Data Point

CPO Sales Increase for Third Consecutive Month, Remain Off Last Year’s Pace

Wednesday April 13, 2022

Article Highlights

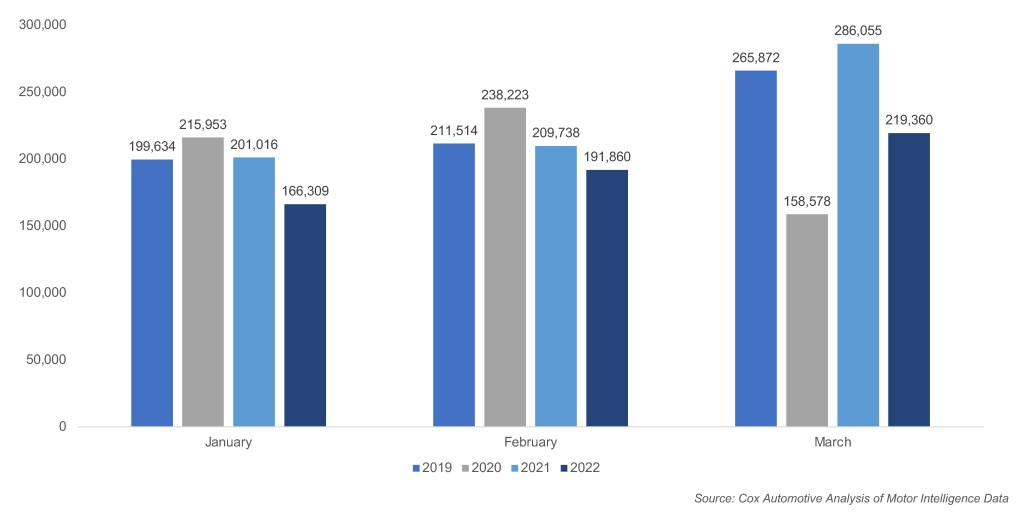

- Certified pre-owned (CPO) sales in March rose to 219,360 units, up 14.3% from February’s 191,860, but down nearly 23.3% from March 2021.

- March’s CPO result is the highest since September 2021 and is the third straight uptick this year.

- A downward revision was made to the 2022 CPO sales forecast bringing it to 2.8 million units.

Certified pre-owned (CPO) sales in March rose to 219,360 units. This total is up 14.3% from February’s 191,860, but down nearly 23.3% from March 2021. March’s CPO result is the highest since September 2021 and is the third straight uptick this year.

MARCH 2022 CPO SALES

Used-vehicle sales in March were down nearly 12% from one year ago according to Cox Automotive estimates. The seasonally adjusted annual rate, or SAAR, was 38.0 million in March, which is down from February’s revised 34.0 million, and down from March 2021’s hot pace of 43.1 million. Used retail sales were also lower in March, estimated to be down about 11% from last March.

According to Charles Chesbrough, senior economist at Cox Automotive: “Limited new-vehicle inventory has slowed the gently used segment due to fewer trade-ins. And higher prices have slowed the sales of older model-year vehicles. Sales are likely to be slightly less this spring selling season.”

CPO Sales Forecast Revised Down for 2022

The Cox Automotive forecasts for 2022 were revised at the end of the first quarter. A downward revision was made to the 2022 CPO sales forecast bringing it to 2.8 million units. Due to fierce competition in nearly-new vehicles, including from rental car companies, CPO will struggle with setting a record this year.