Data Point

Fleet Sales Continue to Get Pummeled, Rental Units Drop 91.3% in May

Thursday June 4, 2020

Article Highlights

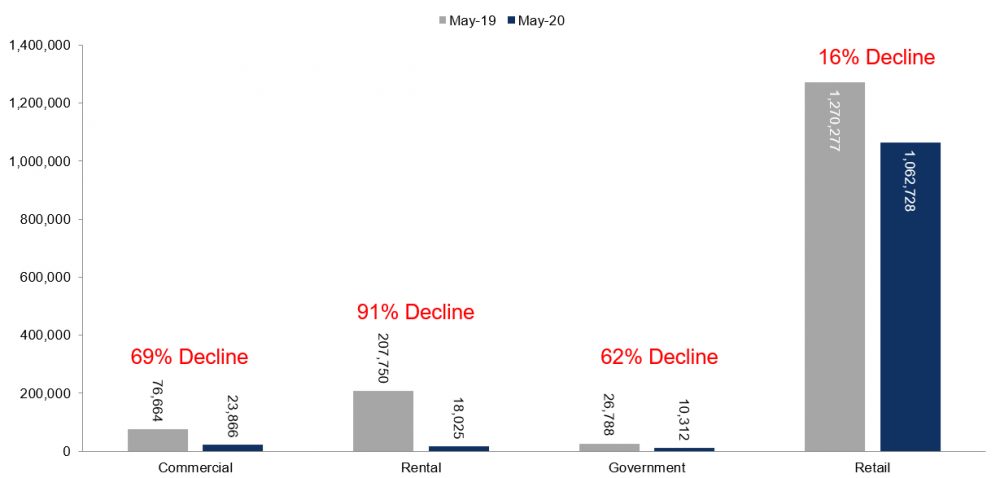

- Year-over-year fleet sales are down 83.2% in May with only 52,203 units sold into fleet for the month.

- Total fleet volume in May was down significantly from the year-ago level when 311,202 units sold into fleet.

- Rental units led the drop with a 91.3% decrease year over year in May.

Year-over-year fleet sales continued its remarkable decline compared to the prior year as the combined rental, commercial and government purchases of new vehicles were down 83.2% in May. Total fleet volume in May was 52,203, down significantly from 311,202 in May 2019. Rental units led the drop with a 91.3% decrease year over year in May. The dismal May result follows drops in both March (down 34%) and April (down 77%).

It’s not all bad news for the industry, though. As Michelle Krebs, executive analyst for Cox Automotive notes, “Reduced fleet business is not necessarily an awful trend, as automakers need to be replenishing dealer lots to help deliver more profitable retail business. If there is ever a good time for bad fleet, it’s now.”

Retail sales of new vehicles were down 16% year over year in May, leading to a retail seasonally adjusted annual rate (SAAR) of 11.6 million, down from 14.0 million last May but up from April’s 7.9 million rate.

May total new-vehicle sales were down 30% year over year, with the same number of selling days compared to May 2019. The May SAAR came in at 12.2 million, a decrease from last year’s 17.4 million but up from April’s 8.6 million rate.

Looking at automakers, all manufacturers saw large year-over-year declines in fleet sales ranging from -78.1% to -89.7% due to the impact of the COVID-19 pandemic. FCA and Nissan saw the largest decreases in fleet sales this month, according to our data analysis, compared to May 2019.