Commentary & Voices

Is There Such Thing as a Good Labor Day Deal in Today’s New Car Market?

Monday August 30, 2021

It wasn’t that long ago when shoppers were overwhelmed with advertisements for incredible deals and offers on new cars: loyalty cash, conquest cash, retail cash, holiday bonus cash, dealer cash, lease cash … cash, cash, cash and more cash!

Car companies used to celebrate more holidays than Hallmark has greeting cards.

But all that cash was no cause for celebration as OEM incentives and dealer markdowns eroded profitability.

Today the U.S. auto industry is “living its best life” as OEM and dealer profits continue to soar thanks to the reduction in inventory from 3.5 million units1 in February 2020 to 1.0 million units2 at the beginning of August 2021. Inventory shortages coupled with strong demand for new vehicles have been a winning hand.

The American consumer is absolutely swimming in cash right now with $3.7 trillion (yes, trillion with a “T”) in collective savings account deposits3, up from $300 billion prior to the pandemic.

As the car companies resume their annual “All Dealer Meetings” in Las Vegas this year, there will be plenty of high fives and extra-large platters of jumbo shrimp as dealers and OEMs are witnessing margins they never could have dreamed of.

Demand for new cars remains significantly stronger than supply, and the need for traditional cash incentives to spur sales is all but gone with manufacturers incentivizing with a great deal of selectivity. OEM incentive spending has fallen from 10.9% of average transaction price (ATP) before the pandemic, according to Kelley Blue Book data, to only 5.9% last month. This equates to roughly $2,700 per vehicle in reduced incentive spending. In a typical month, the industry is retailing 1.0-1.2 million new units, which means car companies are generating $2.7-$3.2 billion in additional profits per month, by having fewer incentives.

In recent years many dealers struggled to achieve $1,700 in gross profit per vehicle4 including F&I, but this year the average new car gross is almost $3,300 per vehicle5. New car margins are fueling dealer profitability as the average franchised dealer is on pace to net over $3.5 million this year.

So, what does this mean for the consumer who is out looking for a good Labor Day deal on a new car? Are there any deals to be found? The short answer: yes, but it might not be as easy as before.

Autotrader published recently a list of 20 new vehicles that consistently sell above the manufacturer’s suggested retail price (MSRP) but most have less than 30 days’ supply, so less inventory is available than the industry average. Kelley Blue Book published its 10 Best Labor Day Deals of 2021 looking at the best lease offers (lowest down payment and lowest monthly payment) and best financing offers (lowest APR + highest cash back) that will be available through Labor Day weekend.

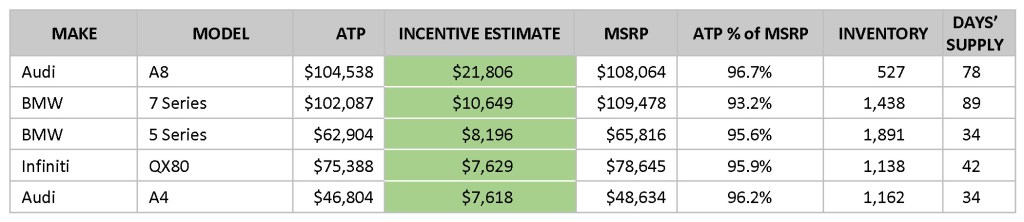

To answer this question, we looked at vehicles in both luxury and non-luxury segments that have more than 30 days’ supply, so above the industry average, and at least 500 units in inventory. We also took into consideration the blended incentive costs (retail cash/special APR/lease support) as well as the ATP versus the MSRP. The average transaction price includes dealer markups or dealer discounts in addition to the incentives and gives a truer picture of what the consumer ends up paying for a vehicle.

First, let’s look at the luxury segment. The Audi A8 has an estimated incentive of $21,806 which is the highest available by far, but the average transaction price is only $3,500 below MSRP. The reason is that most luxury incentives are applied to support a lower lease payment instead of a cash offer.

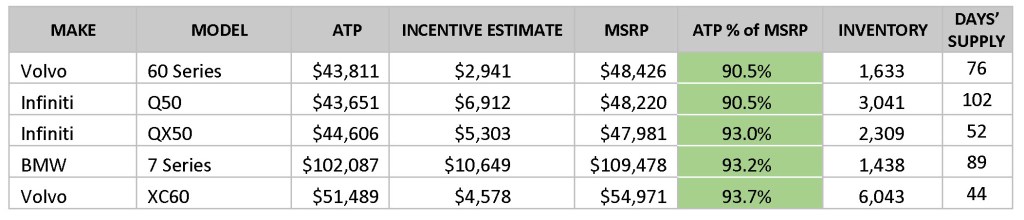

But if shoppers are looking lowest ATP versus MSRP, the Volvo 60 Series (S Sedan and V Wagon) and the Infiniti Q50 are the best deals out there. Both have an average transaction price that is coming in at 90.5% of MSRP.

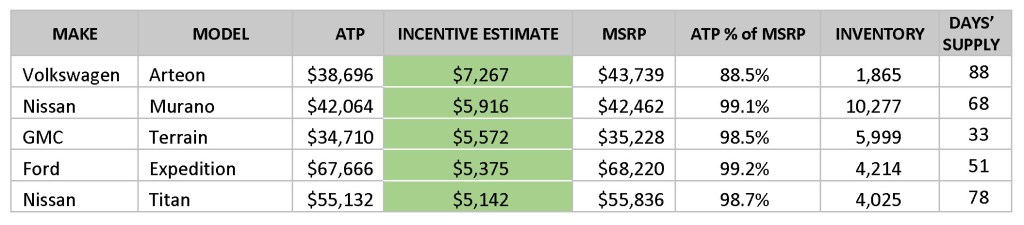

For the non-luxury segment, the Volkswagen Arteon takes the prize for the highest incentive. If getting a new SUV is the goal, consumers are in luck since three of them made the list. There is even a full-size truck, the Nissan Titan. Besides a strong incentive, the Titan also comes with a 5-year/100,000-mile bumper-to-bumper warranty.

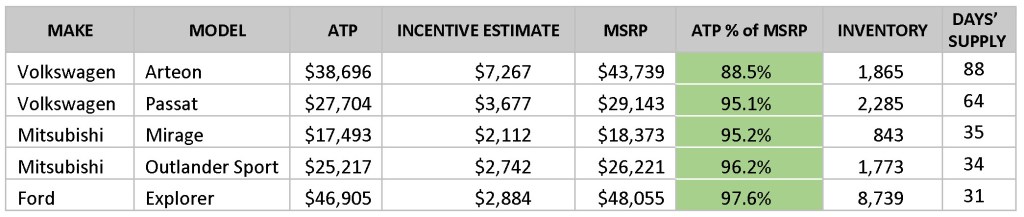

Now let’s take a look at ATP versus MSRP. The Arteon comes out on top here also. If it is a bit too pricey, Volkswagen dealers are also offering a bargain on the Passat.

In normal years, Labor Day weekend marks the kick-off of the model year-end sell down with extra incentives as OEMs make way for the new models. Consumers who are out shopping this Labor Day weekend are more likely to enjoy a free hot dog than a great deal on their next new car. If getting the most “bang for your buck” is the primary objective, shoppers better visit a local VW dealer and take the Arteon for a test drive.

Brian Finkelmeyer is senior director of new vehicle solutions at Cox Automotive.

1 vAuto Available Inventory data

2 vAuto Available Inventory data

3 U.S. Federal Reserve

4 NADA Dealer Profile

5 NADA Dealer Profile