Data Point

Wholesale Used-Vehicle Prices See Continued Declines in May

Wednesday June 7, 2023

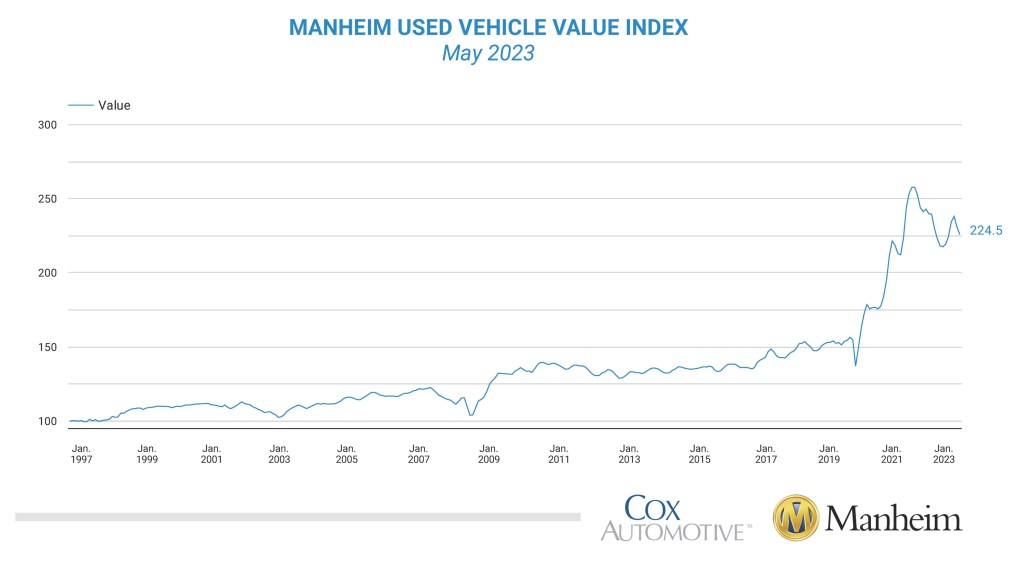

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.7% in May from April. The Manheim Used Vehicle Value Index (MUVVI) declined to 224.5, down 7.6% from a year ago.

“Price erosion continued in May, with another month-over-month drop in the index bringing it 0.3 points below our January result,” said Chris Frey, senior manager of economic and industry insights for Cox Automotive. “Taking a longer view, May’s year-over-year decline accelerated from April and March; however, the rate of decline might slow over the next several months as we encounter the lower prices seen at auction from May through November last year. Two consecutive reads in either measure do not a trend make, as used retail inventory is still below last year, and that tends to keep buyers at the auction, supporting prices.”

May’s decrease was partially impacted by the seasonal adjustment. The non-adjusted price change in May decreased by 1.7% compared to April, moving the unadjusted average price down 8.2% year over year.

In May, Manheim Market Report (MMR) values saw declines that accelerated as the month progressed. Over the last four weeks, the Three-Year-Old Index declined an aggregate 2.6%. Over the month of May, daily MMR Retention, which is the average difference in price relative to the current MMR, averaged 98.7%, meaning market prices were below MMR values. The average daily sales conversion rate declined to 56.3%, which was below normal for the time of year. For context, the daily sales conversion rate averaged 59.9% in May 2019. Conditions have shifted to favoring buyers, but with tight supply, the market is not far from being balanced between buyers and sellers.

