Data Point

Large Dealer Groups Perform Slightly Better Than Overall Market in First Half

Wednesday August 19, 2020

Article Highlights

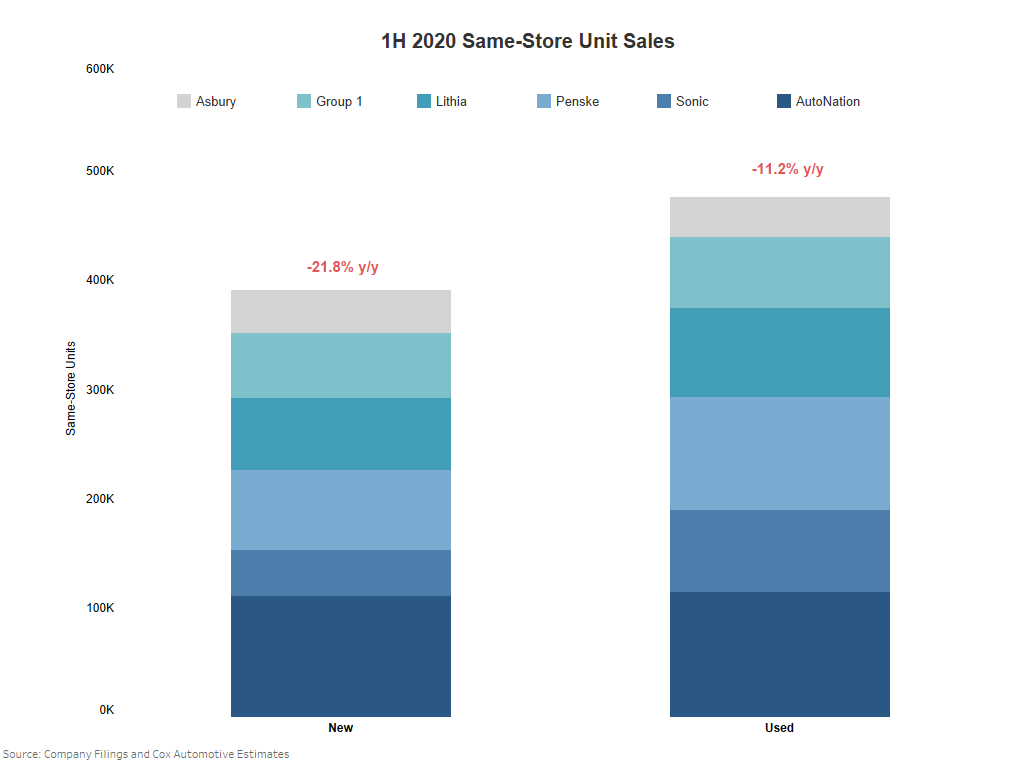

- Looking at the 1H performances of these publicly traded dealer groups, the trend in our industry is crystal clear: Sales are down, but the used market is performing better than new.

- Aggregate same-store sales in the first half for new-vehicle sales year over year are down 21.8% while used-vehicle sales are down 11.2%.

- Larger dealer group sales represent a sightly better performance than the overall market.

The shift in vehicle demand, away from new and toward used, is clearly reflected in the 1H financial reporting of the largest players in the auto industry: franchised dealer groups. Large dealer groups account for roughly 7% of new-vehicle sales and 5% of used-vehicles sales in the U.S., or 866,695 units for the first half of this year. Looking at the 1H performances of these publicly traded dealer groups, the trend in our industry is crystal clear: Sales are down, but the used market is performing better than new.

Looking at aggregate same-store sales in the first half, new-vehicle sales year over year are down 21.8% while used-vehicle sales are down 11.2%. These sales represent a sightly better performance than the overall market where new-vehicles sales remain weak and are down 23% year over year while the used-vehicle market saw a 17% year-over-year decrease in the first half. Cox Automotive estimates for 1H new retail registrations is 5.37 million and used retail is 9.15 million.

In total, the large dealer groups are selling more used units which follows general industry guidelines for dealer operations. How much they can skew to used-vehicle sales is contingent on used-vehicle supply and pricing. Strong demand for used vehicles has caused retail used-vehicle inventories to slump to new lows, according to the latest Cox Automotive analysis of vAuto Available Inventory data.