Commentary & Voices

Leasing Decline Has Short-Term and Long-Term Implications

Friday October 28, 2022

Leasing is an important financing option for potential shoppers in the new-vehicle market. New vehicles financed through an auto loan generally have a higher monthly payment. Thus leasing provides an affordable “bridge” to new vehicles for people who cannot afford to purchase outright.

Additionally, leasing has been an important option for potential buyers who don’t want to commit to a vehicle, its aging technology, and its purchase contract for more than three years.

One would think that a short-term commitment, a lower monthly payment, and access to all the latest technology would make leasing especially popular in our current volatile economic climate. However, this has not been the case, as leasing’s role in the post-COVID marketplace has declined substantially, and there will be long-term consequences.

During the boom years of 2015-2019, when annual new-vehicle sales averaged nearly 17.3 million units, nearly 30% of all retail sales were leased. However, in the years since, the importance of leasing in the market has changed significantly.

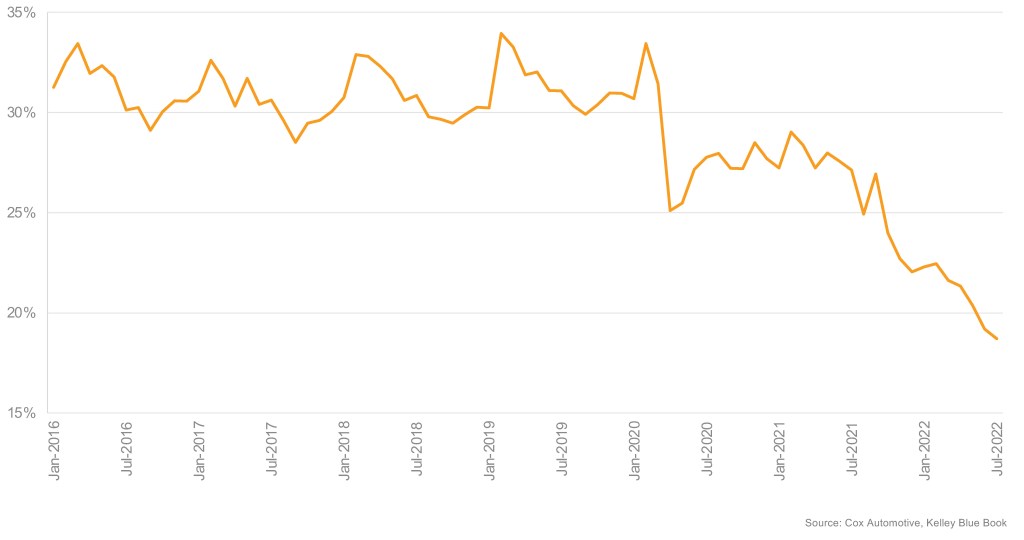

Retail Lease Share of Retail Sales

After reaching a modern peak of nearly 34% in February 2019, the leasing share of retail new-vehicle sales has been falling. When the global pandemic first hit the market, lease share fell as purchasers dominated sales activity, spurred on by 0% financing offers. Then, when supply shortages began impacting sales in the spring of 2021, leasing share began a rapid and consistent decline. Cox Automotive lowered its 2022 lease share forecast to 19%, and it could go even lower based on current trends.

Leasing has Declined for Three Main Reasons

A number of reasons are driving the leasing decline in the post-COVID marketplace. Here are the three top factors:

