Data Point

July Fleet Sales Rebound, Approaching Pre-Pandemic Level

Friday August 4, 2023

Sales into large fleets, not including sales into dealer and manufacturer fleets, increased 34.5% year over year in July to 171,464 units, according to an early estimate from Cox Automotive sources. July fleet volume rebounded to less than 2% below the pre-pandemic level seen in July 2019, a record year for fleet sales.

“U.S. new-vehicle sales were boosted again in July by strong fleet sales, particularly in the government and rental segments,” said Cox Automotive Senior Economist Charlie Chesbrough. “Fleet sales are typically a bit lower in July, but the volume last month was higher than the July volumes in each of the three years prior to 2019.”

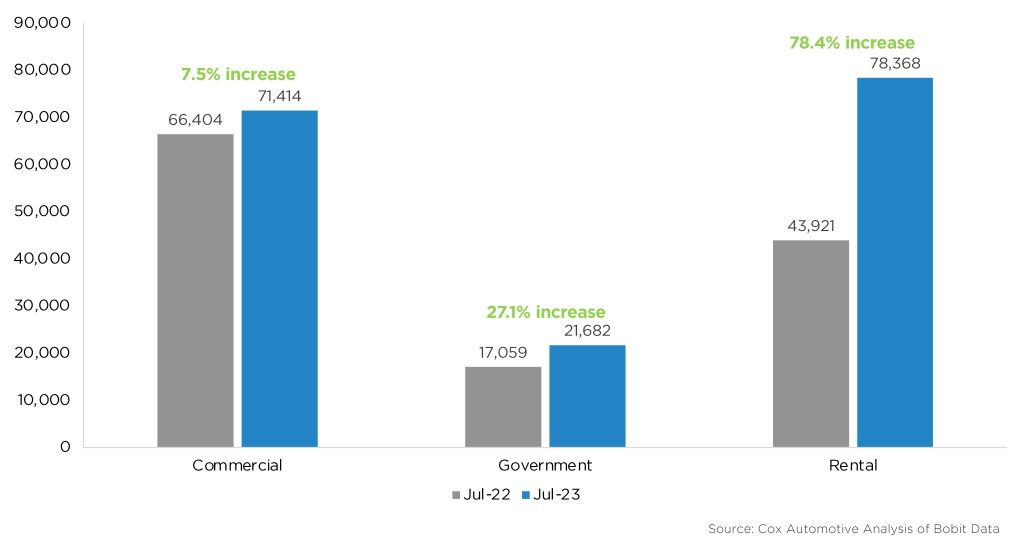

Combined sales into large rental, commercial, and government fleets continue to improve, posting another month of double-digit, year-over-year increases. Sales into rental fleets in July were up 78.4% year over year, sales into government fleets were up 27.1%, and sales into commercial fleets were up 7.5%.

July 2023 Fleet Sales

All large manufacturers showed gains in fleet over last year. Of large-volume automakers, General Motors had the largest increase in July, followed by Stellantis.

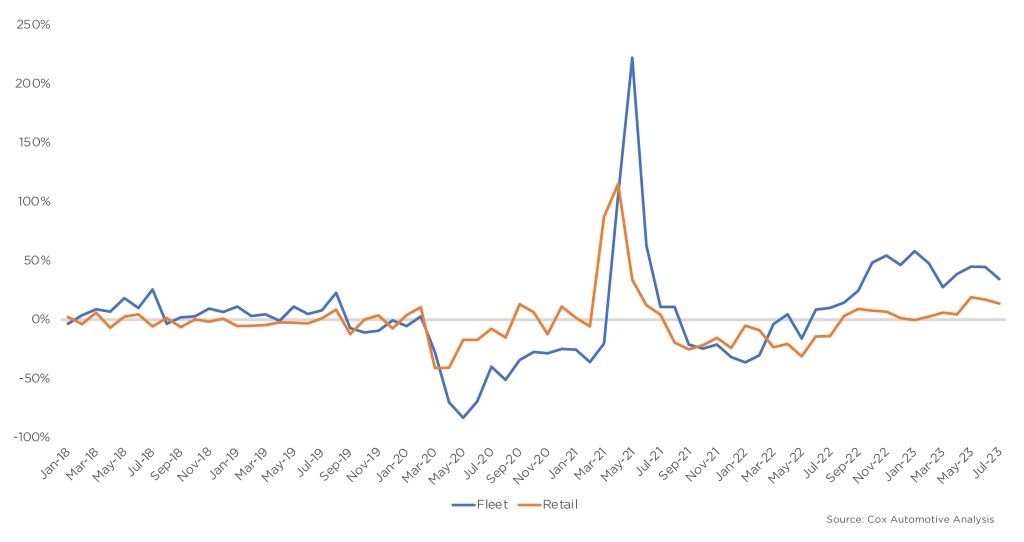

Fleet Sales Recovery Outpaces Retail

Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 12.8%, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 13.2 million, up from last year’s 11.4 million pace and up 0.4 million from last month’s 12.8 million pace. The fleet market share was estimated to be 16.0%, a gain of 2.2% over last year’s share but a decrease from June’s 17.4% market share. For comparison, nearly 22% of all vehicles sold in 2019 were through fleet channels.