Data Point

New-Vehicle Inventory Rises through January; Average List Price Retreats

Thursday February 11, 2021

Article Highlights

- New-vehicle inventory rose through January but remains well below year-ago levels.

- Average new-vehicle list price retreated from early January’s record.

- The highest volume luxury brands had the lowest inventories.

New-vehicle inventory edged higher throughout January but remains far lower than a year ago, while the average list price retreated from its early January peak, according to a Cox Automotive analysis of vAuto Available Inventory data.

2.79M

Total Inventory

66

Days’ Supply

$40,474

Average List Price

The total U.S. supply of available unsold new vehicles stood at 2.79 million vehicles as January closed. That compares with 3 million near the end of December. Still, as has been the case for many months, inventory remains well below year-ago levels when 3.35 million vehicles were available in the comparable timeframe.

A global shortage of computer chips for vehicles has forced automakers around the world to trim production. Nearly every major automaker in every region has been hit, including automakers operating in the U.S. Most recently, GM said it would trim production at three North American plants into mid-March. So far, with a few exceptions, the affected models are those with ample or, in some cases overabundant, inventory.

“Inventories remain lean in the industry, and the chip shortage will make matters worse,” said Charlie Chesbrough, Cox Automotive senior economist. “However, tight supplies haven’t hurt sales. Sales results in December and January were surprisingly strong.”

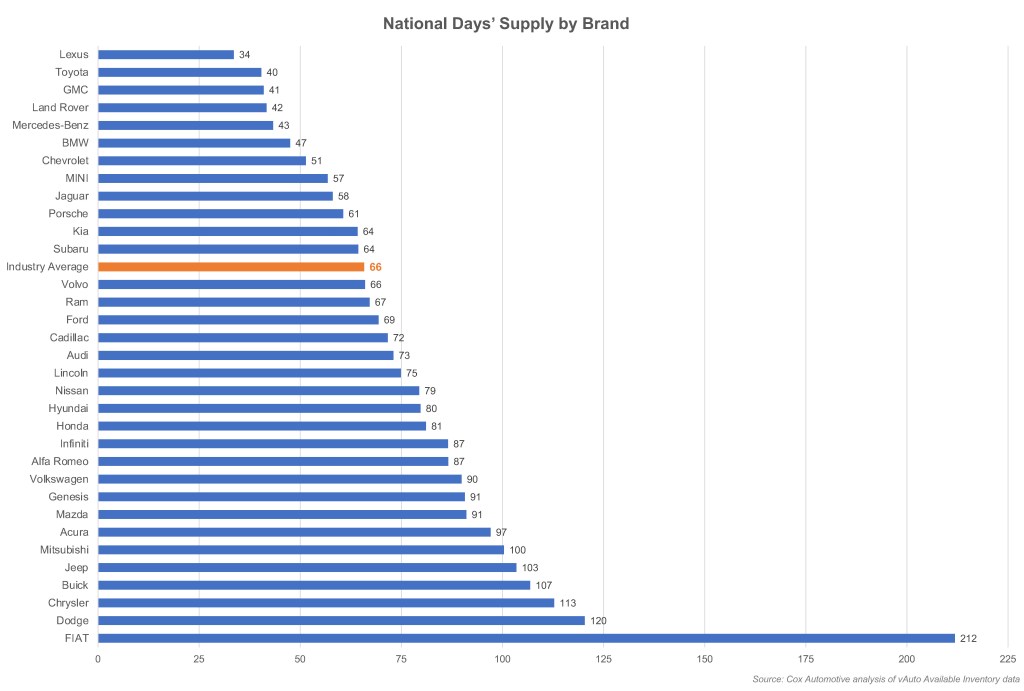

The days’ supply near the end of January stood at 66. That compares with 70 near the end of December but well below last January’s 82.

During January, the days’ supply slipped to 62 but rose near the end of the month. Luxury vehicle days’ supply dipped to 62 in January from 65 in December. Non-luxury vehicle days’ supply was at 66 in January, down from 71 the previous month. The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period. While January sales volume ticked down from a robust December, the sales pace was at the highest level post-COVID.

“Tighter supplies may become the new normal, at least for the time being,” said Chesbrough. “With sales strong and inventories tight, manufacturers can save money because incentives can be relatively modest. Dealers save by carrying less inventory, which lowers their financing costs. Yet vehicle prices stay high. Those factors – lower costs and higher profits – add up to strong profit margins. Manufacturers and dealers will have little incentive to build their inventories to pre-pandemic levels in that scenario.”

