Data Point

Large Dealer Groups Underperformed Market Yet Saw Phenomenal Financial Performance in Q3

Tuesday November 10, 2020

Article Highlights

- The gap between same-store unit sales of new- and used-vehicles shrank in Q3 at franchised dealer groups.

- Considering the Q3 performances of these publicly traded dealer groups, the trend of used-vehicle sales performing better than new is diminishing.

- While large dealer groups underperformed the overall market, they saw phenomenal financial performance and profitability due to the rise in retail demand and sales of higher priced vehicles.

The gap between same-store unit sales of new- and used-vehicles shrank in Q3, according to the largest players in the auto industry: franchised dealer groups. Compared to Q2, large dealer group new-vehicle sales improved by 13% while used-vehicle sales improved by 6% in the third quarter. Large dealer groups account for roughly 7% of new-vehicle sales and 5% of used-vehicles sales in the U.S., equaling more than 400,000 units sold in the third quarter of this year.

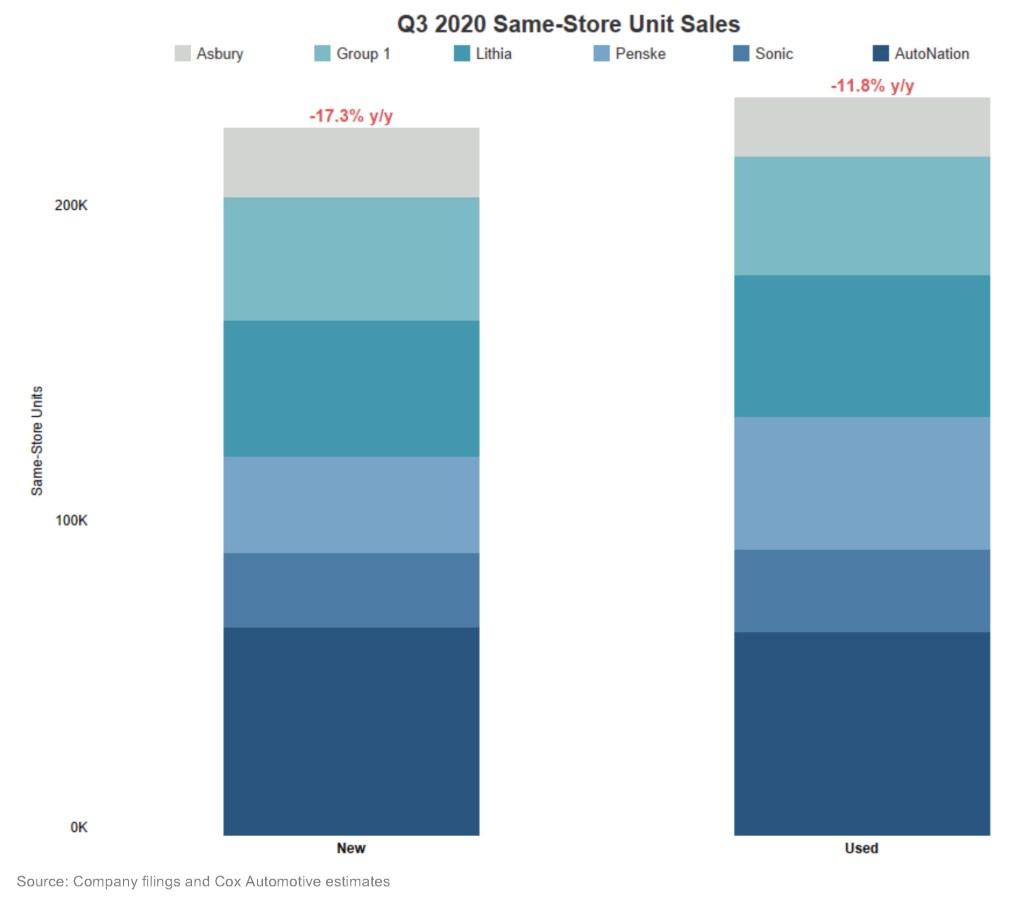

Looking at aggregate same-store sales in the third quarter, while large dealer groups underperformed the overall market, they saw phenomenal financial performance and profitability due to the rise in retail demand and sales of higher priced vehicles. At large dealer groups, year-over-year new-vehicle sales were down 17.3% while used-vehicle sales were down 11.8%.

When reviewing the overall Q3 market performance, new-vehicle unit sales, including fleet, were down 9.5% year over year. Q3 results for new retail were down 6% while the overall used market was up 6.4% year over year, according to a Cox Automotive analysis of IHS Markit new retail registrations data.

In total, large dealer groups are still selling more used units which follows general industry guidelines for dealer operations. How much they can skew to used-vehicle sales is contingent on used-vehicle supply and pricing. Strong demand for used vehicles caused retail used-vehicle inventories to slump to new lows in July, though supply has stabilized more recently, according to the latest Cox Automotive analysis of vAuto Available Inventory data.