Data Point

Wholesale Used-Vehicle Prices See Modest Increase in March

Friday April 7, 2023

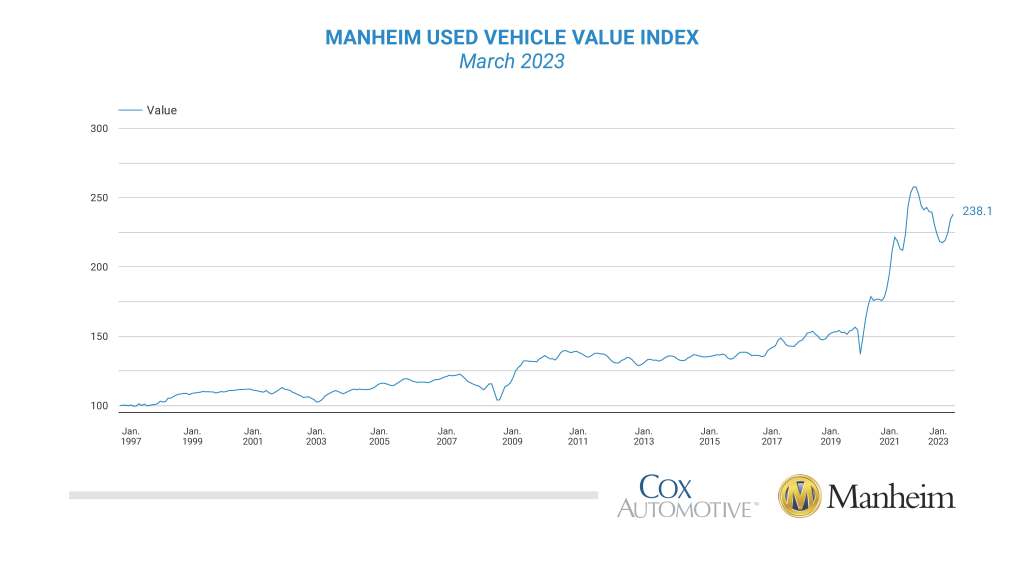

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) increased 1.5% in March from February. The Manheim Used Vehicle Value Index (MUVVI) rose to 238.1, down 2.4% from a year ago. March’s increase was moderated by the seasonal adjustment. The non-adjusted price change in March increased by 3.5% compared to February, moving the unadjusted average price down 2.9% year over year.

In March, Manheim Market Report (MMR) values saw increases that were stronger than normal to start the month but below normal to end the month. Over the last four weeks, the Three-Year-Old Index increased an aggregate 1.6%. Over the month of March, daily MMR Retention, which is the average difference in price relative to the current MMR, averaged 99.8%, meaning market prices were slightly below MMR values. The average daily sales conversion rate increased to 65.4%, which was a normal average for the time of year. For context, the daily sales conversion rate averaged 65.3% in March 2019. However, the conversion rate declined as the month progressed, which indicates the month started with conditions favoring sellers, but by month end, conditions were starting to shift.