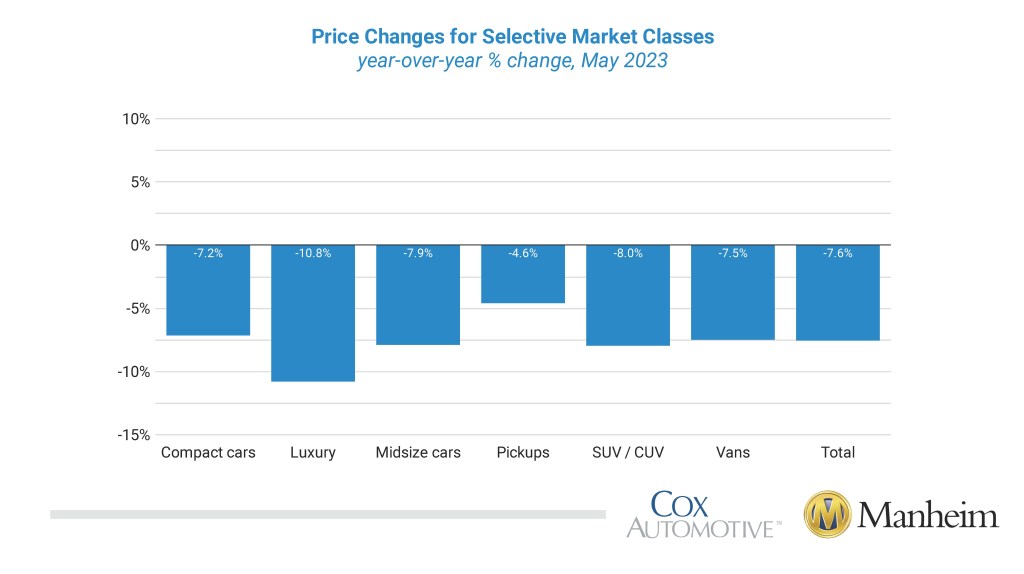

The major market segments saw seasonally adjusted prices that were again lower year over year in May. Compared to May 2022, pickups, compact cars and vans lost less than the industry, at 4.6%, 7.2% and 7.5%, respectively. The luxury segment lost 10.8%, SUVs were down 8.0%, and midsize cars were off by 7.9%. Compared to last month, vans actually increased by 0.2%, while compact and midsize cars declined by 2.4% each. SUVs were flat versus April, with luxury and pickups down 3.0% and 4.3%, respectively.

Used Retail Vehicle Sales Declined Year Over Year in May

Assessing retail vehicle sales based on observed changes in advertised units tracked by vAuto, we initially estimate that used-vehicle retail sales were steady in May compared to April but saw the year-over-year comparison with 2022 deteriorate. Used retail sales are estimated to be down 11% year over year in May. The average retail listing price for a used vehicle moved 0.8% higher over the last four weeks.

Using estimates of used retail days’ supply based on vAuto data, an initial assessment indicates May ended at 45 days’ supply, unchanged from 45 days at the end of April but four days lower than how May 2022 ended at 49 days. Leveraging Manheim sales and inventory data, wholesale supply is estimated to have finished May at 24 days, down one day from the end of April and down one day from May 2022’s estimate of 25 days.

May’s total new-light-vehicle sales were up 22.9% year over year, with one more selling day than May 2022. By volume, May new-vehicle sales were flat month over month. The May sales pace, or seasonally adjusted annual rate (SAAR), came in at 15.0 million, an increase of 19.6% from last year’s 12.6 million but down 6.5% from April’s revised 16.1 million pace.

Combined sales into large rental, commercial and government fleets increased 45% year over year in May. Sales into rental fleets were up 74% year over year, sales into commercial fleets were up 20%, and sales into government fleets were up 57%. Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 20.4%, leading to an estimated retail SAAR of 12.7 million, up from last year’s 10.7 million pace but down from last month’s 13.4 million pace. Fleet share was estimated to be 16.8%, a gain of 1.8% over last year’s share and a decrease from April’s 17.5% share.

Rental Risk Prices and Mileage Mixed in May

The average price for rental risk units sold at auction in May was up 3.0% year over year. Rental risk prices were up 1.0% compared to April. Average mileage for rental risk units in May (at 58,500 miles) was down 7.9% compared to a year ago and down 1.8% from April.

Measures of Consumer Confidence Mixed in April

The Conference Board Consumer Confidence Index® declined by 1.4% in May, as views of the present situation and future expectations both declined. Consumer confidence was down 0.9% year over year. Plans to purchase a vehicle in the next six months increased and was up year over year. The confidence index did not fall as much during the pandemic as the sentiment index from the University of Michigan, but both series declined in May. The Michigan index declined 6.8% for the month but was up 1.4% year over year. Consumers’ views of buying conditions for vehicles declined in May to the lowest level this year but remained better than a year ago. The daily index of consumer sentiment from Morning Consult declined 1.8% in May. Consumer attitudes have been sensitive to inflation and especially the price of gasoline for over a year now, but gas prices fell slightly in May. According to AAA, the national average price for unleaded gas declined 1% in May to $3.57 per gallon, which was down 23% year over year.

The complete suite of monthly MUVVI data for April will be released on July 10, 2023, the fifth business day of the month, as regularly scheduled. The next call is scheduled for Monday, July 10, at 11 a.m. EDT. Register to attend.

For questions or to request data, please email manheim.data@coxautoinc.com. If you want updates about the Manheim Used Vehicle Value Index, as well as direct invitations to the quarterly call sent to you, please sign up for our Cox Automotive newsletter and select Manheim Used Vehicle Value Index quarterly calls.

Note: The Manheim Used Vehicle Value Index was adjusted to improve accuracy and consistency across the data set as of the January 2023 data release. The starting point for the MUVVI was adjusted from January 1995 to January 1997. The index was then recalculated with January 1997 = 100, whereas prior reports had 1995 as the baseline of 100. All monthly and yearly percent changes since January 2015 are identical. Learn more about the decision to rebase the index.