Commentary & Voices

Labor Day Weekend is New-Vehicle Clearance Time

Wednesday August 28, 2019

Article Highlights

- The volume of new-vehicle incentive programs available remains at record levels due in part to how the automakers are allocating incentive spend for targeted offers on aged inventory, slow-selling product and poorly-equipped vehicles.

- There are generally three tactics associated with the way incentives are assigned to help drive inventory turns and sustain a desirable pace of new-vehicle sales: stimulate, manipulate and motivate.

- Dealers need to maintain lean and desirable dealer inventory levels by embracing a higher discipline in new-vehicle stocking with a healthy dose of smart pricing and payment tactics.

How will new-car dealers and their manufacturing partners reduce bloated inventory on dealer lots? We’ll get a hint this coming weekend, as the Labor Day holiday puts focus on the trifecta of new-vehicle incentive strategies for clearing lots of older models. Right now, dealers are juggling 2018 (reported to be 3.5% of new-vehicle sales last month), 2019 and 2020 models in inventory.

The U.S. economy continues to show strength, but auto sales are under pressure due to affordability issues, a general saturation point with new-vehicle sales, and an influx of off-lease, nearly-new products that are particularly attractive to price-conscious shoppers. Vehicle inventories have been rising (see more at https://www.coxautoinc.com/market-insights/inventories-rise-automakers-cut-production/) and that’s leading to new incentives to keep sales flowing.

The volume of new-vehicle incentive programs available remains at record levels due in part to how the automakers are allocating incentive spend for targeted offers on aged inventory, slow-selling product and poorly-equipped vehicles. We’re seeing more incentive offers assigned at VIN-specific levels, using “tagged cash” and “percent off,” along with more APR offers from the captive finance companies taking advantage of recent Fed interest rate reductions.

There are generally three tactics associated with the way incentives are being used to help drive inventory turns and sustain a desirable pace of new-vehicle sales.

Tactic #1: Stimulate – These are Tier I/II-advertised specials designed to cast a broad net and engage casual shoppers. Essentially, these incentives are “advertising” incentives and traffic drivers, often 0% APR or 20% off MSRP, and are designed to spike interest in a given brand or specific vehicles that are old inventory or in low demand.

Tactic #2: Manipulate – These incentives include many special APRs and cash offers available to make the deal even more attractive and turn active, on-the-lot shoppers into buyers. Manipulate-type incentives are often “bail out” incentives on specific, must-move vehicles, e.g. 2018 models languishing on the lots.

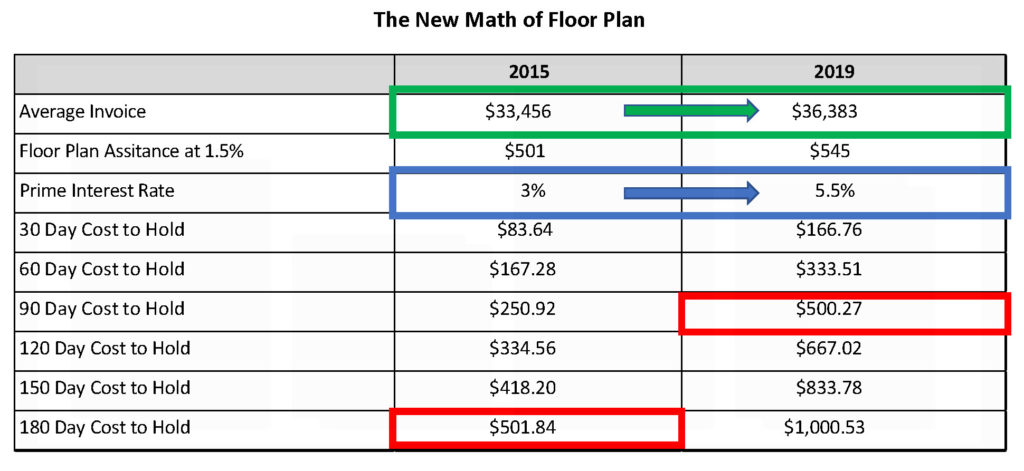

Tactic #3: Motivate – The best dealers are tuned in to local market sales metrics for stocking, promoting and incentivizing high-demand, new vehicles. These smart incentives help keep the inventory moving, which is more important than ever as the math for floor plan carrying costs has changed significantly in the past few years. (See chart below from “Investment Minded New Car Inventory Management,” a Digital Dealer 27 presentation given by Brian Finkelmeyer, senior director of Conquest at vAuto. His presentation is available for download at the end of this blog.)

(Higher interest rates are directly impacting dealer profitability as aged inventory is significantly more expensive to hold. More than ever, dealers must be focused on the right incentives strategies to keep aged inventory in check.)

The long Labor Day weekend is an important milestone in any sales year. If sales are strong, we will be on course for a healthy, profitable fourth quarter. If sales come in weak, we will be watching for even more incentives and special offers to help move old inventory and make room for fresh 2020 vehicles.

Smart incentive strategies and production cuts by the automakers are helping prepare the industry for a lower SAAR, forecast by Cox Automotive to be 16.8 million in 2019, down from 17.3 million last year. Still, dealers need to maintain lean and desirable dealer inventory levels by embracing a higher discipline in new-vehicle stocking with a healthy dose of smart pricing and payment tactics.

Brad Korner is general manager of Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 87,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.