Data Point

June CPO Sales Beat Year-Ago Level

Wednesday July 15, 2020

Article Highlights

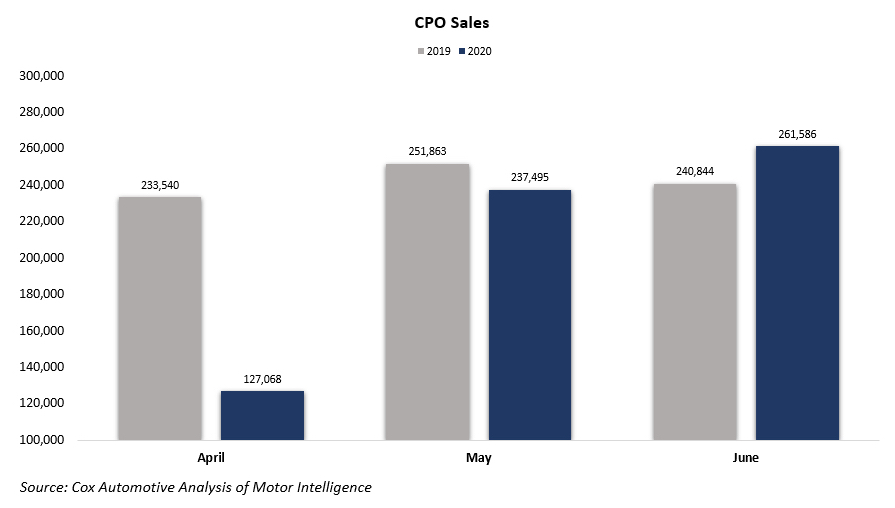

- Sales of certified pre-owned (CPO) vehicles increased 9% year over year in June – with 261,586 units sold – and were up 10% month over month compared to May.

- Stronger CPO sales in June were part of a larger recovery of the overall used-vehicle market.

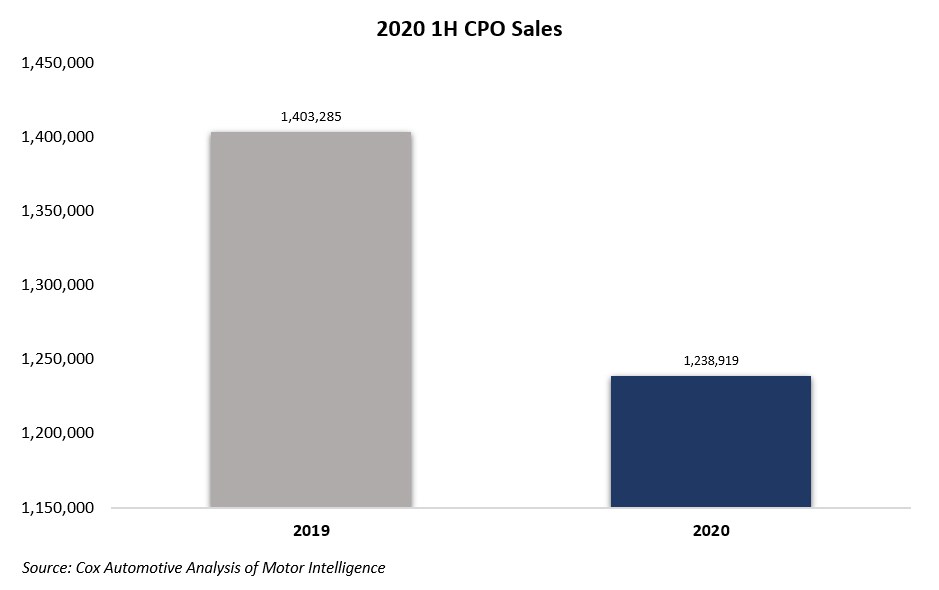

- CPO sales are down 11.7% for the first half of this year, down more than 160,000 units.

Sales of certified pre-owned (CPO) vehicles increased 9% year over year in June and were up 10% month over month compared to May. For June, 261,586 CPO units were sold.

CPO sales were on a record-setting pace the first two months of the year before COVID-19 put the brakes on auto sales. Reflecting huge decreases in March and April, CPO sales are down 11.7% for the first half of this year versus the same time in 2019, with 1,238,919 CPO units sold through June. In the first six months of 2020, the CPO market is more than 160,000 units below last year.

For June, Toyota, Honda and Chevy continue to be the biggest players in the CPO market, collectively representing a third of all CPO sales. Those three plus Ford and Nissan account for 44% of CPO sales so far in 2020. Last year, Toyota, Honda and Chevy accounted for 32% of the total industry CPO sales reflecting that brands are maintaining consistent CPO sales share this year compared to 2019.

Stronger CPO sales in June were part of a larger recovery of the overall used-vehicle market. According to Cox Automotive estimates, total used-vehicle sales volume was down 12% year over year in June. In comparison, the new-vehicle market was down by 27%.

June used SAAR is estimated to be 36.0 million, down from 39.8 million last June, but an improvement of May’s 32 million rate. Looking more narrowly at used vehicles sold through certified dealerships, the used retail SAAR in June is estimated to be 18.9 million, down from 21.0 million last year but up month over month from May’s 16.7 million rate.

For the first half of 2020, the non-luxury segment had 941,352 total CPO sales, a 12.1% year-over-year decrease. Ram, with 35,579 CPO sales, performed best with a 1.1 percentage point gain in share compared to last year. Nissan rounded out the segment for 2020 with a decrease of 1.1 percentage points in share year over year.

For the luxury segment, 291,868 CPO sales were made in the first six months of 2020 for a 10.4% drop compared to a year ago. Mercedes-Benz outperformed the competition with a 1.2 percentage point gain year over year and 61,272 CPO sales for 2020. Porsche reported record-setting CPO sales in June, selling nearly 3,000 CPO vehicles last month, versus 5,000 new vehicles. Lexus lost 1.6 share within the segment and fell 20.3% in CPO sales compared to first half 2019.