Data Point

Fleet Sales Continue to Suffer in January, Down 26% from Year-Ago Level

Tuesday February 9, 2021

Article Highlights

- In January, 153,372 total fleet units were sold, compared to 165,713 in December.

- Combined sales into large rental, commercial, and government buyers were down 26% year over year in January.

- Toyota showed the most resilience with a 17% year over year decline for January.

In January, 153,372 total fleet units were sold, compared to 165,713 in December. Combined sales into large rental, commercial, and government buyers were down 26% year over year in January.

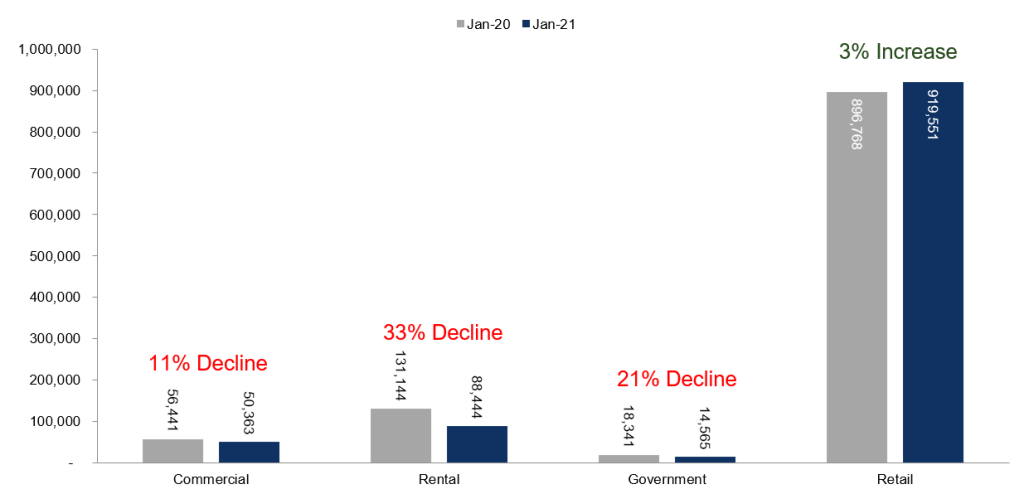

Government units were down 21% year over year, on a small base, while rental units were down 33% year over year in January, an improvement over the 54% year over year drop in 2020. New-vehicle sales into the commercial channel declined 11% year over year in January. We estimate that the remaining retail sales were up 3% year over year in January, leading to an estimated retail SAAR of 14.0 million, up from 13.3 million last January but down from December’s 14.1 million rate.

January total new-vehicle sales were down 3.7% year over year, with one fewer selling day compared to January 2020. The January SAAR came in at 16.6 million, a decrease from last year’s 16.9 million but up from December’s 16.2 million rate.

Looking at automakers, year-over-year changes in fleet sales ranged from declines of 17% to 37%. Toyota showed the most resilience with a 17% year over year decline for January. Ford saw the largest decrease in fleet sales in January, according to a Cox Automotive analysis.