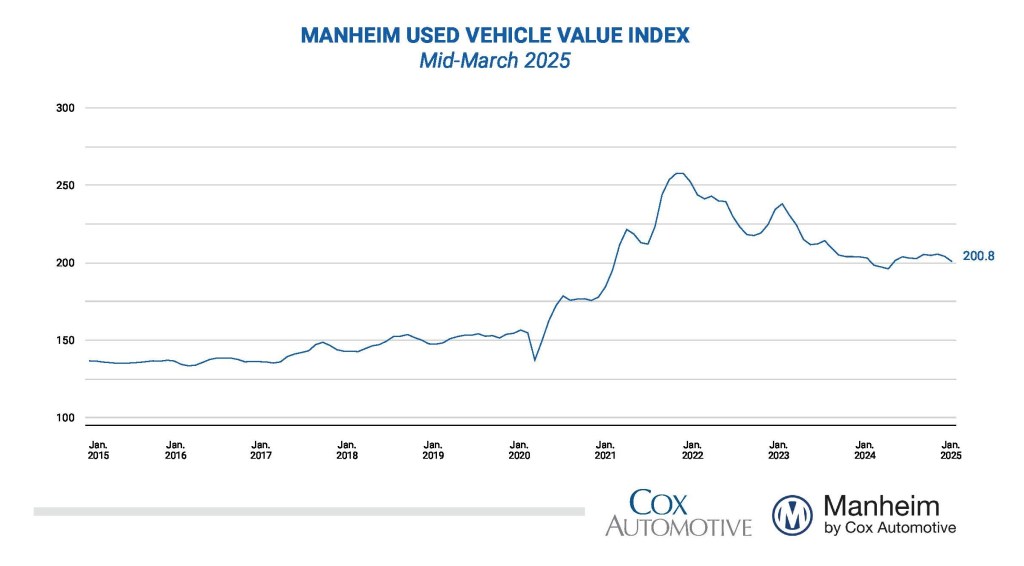

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) dropped from February in the first 15 days of March. The mid-month Manheim Used Vehicle Value Index fell to 200.8, now showing a decline of 1.1% from the full month of March 2024. The seasonal adjustment worked against the March non-adjusted price increase. The non-adjusted price change in the first half of March rose 1.7% compared to February, and the unadjusted price is down 0.5% year over year. The average move for the month of March is an increase of more than 3 points on non-adjusted values, indicating the appreciation observed so far in March is lower than typically seen.

“In the first half of March, we have seen exactly half of the rise in vehicle appreciation that we typically see for the full month,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “Prices are higher, but up less than expected, likely due to an older vehicle mix as lease maturities decline. While full March results are a few weeks away, we are now at the time when we typically see the strongest weekly gains for wholesale prices – our ‘Spring Bounce.’ Tax refund season is well underway, and consumers are getting more money in their pockets; used retail days’ supply is tight. But there’s no question that tariff talk is spooking some consumers, and we may have already seen the peak in the wholesale market.”

Over the last two weeks, the Manheim Market Report (MMR) prices in the Three-Year-Old Index increased by an aggregate of 0.6%, which demonstrates weaker appreciation trends than have been seen over the same weeks in recent years. Over the first 15 days of March, MMR Retention, the average difference in price relative to current MMR, averaged 100.7%, indicating that market prices have moved a bit ahead of valuation models early in March. MMR retention is eight-tenths of a point higher compared to the first half of March 2024. The average daily sales conversion rate of 66.6% in the first half of the month was 5 points higher than last year’s level of 61.5%, and it is above the first half of March 2019 by more than 1 point.

