Data Point

CPO Sales Roar Back From Large Drops In March And April

Thursday June 4, 2020

Article Highlights

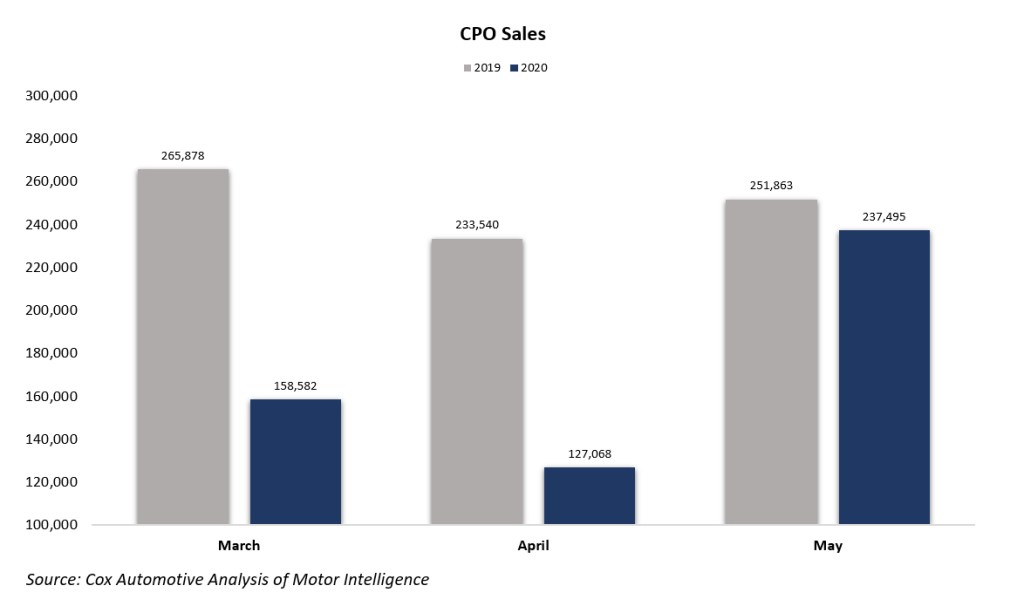

- Sales of certified pre-owned (CPO) vehicles decreased 6% year over year in May with 237,495 CPO units sold.

- This year CPO sales are down 15.9% versus 2019, with 977,333 CPO units sold through May.

- Relatively stronger CPO sales in May were part of a larger recovery of the overall used-vehicle market.

Sales of certified pre-owned (CPO) vehicles decreased 6% year over year in May but were up 87% month over month compared to April. For May, 237,495 CPO units were sold.

CPO sales were on a record-setting pace the first two months of the year before COVID-19 put the brakes on auto sales. Reflecting huge decreases in March and April, CPO sales are down 15.9% so far this year versus the same time in 2019, with 977,333 CPO units sold through May. This means that the CPO market is more than 200,000 units below last year for the first five months of 2020.

Toyota, Honda and Chevy continue to be the biggest players in the CPO market, collectively representing a third of all CPO sales. Those three plus Ford and Nissan account for 44% of CPO sales so far in 2020. Last year, Toyota, Honda and Chevy accounted for 32% of the total industry CPO sales reflecting that brands are maintaining consistent CPO sales share this year compared to 2019.

Relatively stronger CPO sales in May were part of a larger recovery of the overall used-vehicle market. According to Cox Automotive analysis of the numbers, used-vehicle sales were down 22.4% year over year in May. In comparison, the new-vehicle market was down by 30%.

May used SAAR is estimated to be 32.0 million, down from 39.2 million last May, but an improvement of April’s 27 million rate. Looking more narrowly at used vehicles sold through certified dealerships, the used retail SAAR in May is estimated to be 16.7 million, down from 21.0 million last year but, again, up month over month from April’s 14.4 million rate. Overall, used-vehicle demand continues to improve, which has helped stabilize wholesale vehicle prices and reduce the excess supply of used vehicles. The wholesale used-vehicle supply peaked at 149 days on April 9, when normal supply is 23. It was down to 39 days by the end of May.