PRICES STAY HIGH

Indeed, prices remained high in January, about 6% above a year ago. As January closed, the average list price was $40,474, according to Cox Automotive’s analysis of vAuto Available Inventory data. That compares with $40,684 at the end of December and $38,271 in the same January timeframe 2020.

During the pandemic lockdowns last spring, the average list price hit a 2020 low of $37,211 in March. Prices have marched higher ever since, surpassing $40,000 in late 2020. The week of January 4, the average listing price hit a record high of $40,994. It retreated a bit in the following weeks.

For luxury vehicles, the average listing price in January hit $59,336, up from $59,137 in December. The average non-luxury price in January was $36,805, compared with $37,006 in December.

LUXURY BRANDS HAVE TIGHTEST INVENTORY

High-volume luxury brands had the lowest inventories in January after closing out 2020 with strong sales. Lexus, BMW and Mercedes-Benz along with Jaguar, Land Rover and Porsche had days’ supply below the luxury average of 62.

Once again, Lexus had the skimpiest stocks of all brands – luxury and non-luxury – at a mere 34 days’ supply. Its volume-leading RX SUV has a scant 26 days’ supply; the NX SUV has 40.

Buick, again, had the heftiest inventory among luxury makes at 107 days’ supply. Acura and Genesis were above 90 days’ supply. Infiniti and Alfa Romeo were above 80. Cadillac, Lincoln and Volvo were mid-pack. Cadillac’s new Escalade has less than 25 days’ supply.

TOYOTA, GMC HAVE LOW STOCKS

Among non-luxury brands, Toyota, once again, had the lowest at 40 days’ supply. Almost no Toyota model had an ample supply of vehicles, but SUVs and trucks had the least. The midsize Tacoma pickup, which dominates the segment, had less than 22 days’ supply. The full-size Tundra pickup, which has been hit by the chip shortage and is being redesigned this year, had less than 25 days’ supply. The volume-leading RAV4 was down to 29 days’ supply; the RAV4 prime was at 15, about the lowest supply of any model in the industry except for the Chevrolet Corvette at 9 days’ supply.

GMC wasn’t far behind Toyota with only 41 days’ supply, extremely tight for a brand that sells mostly pickup trucks that come in numerous iterations. The full-size Sierra pickup had only 32 days’ supply, with the heavy-duty versions having even less. The mid-size Canyon pickup had a 41-day supply. The new Yukon and Yukon XL, full-size SUVs redesigned this year, had less than 25 days’ supply.

Other non-luxury makes with less than the average 66 days’ supply were Chevrolet, Kia and Subaru. Kia’s popular Telluride, plagued with shortages for the past year, was down to a 26-day supply. Its cousin, the Hyundai Palisade, also had little inventory at 35 days’ supply. Chevrolet’s full-size Silverado truck, midsize Colorado pickup and new full-size SUVs – Tahoe and Suburban – all had skimpy inventories.

At the other end of the inventory spectrum, Stellantis (formerly Fiat Chrysler) brands had inventory in the triple digits. Fiat, again, had the most of any brand at 212 days’ supply. Jeep, Chrysler and Dodge also had days’ supply in the triple digits as did Mitsubishi.

PRICEY TRUCKS, SUVS HAD LEAST INVENTORY

By vehicle segments, full- and mid-size pickup trucks, full-size SUVs and luxury SUVs of all sizes. EVs and hybrids along with small and full-size cars had the beefiest inventories.

Ford and Ram had better inventories of trucks than its competitors, though not an overabundance. However, the Ford F-150, which launched in the new version late last year, has been hit by the chip shortage resulting in Ford trimming production. The truck has 73 days’ supply, but the split between the new versus the previous version is not clear. The Super Duty F-Series had very low inventories.

Ram had only 67 days’ supply of the 1500; the Classic version had high inventories. The Jeep Gladiator was the only midsize truck with substantial inventory, in fact, an oversupply at 118 days.

By price category, the most abundant inventory in terms of days’ supply was vehicles listed at less than $30,000, according to a Cox Automotive analysis. The price segment had about an 80 days’ supply. The most expensive models, priced $80,000 and higher, had a scant 39 days’ supply, though those vehicles sell in a small volume. The $30,000 to $80,000 price categories had inventory under the national average.