Data Point

CPO Sales Fall in August, Barely Sustain Record Pace

Thursday September 9, 2021

Article Highlights

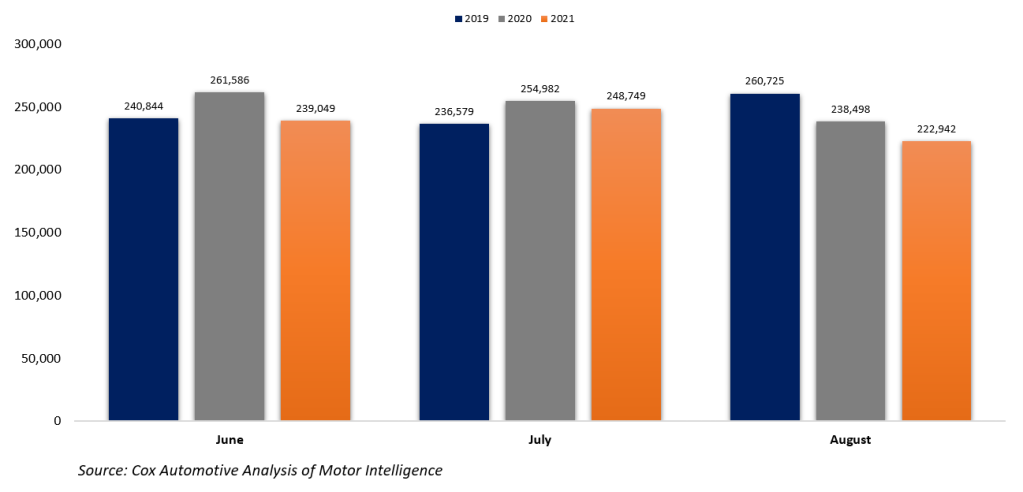

- Certified pre-owned (CPO) sales reached 222,942 units in August, reflecting a 10% month-over-month decrease and a 7% year-over-year decrease when CPO sales continued their strong performance in August 2020 CPO as an important part of the used-vehicle market recovery.

- Another comparison to August 2019 shows that CPO sales are down 14% compared to that more normal period.

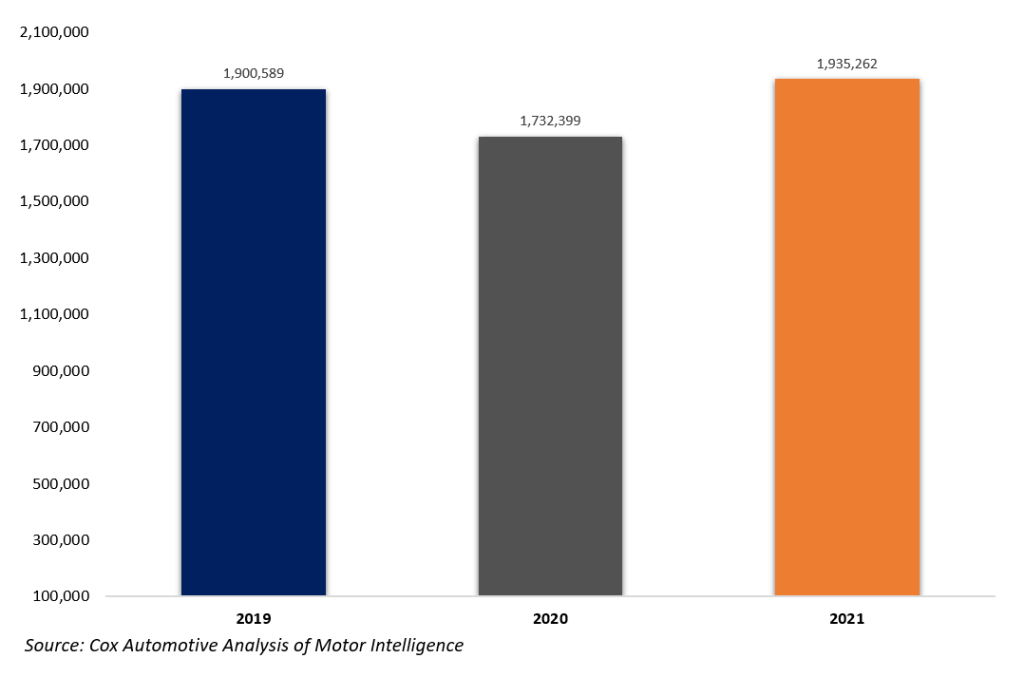

- With 1,935,262 units sold through August, CPO sales are up 12% versus the same time in 2020 and are marginally above the same period in 2019 when a record-high 1,900,589 units were sold.

Certified pre-owned (CPO) sales reached 222,942 units in August. This sales level reflects a 10% month-over-month decrease and a 7% year-over-year decrease when CPO sales continued their strong performance in August 2020 as an important part of the used-vehicle market recovery. The year-over-year decrease was less than the overall used-vehicle market decline of 12%. A comparison to August 2019 shows that CPO sales are down 14% compared to that more normal period.

CPO Sales

With 1,935,262 units sold through August, CPO sales are up 12% versus the same time in 2020 and are marginally above the same period in 2019 when 1,900,589 units were sold. 2019 set a record for CPO sales at 2.80 million units. Despite slowing down, the CPO market is up more than 200,000 units above 2020 and is over 34,000 units above the 2019 level.

Current Year-to-Date CPO Sales

With four months to go, reaching the Cox Automotive CPO sales forecast of 2.80 million units – and matching the record-setting 2019 level – remains within reach. However, as the market slows, achieving that sales level will be a challenge. An analysis of the CPO percentage of used registrations for the first half of 2020 versus the first half of 2021 shows that 24 brands saw a drop in CPO share of used sales in the first half of this year.

When looking at the non-luxury brand performance last month within the CPO market, Ram had the largest year-over-year sales increase at 15% whereas big brands like Subaru and Volkswagen saw more than a 15% decrease in CPO sales compared to August 2020. Within the luxury segment, Land Rover, with a one-year/unlimited miles or two-year/100,000 miles approved CPO warranty, whichever comes first, saw the largest gain compared to August last year at 27%.

According to Cox Automotive estimates, total used-vehicle sales were down 12% year over year in August. We estimate August used seasonally adjusted annual rate (SAAR) to be 36.7 million, down from 41.6 million last August and flat compared to July’s 36.7 million SAAR. The August used retail SAAR estimate is 20.1 million, down from 22 million last year and flat month over month.