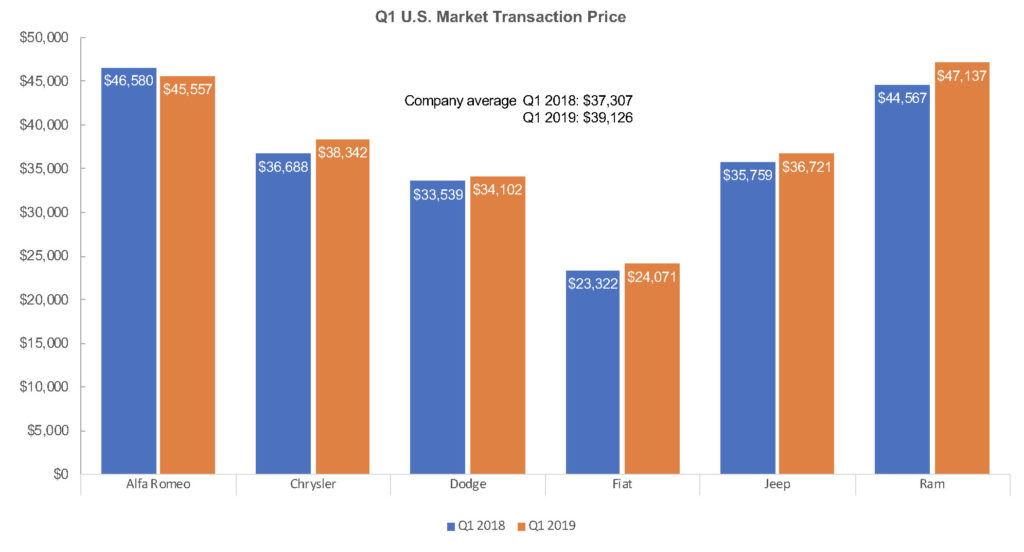

Auto sales are down across the industry in the all-important, profitable U.S. market, and FCA’s volume in Q1 was reflective of the slowing industry. In all, FCA’s U.S. sales volume decreased by 3.2% versus year ago levels in the U.S. according to Kelley Blue Book, roughly in line with the industry. Only the Ram brand showed an increase in volume. The other five FCA brands declined, significantly in the case of Chrysler and Fiat. Jeep and Ram are the engine that power the company’s revenue performance. According to Kelley Blue Book data, transaction prices were up with five of the six FCA brands. Ram brand saw transaction prices up nearly 6% versus year-ago level. Transaction prices for the all-important Ram pickup, which outsold rival Chevrolet Silverado in Q1, were up over 7%. Still, Ram’s growth, coupled with higher transaction prices, was not enough to offset drops elsewhere. Unlike Ford in Q1, which saw an increase in revenue in North America despite lower volumes, higher revenue at FCA brands were not enough to offset the lower volume. Overall, revenue dropped in Q1 vs 2018.

Jeep and Ram are the engine that power the company’s revenue performance. According to Kelley Blue Book data, transaction prices were up with five of the six FCA brands. Ram brand saw transaction prices up nearly 6% versus year-ago level. Transaction prices for the all-important Ram pickup, which outsold rival Chevrolet Silverado in Q1, were up over 7%. Still, Ram’s growth, coupled with higher transaction prices, was not enough to offset drops elsewhere. Unlike Ford in Q1, which saw an increase in revenue in North America despite lower volumes, higher revenue at FCA brands were not enough to offset the lower volume. Overall, revenue dropped in Q1 vs 2018.

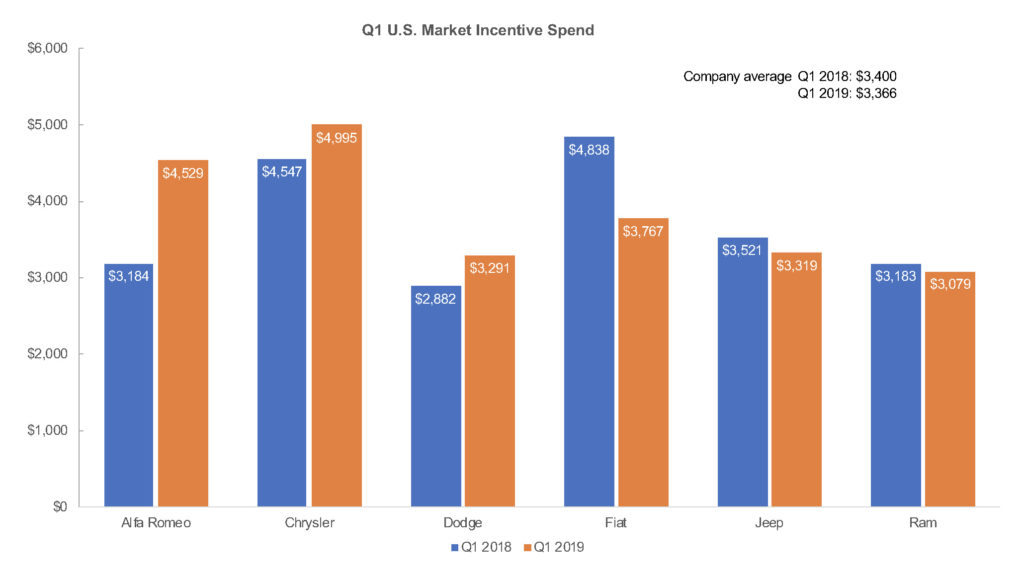

In Q1 2019, rivals Ford and GM were also able to significantly reduce incentive spending, with Ford dropping nearly 8% and GM cutting spend by more than 15%. FCA, on the other hand, struggled with incentive spending. Three of the company’s 6 brands saw spending increases. While spending was down for Jeep and Ram, which helped deliver an overall incentive decrease of 1% in the quarter, it was not enough. In North America, overall earnings for FCA dropped. Before then-CEO Sergio Marchionne passed away unexpectedly last year, he laid out a long-term plan for FCA centered squarely on the Jeep and Ram brands. He was smart to put his focus on those profit machines. Still, Q1 data shows that while FCA is profitable, weaknesses across the company – particularly outside of North America – continue to pull down the Ram and Jeep brands, two of the strongest, most-successful brands in the U.S. right now.

Before then-CEO Sergio Marchionne passed away unexpectedly last year, he laid out a long-term plan for FCA centered squarely on the Jeep and Ram brands. He was smart to put his focus on those profit machines. Still, Q1 data shows that while FCA is profitable, weaknesses across the company – particularly outside of North America – continue to pull down the Ram and Jeep brands, two of the strongest, most-successful brands in the U.S. right now.

Reacting to FCA’s Q1 results, Zo Rahim, manager, Economics and Industry Insights, Cox Automotive:

FCA reiterated their full-year guidance with the expectation that the rest of the year should see improvement from the soft Q1 print. Global weakness, particularly in Europe and Asia, hurt volumes and pricing which drove down regional adjusted EBIT and margin. This weakness was partially offset by performance in North America and Latin America. In North America, adjusted EBIT and margin were down due to lower volumes. North America continues to play a central role at FCA. The region accounted for 97.8% of total company adjusted EBIT for the quarter.