Data Point

May Fleet Sales Rebound After April Drop

Tuesday June 8, 2021

Article Highlights

- In May, 168,166 total fleet units were sold, a 14% month-over-month increase compared to 148,118 in April.

- This brings the 2021 year-to-date total combined large rental, commercial, and government purchases of new vehicles to 830,950 units.

- Toyota saw the largest growth last month with more than 35,000 sales while no manufacturers saw overall decreases compared to May 2020.

In May, 168,166 total fleet units were sold, a 14% month-over-month increase compared to 148,118 in April but a 222% increase from May 2020 which recorded 52,203 units. This brings the 2021 year-to-date total combined large rental, commercial, and government purchases of new vehicles to 830,950 units, a .9% decrease from this time in 2020 when 838,499 units were sold and a 39% decrease from the same time in 2019 when 1,358,183 units were sold.

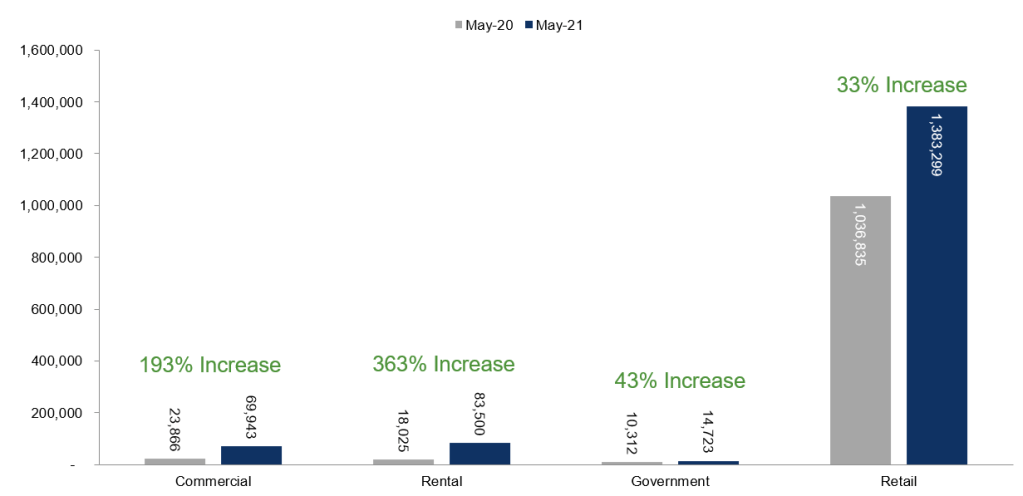

Comparing fleet sales to this time last year, when stay at home orders were in full effect, government units were up 43% year over year, on a small base, while rental units more than tripled year over year in May, an improvement over the 34% year-over-year drop in 2020. New-vehicle sales into the commercial channel increased almost 200% year over year in May. Including an estimate for fleet deliveries into the dealer and manufacturer channel, we estimate that the remaining retail sales were up 33% year over year in May, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 14.9 million, up from 11.2 million last May and up from May 2019’s 13.5 million rate.

May total new-vehicle sales were up 41% year over year, with the same number of selling days compared to May 2020. The May SAAR came in at 17.0 million, an increase from last year’s 12.1 million but down from May 2019’s 17.3 million rate.

Looking at automakers, year-over-year changes in fleet sales more than doubled for some manufacturers in May. Toyota saw the largest growth last month with more than 35,000 sales while no manufacturers saw overall decreases compared to May 2020.