Data Point

New-Vehicle Prices Set New Record in July 2022, According to Kelley Blue Book, as Inventory Improves Year-Over-Year and Luxury Share Remains Elevated

Wednesday August 10, 2022

Article Highlights

- New-vehicle buyers remain in an “over sticker” market, paying above MSRP every month this year.

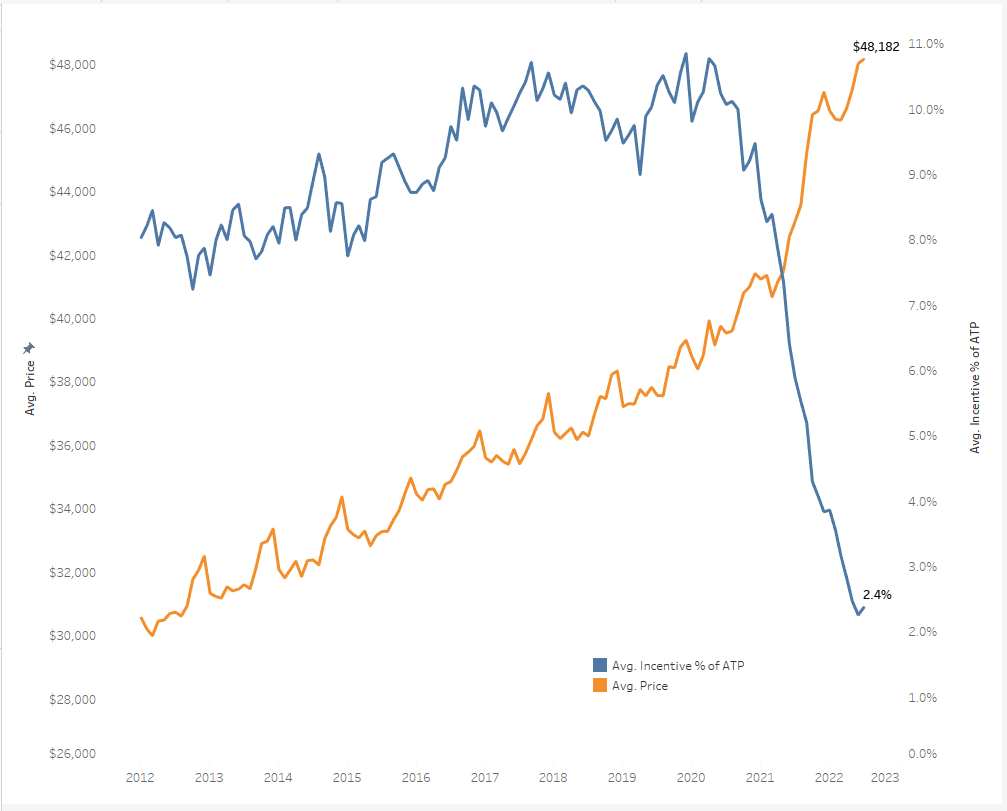

- Inventory improves year-over-year but remains low; incentives increased slightly in July over June, but remain muted, averaging only 2.4% of the average transaction price.

- Strong luxury share – at 17.8% of sales – pushes industry average price higher.

