Data Point

New-Vehicle Inventory Remains in Check to Start 2024

Thursday January 18, 2024

Article Highlights

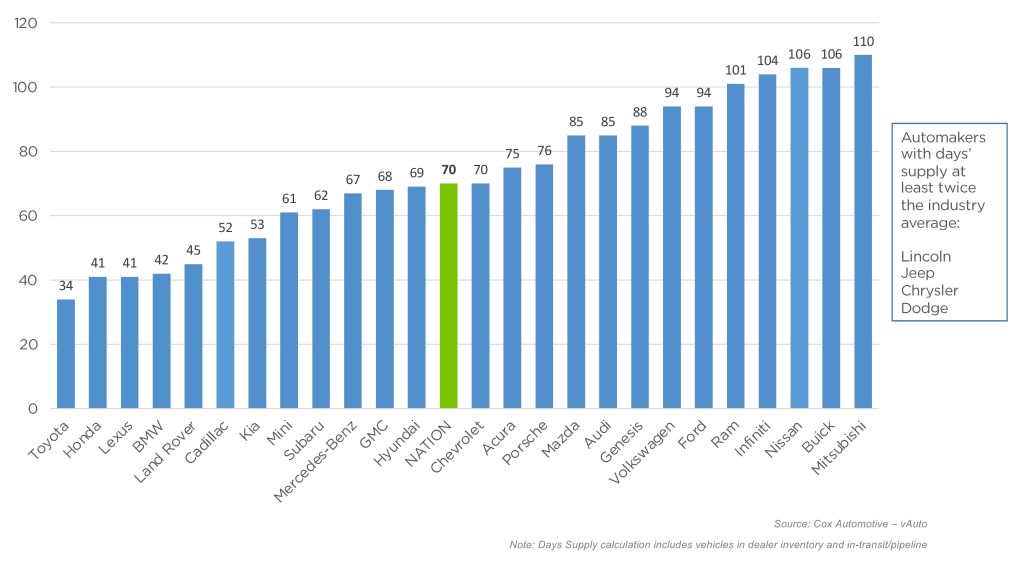

- Strong December sales pulled down new-vehicle days' supply to start 2024.

- Total supply stood at 2.66 million units for 70 days of supply.

- Toyota, Honda inventory low; Stellantis brands and Ford supply high.

Strong December sales pulled down the new-vehicle inventory measure of days’ supply for the start of 2024, according to Cox Automotive’s analysis of vAuto Available Inventory data. While the sheer volume of new vehicles in inventory was higher at the end of December than at the start, the days of supply, which is based on a daily sales rate, fell from 73 to 70.

2.66M

Total Inventory

as of Jan. 1, 2024

70

Days’ Supply

$48,805

Average Listing Price

The total U.S. supply of available unsold new vehicles closed 2023 at 2.66 million units. That was about 50% higher than a year ago and above the 2.56 million vehicles at the start of the month. However, through the middle of the month, supply rose to 2.73 million units. A strong finish to December pulled supply back down. Inventory numbers include vehicles available on dealer lots and some in transit.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period ended Jan. 1, when sales totaled 1.41 million units. Sales for the full month of December were up 13% over the year earlier for a brisk sales pace of 15.8 million units.

Automakers Strive to Manage Inventory Levels

Production cuts also helped keep inventory in check. After the six-week strike by the UAW against the Detroit Three ended, production ramped up. But the automakers also began trimming output at some factories as 2023 wound to a close. Stellantis cut a shift at Jeep plants in Detroit and Toledo, Ohio. Ford slashed production of its electric F-150 Lightning going into 2024. GM extended holiday downtime at some of its full-size truck plants and several other plants.

Toyota and Honda closed 2023 with the lowest inventory of major automakers. Lexus and BMW had the lowest among luxury makes.

DECEMBER DAYS’ SUPPLY OF INVENTORY BY BRAND

Dodge has the highest inventory levels, while Toyota has the lowest.

Of the top-selling 30 models, the ones with the lowest inventory were mostly Toyota and Honda models. The new Chevrolet Trax was lower than average as well.

Toyota executives recently told the Cox Automotive Industry Insights team that Toyota and Lexus brands are both running too lean, closing the year at about 13 days’ supply, by their measure. Their goal throughout the year is to beef up Toyota brand supply to 25 or 30 days’ supply and Lexus to 20 days’ supply. Toyota said it is targeting 150,000 vehicles in inventory by year-end 2024, compared with 81,000 at the end of 2023.

Inventory levels at Honda were still tight going into 2024 but were vastly improved from year-earlier levels. For Honda brand, supply volume at the end of December was 75% higher than a year ago. Meanwhile, Acura’s inventory level also increased in December and was up nearly 120% year over year.

At the other end of the spectrum, Stellantis’ Dodge, Jeep and Chrysler brands had an overabundance of inventory. Notably, on January 12, Stellantis cut 539 supplemental employees across its U.S. manufacturing footprint. This is in addition to as many as 2,453 previously announced temporary layoffs affecting the Mack Assembly Plant in Detroit, where Stellantis builds Jeep Grand Cherokee SUVs, and 1,225 layoffs at the Toledo Assembly Plant in Ohio, home of the Jeep Wrangler SUV and Gladiator midsize pickup, according to Worker Adjustment and Retaining Notification letters. Those layoffs remain effective starting February 5.

Average Listing Price for New Vehicle Hits Two-Year High

During December, the average listing price increased and reached its peak of the last two years. For a new vehicle, the average listing price increased by nearly 4% month over month, rising from $47,435 at the end of November to $48,805 at the end of December. Year over year, the average listing price at the end of the year was up 1.9% compared to the end of 2022. While listing prices have increased year over, discounts and incentives have helped push average transaction prices – the amount buyers paid – DOWN a record 2.4% year over year to $48,759.