Data Point

Fleet Sales Continue Hot Streak in May

Tuesday June 6, 2023

Sales into large fleets, not including sales into dealer and manufacturer fleets, increased 37.2% year over year in May to 228,342 units, according to an early estimate from Cox Automotive.

“May fleet sales had another strong month of gains over last year with rental, government and commercial all rising,” said Cox Automotive Senior economist Charlie Chesbrough. “However, it is rental fleet showing the largest volume increases, suggesting that the supply chain limitations of 2021 and 2022 are now in the rearview mirror.”

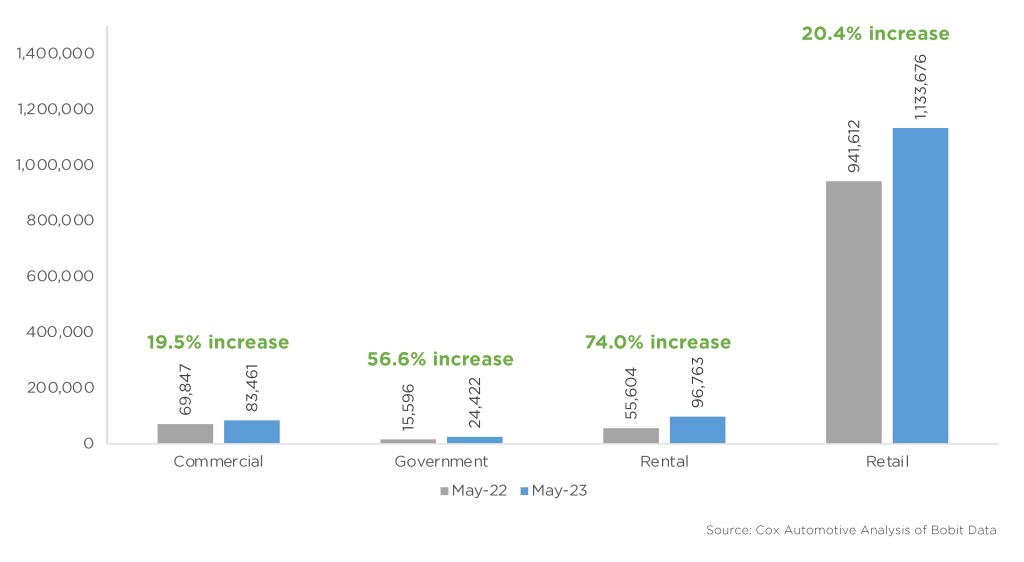

Combined sales into large rental, commercial, and government fleets have seen 11 consecutive months of double-digit, year-over-year increases. Sales into rental fleets were up 74.0% year over year, sales into government fleets were up 56.6%, and sales into commercial fleets were up 19.5%.

May 2023 Fleet Sales

Fleet Share of Retail Sales Increases Again in May

Fed by pent-up demand and improved inventory levels, May new-vehicle sales finished higher than the Cox Automotive forecast. Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 20.4%, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 12.7 million, up from last year’s 10.7 million pace but down from last month’s 13.4 million pace. The fleet market share was estimated to be 16.8%, a gain of 1.8% over last year’s share, and a decrease from April’s 17.5% market share. For comparison, nearly 22% of all vehicles sold in 2019 were through fleet channels. In 2022, the market shifted dramatically, with the fleet share of sales closer to 16% in many months as automakers focused on keeping retail channels stocked.

Among the large manufacturers, General Motors and Ford had the largest increases while Hyundai had the smallest increase in fleet volume compared to May 2022.