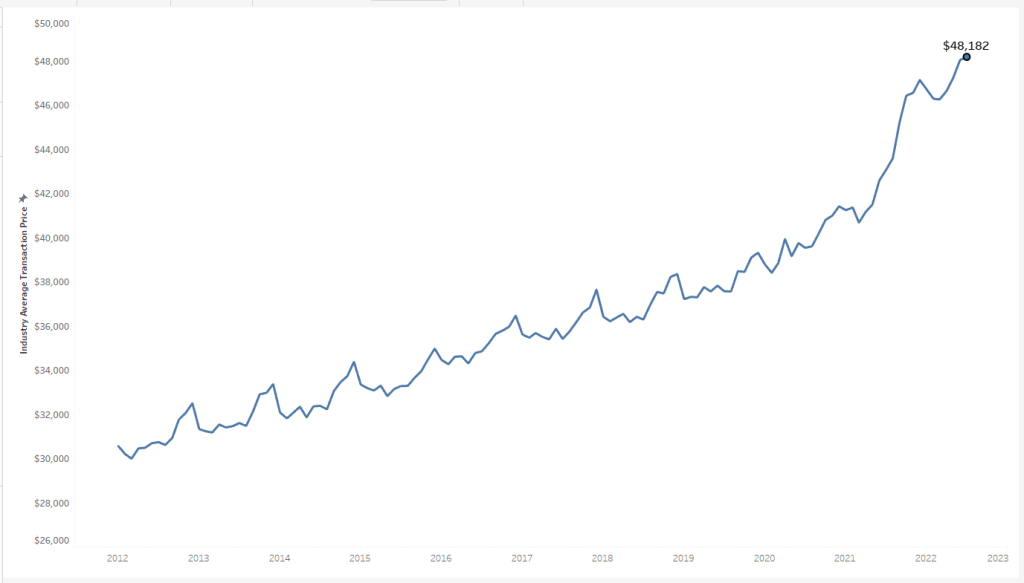

The average price paid for a new vehicle in the U.S. in July topped June’s record and kept the average transaction price (ATP) solidly above the $48,000 mark, according to new data released today by Kelley Blue Book, a Cox Automotive brand.

The Kelley Blue Book new-vehicle ATP increased to $48,182 in July 2022, beating the previous high of $48,043 set last month. July prices rose 0.3% ($139) from June and 11.9% ($5,126) from July 2021.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

New-vehicle inventory days’ supply held steady in the mid-30s in July, where it has been consistently since the final months of 2021. Surprisingly, days’ supply the end of July was 27% higher than it was in 2021, when inventory shortages first started to impact the market, demand was even higher, and days’ supply dropped into the 20s. Still, with roughly 1.1 million units in inventory in the U.S., new-vehicle inventory remains significantly below levels seen in 2020 and 2019.

With tight inventory and sufficient demand, transaction prices remain elevated. Most dealers continue to sell vehicles above the manufacturer’s suggested retail price (MSRP). Honda, Kia, Land Rover, and Hyundai continue to show the most price strength in the market, transacting between 5% to 8% over sticker last month. Ram, Volvo, Lincoln, Buick, and the smaller Italian brands, Alfa Romeo and Fiat, showed the least price strength last month, selling 1% or more below MSRP.

“It’s still a sellers’ market,” said Rebecca Rydzewski, research manager of economic and industry insights for Cox Automotive. “New-vehicle inventory levels are better than a year ago, but remain historically low, and that’s keeping new-vehicle prices elevated. Still, even though average prices are at a record, there are affordable vehicles out there. Compact cars and SUVs and subcompact models typically transact for 30% to 40% below the industry average.”

The average price paid for a new non-luxury vehicle last month was $44,431, up $363 from June 2022, and a new record for non-luxury vehicles, beating out the high set the prior month. Car shoppers in the non-luxury segment paid on average $875 above sticker price, a decrease from the prior month. Still, shoppers are paying more than they did compared to a year ago in July 2021 when they paid 0.8% below MSRP.

In July, the average luxury buyer paid $65,530 for a new vehicle, down $382 from last month, when luxury ATPs hit a record $65,912. Luxury buyers continue to pay more than MSRP for new vehicles, although prices are trending closer sticker prices. For comparison, luxury vehicles were selling for $386 under MSRP one year ago. Luxury vehicle share remains historically high, pushing the overall industry ATP higher, but decreased to 17.8% of total sales in July from 18.2% in June.

The average price paid for a new electric vehicle (EV) dropped in July by 2.3% compared to June but increased by 18.8% versus a year ago. The average price for a new electric vehicle – over $66,000, according to Kelley Blue Book estimates – remains well above the industry average and more aligned with luxury prices versus mainstream prices.

Incentives increased slightly in July versus June, but remain low, at only 2.4% of the average transaction price. A year ago, incentives averaged 5.9% of ATP. Full-size cars and luxury cars had the highest incentives in July, while high-performance cars, full-size luxury SUVs, and electric vehicles had the lowest

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP