Data Point

March Fleet Sales Struggle to Recover, Remain Down 20% from 2020

Thursday April 8, 2021

Article Highlights

- In March, 183,042 total fleet units were sold, compared to 178,252 in February and 229,725 last March, a 2.7% month-over-month improvement.

- Combined sales into large rental, commercial, and government buyers were down 20.3% year over year in March.

- Government units were down 17% year over year, on a small base, while rental units were down 31% year over year in March, an improvement over the 34% year-over-year drop in 2020.

In March, 183,042 total fleet units were sold, compared to 178,252 in February and 229,725 last March, a 2.7% month-over-month improvement. Combined sales into large rental, commercial, and government buyers were down 20.3% year over year in March. This brings the Q1 2021 total fleet sales to 514,666 units, a 28% decrease from Q1 2020 when 715,212 units were sold into fleet.

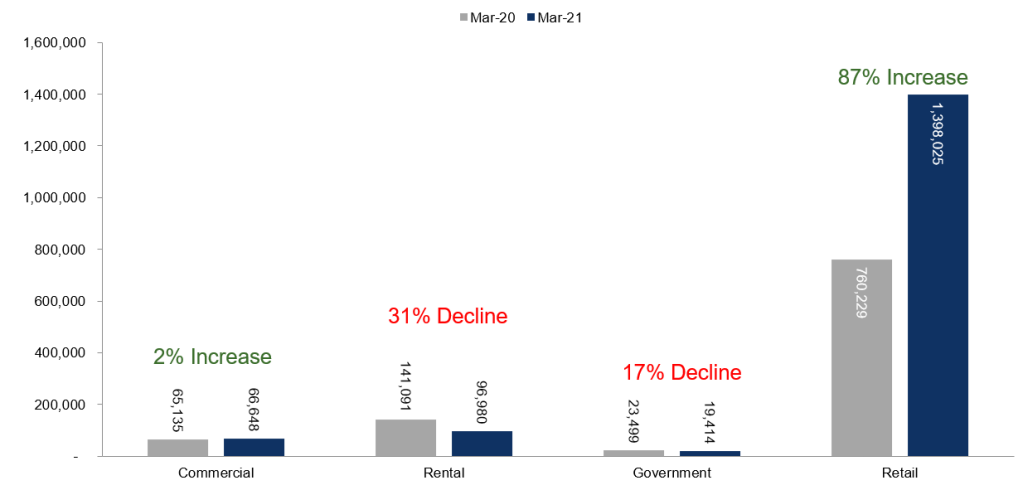

Fleet Sales Year-Over-Year Comparison

Government units were down 17% year over year, on a small base, while rental units were down 31% year over year in March, an improvement over the 34% year-over-year drop in 2020. New-vehicle sales into the commercial channel increased 2% year over year in March. Including an estimate for fleet deliveries into the dealer and manufacturer channel, we estimate that the remaining retail sales were up 87% year over year in March, leading to an estimated retail SAAR of 15.4 million, a vast improvement from 8.4 million last March and up from March 2019’s 13.4 million rate.

March total new-vehicle sales were up 59.7% year over year, with one more selling day compared to March 2020. The March SAAR came in at 17.7 million, an impressive increase from last year’s 11.4 million and the highest monthly SAAR since October 2017.

Looking at automakers, year-over-year changes in fleet sales ranged from 30% growth to a decline of 34%. Nissan fleet sales increased 30% year over year for March. Ford saw the largest decrease in fleet sales in March, according to a Cox Automotive analysis.