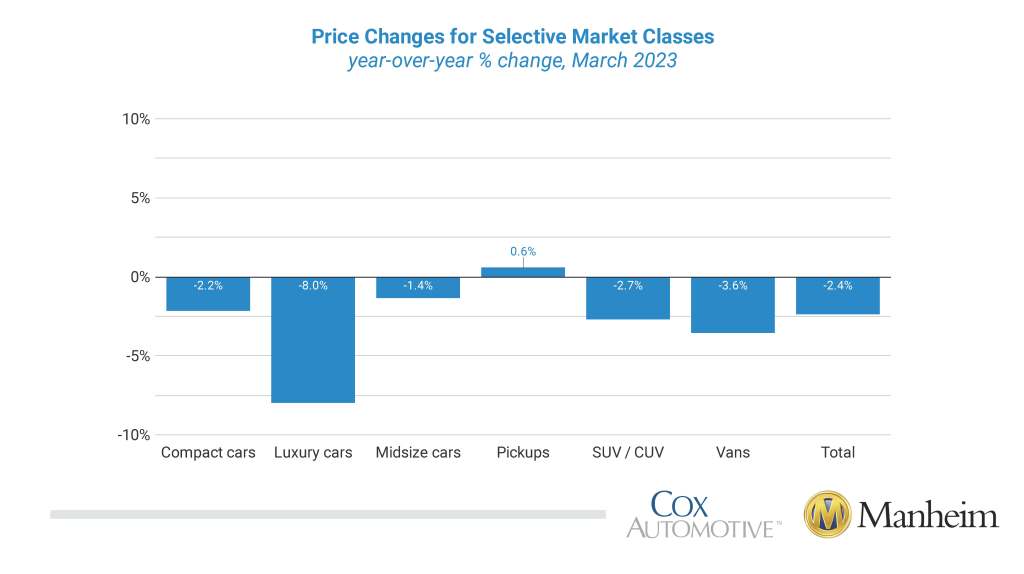

Seven of eight major market segments continued to see seasonally adjusted prices that were lower year over year in March. Pickups showed a 0.6% increase. Compared to last March, midsize and compact cars lost less than the industry, at 1.4% and 2.2%, respectively, while luxury cars lost 8.0%, and the remaining three segments declined between 2.7% and 3.8%. Six of eight categories showed gains compared to February of between 0.5% and 2.1%. Vans were flat, and sports cars lost 1.6% versus last month.

Used Retail Vehicle Sales Declined Year Over Year in March

Assessing retail vehicle sales based on observed changes in advertised units tracked by vAuto, we initially estimate that used retail sales increased 13% in March from February but failed to see the normal March lift. Used retail sales are estimated to be down 6% year over year.

Using estimates of used retail days’ supply based on vAuto data, an initial assessment indicates March ended near 38 days’ supply, down from 43 days at the end of February and nine days lower than how March 2022 ended at 47 days. Leveraging Manheim sales and inventory data, wholesale supply is estimated to have finished March at 22 days, down two days from the end of February and down one day from how March 2022 ended at 23 days.

March’s total new-light-vehicle sales were up 8.6% year over year, with the same number of selling days as March 2022. By volume, March new-vehicle sales were up 19.3% from February. The March sales pace, or seasonally adjusted annual rate (SAAR), came in at 14.8 million, a 9.3% increase from last year’s 13.6 million but down 1.2% from February’s revised 15.0 million pace.

Combined sales into large rental, commercial, and government fleets increased 28% year over year in March. Sales into rental fleets were up 46% year over year, sales into commercial fleets were up 7%, and sales into government fleets were up 39%. Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 5.6%, leading to an estimated retail SAAR of 12.9 million, up 1.5 million from last year’s pace and up 0.6 million from last month’s 12.3 million pace. The fleet market share of 17.9% was a 2.4% gain compared to last year’s share of 15.5% and was a 0.2% increase from last month’s estimated 17.7% market share.

Rental Risk Prices and Mileage Rise Again in March

The average price for rental risk units sold at auction in March was up 4.4% year over year. Rental risk prices were up 2.5% compared to February. Average mileage for rental risk units in March (at 64,800 miles) was up 2.9% compared to a year ago and up 6.8% from February.

Measures of Consumer Confidence Mixed in March

The Conference Board Consumer Confidence Index® increased by 0.8% in March, as views of present situation declined by 1.2% but future expectations increased by 3.7%. Consumer confidence was down 3.2% year over year. Plans to purchase a vehicle in the next six months increased, yet was lower than in January but higher than a year ago. The confidence index did not decline as much during the pandemic as the sentiment index from the University of Michigan, and the two series diverged again in March. The Michigan index declined 7.5% in March but was up 4.4% year over year. Views of both current economic conditions and expectations declined. Consumers’ views of buying conditions for vehicles declined in March but remained better than a year ago. The daily index of consumer sentiment from Morning Consult measured declining sentiment in March that worsened as the month progressed, following an up month in February. That index declined 2.2% in March as the price of gasoline increased. According to AAA, the national average price for unleaded gas increased 4.3% in March to $3.51 per gallon on March 31, down 16% year over year.

Join us: To hear about the latest MUVVI and trends that shaped the quarter, register to attend the Q1 Manheim Used Vehicle Value Index Call on Friday, April 7, at 11 a.m. EDT. If you are observing Good Friday or Passover, a recording of the call will be available in the Newsroom on Monday, April 10.

The complete suite of monthly MUVVI data for March will be released on April 7, 2023, the fifth business day of the month, as regularly scheduled.

For questions or to request data, please email manheim.data@coxautoinc.com. If you want updates about the Manheim Used Vehicle Value Index, as well as direct invitations to the quarterly call sent to you, please sign up for our Cox Automotive newsletter and select Manheim Used Vehicle Value Index quarterly calls.

The Manheim Used Vehicle Value Index was adjusted to improve accuracy and consistency across the data set as of the January 2023 data release. The starting point for the MUVVI was adjusted from January 1995 to January 1997. The index was then recalculated with January 1997 = 100, whereas prior reports had 1995 as the baseline of 100. All monthly and yearly percent changes since January 2015 are identical. Read more about the decision to rebase the index and review the index methodology for more details.