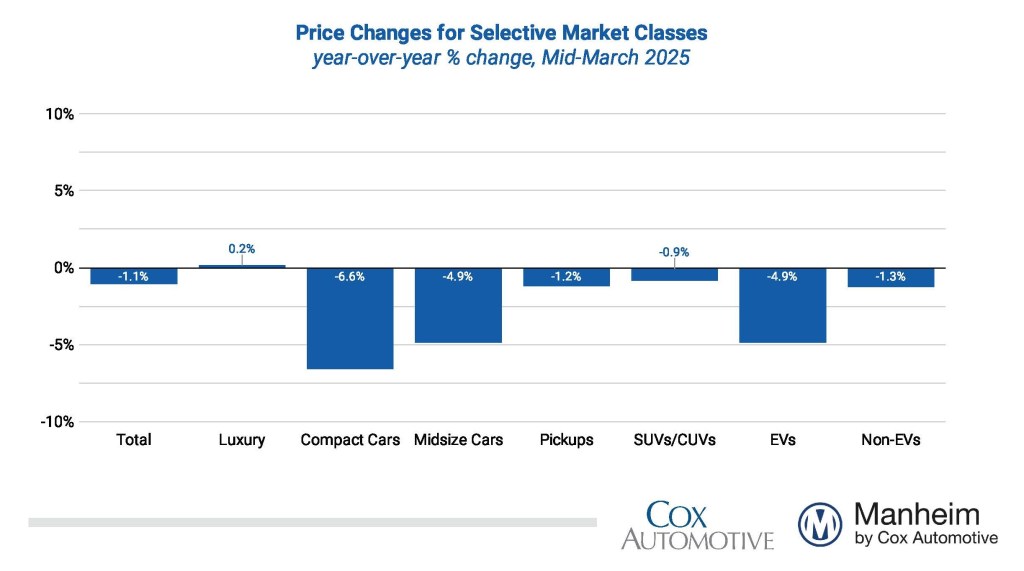

Most major market segments saw negative results for seasonally adjusted prices year over year in the first half of March. Compared to the industry’s year-over-year decrease of 1.1%, luxury performed best, rising by 0.2%. The 0.8% decline in SUVs was also less than the industry average. All other segments declined more, as pickup trucks fell 1.2%, mid-size cars were down 4.9%, and compact cars were down 6.6% during the first 15 days of March. All segments were down compared with the results at the end of February. The overall industry decreased by 1.6% compared to the prior month. The luxury segment declined just 0.5%, SUVs fell 0.9%, while pickup trucks and compact cars decreased 1.2% over the period. The mid-size sedan segment performed the worst, falling by 1.8% compared to the prior month.

Electric vehicle (EV) depreciation levels have moderated recently. EVs were down 4.9% against March 2024, while the non-EV segment was down 1.3%. EVs decreased by 4.0% in the first half of March compared to February values, while non-EVs were down only 0.8% in the month.

Wholesale Supply is Down in Mid-March

Leveraging Manheim sales and inventory data, wholesale supply ended February at an estimated 26 days, down one day from the end of January and up one day compared to February 2024 at 25 days. Wholesale supply continues to hold tighter at this time of year, running almost four days lower than the longer-term levels for this week. As of March 15, wholesale supply had declined two days from the end of February, at 24 days, and was flat versus last year.

Measures of Consumer Sentiment Show Continued Weakness in March

The initial March reading on Consumer Sentiment from the University of Michigan declined 10.5% to 57.9, which was much weaker than expected and was the lowest reading since June 2022. The index was down 27.1% year over year. Views of current conditions and expectations declined, with expectations declining the most. Expectations for inflation in one year jumped to 4.9% from 4.3%, and expectations for inflation in five years increased to 3.9% from 3.5%. Consumers’ views of buying conditions for vehicles declined to the lowest level in more than two years as views of prices deteriorated, but views of interest rates improved. The daily index of consumer sentiment from Morning Consult also shows a decline through March 15. The index declined 0.1% in January, another 1.7% in February, and has declined 1.2% so far in March, leaving the index up by only 3.8% year over year. The average price of unleaded gasoline has declined 0.9% as of March 15 and is down 11% year over year.

The next complete suite of monthly MUVVI data will be released on April 7, 2025, the fifth business day of the month, as regularly scheduled. The Q1 MUVVI call will be held on April 7 at 11 a.m. EDT. Register to attend.

For questions or to request data, please email manheim.data@coxautoinc.com. If you want updates about the Manheim Used Vehicle Value Index, as well as direct invitations to the quarterly call sent to you, please sign up for our Cox Automotive newsletter and select Manheim Used Vehicle Value Index quarterly calls.

Note: The Manheim Used Vehicle Value Index was adjusted to improve accuracy and consistency across the data set as of the January 2023 data release. The starting point for the MUVVI was adjusted from January 1995 to January 1997. The index was then recalculated with January 1997 = 100, whereas prior reports had 1995 as the baseline of 100. All monthly and yearly percent changes since January 2015 are identical. Learn more about the decision to rebase the index.