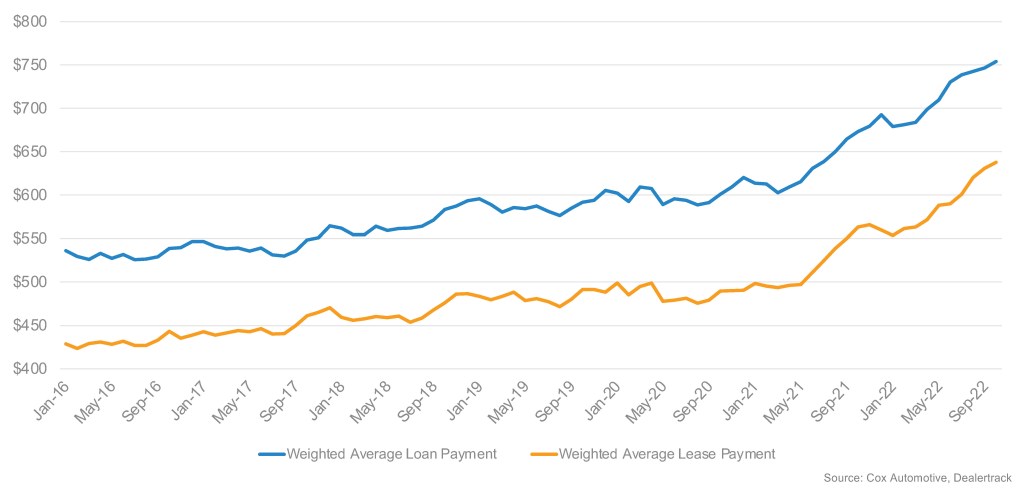

- Higher vehicle prices and interest rates have eliminated many buyers from the market. This year’s average lease payment is about equal to 2020’s average new-vehicle loan payment. Leasing customers – who are generally looking for lower monthly payments – have likely been hit hard and have stepped away from the market, choosing to wait out the rough weather.

- Returning lease customers may not have returned after all. Normally, people return the keys to their leased vehicle when the contract is up and choose to replace their leased vehicle with a new leased vehicle. It’s a virtuous circle, but it has been interrupted this year. Vehicle values rose substantially over the last two years, and existing lease customers likely saw their vehicle’s worth increase as well. When the contract was up, they exercised their right to buy their leased vehicle rather than sign a new lease contract.

- Lease offers just are not very compelling this year. Automakers are not supporting leasing because they would rather sell a new vehicle. Customer and dealer incentives for leasing have been mostly non-existent, and the monthly payment for a lease has risen nearly as much as purchase offers. The deals are just not that good, so consumers are opting out of leasing.

The lack of subvention for leasing by manufacturers could change quickly, though, if inventories start to build up on dealer lots around the country. Supply has been slowly improving, but prices have remained firm so far, which is how the industry would like to keep it. But if inventories build too rapidly, more aggressive sales strategies may be re-employed, and better lease offers may follow. There certainly is a lot of lease share to be re-acquired.

Fewer Leases Result in Higher Prices Now and Fewer High-Quality Used Vehicles Later

The short-term implication of less leasing is that consumers are likely facing higher prices since leasing payments are normally lower than purchasing. This lack of available lease options further limits the pool of people who can afford a new vehicle, which has been shrinking as vehicle prices climb and interest rates increase.

Average New-Vehicle Loan Payment Versus Average New-Vehicle Lease Payment

The longer-term implications, however, may be even more important. Less leasing in today’s market means fewer off-lease vehicles – “gently used” – will be available in the very near future. These vehicles often fuel the certified pre-owned market, popular with consumers who cannot quite afford a new vehicle but want a quality product with a warranty.

The new-vehicle boom years, with nearly four million new leases each year, created millions of excellent off-lease vehicles available for purchase three years later. The market is benefitting from that today.

However, starting in 2023, the effects of the pandemic-driven slowdown and the changes in leasing will significantly impact the used-vehicle supply by mid-decade. The number of lease maturities from 2023-2025 is expected to be 2.5 million fewer than the total maturities between 2020-2022.

This lack of used-vehicle supply – fewer off-lease vehicles – is one reason we believe used prices may remain elevated for longer as demand slows from rising interest rates. Fewer gently-used off-lease vehicles may force more people into the new-vehicle market, but it will also frustrate many consumers who will face higher prices and a lack of product selection.

Although the COVID-19 virus may be in the rearview mirror now, further complications for the vehicle market are dead ahead.

Charlie Chesbrough is the senior economist at Cox Automotive.