Commentary & Voices

Nissan: Sales Fall Despite Soaring Incentives

Monday November 11, 2019

Article Highlights

- Nissan sales lowest, incentives highest in 5 years.

- Infiniti sales plummeted 25%; incentives soared past $8,000 per vehicle.

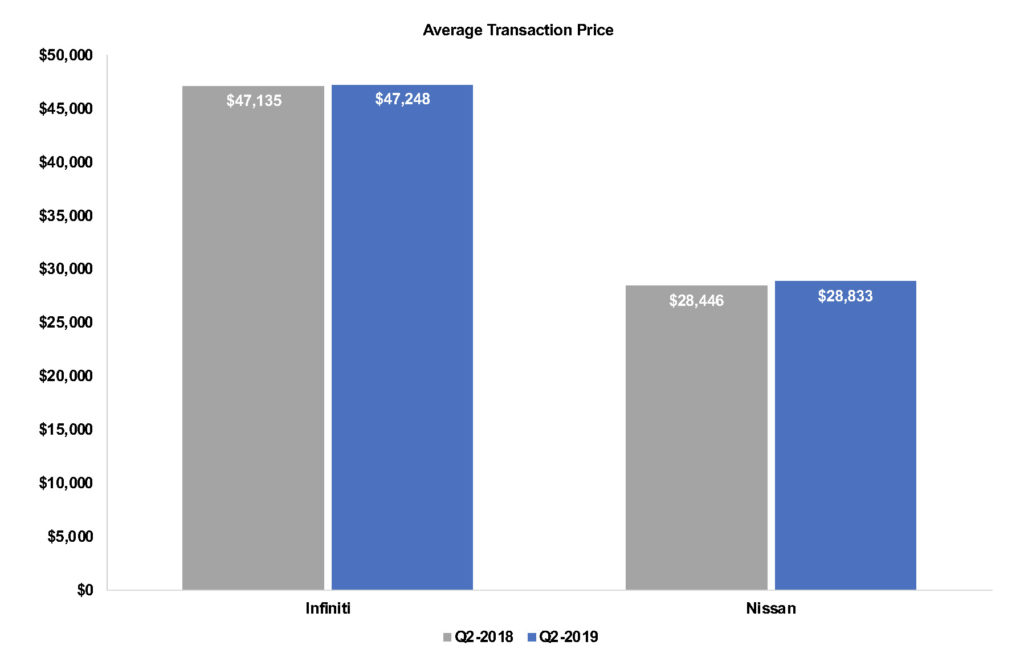

- Average Transaction Prices remain flat.

Nissan Motor Co. in Japan reports earnings Tuesday, November 12, for the quarter ended September 30, its second quarter since its fiscal year ends March 31, 2020.

In the U.S., one of Nissan’s largest markets, Nissan USA’s sales fell to the lowest level in the past five years for the quarter while incentives were the highest on flat average transaction prices, according to Kelley Blue Book data.

Nissan Motor, which is in a troubled alliance with French automaker Renault, has been in turmoil since former CEO Carlos Ghosn was arrested a year ago for alleged financial misdeeds. Since then, there’s been a revolving door of executives at the top of the Japanese company as well as North American operations.

In its first quarter (ended June 30), Nissan Motor reported a 99% plunge in its operating profit, blamed largely on costly incentives to maintain sales against U.S. rivals. Nissan announced massive cost-cutting, including 12,500 jobs globally by 2022 and elimination of products. The company expects a 28% drop in profits for this fiscal year, which ends March 31, 2020, its weakest in more than a decade.

The U.S. story didn’t help in the most recent quarter. Sales fell, and costly incentives soared.

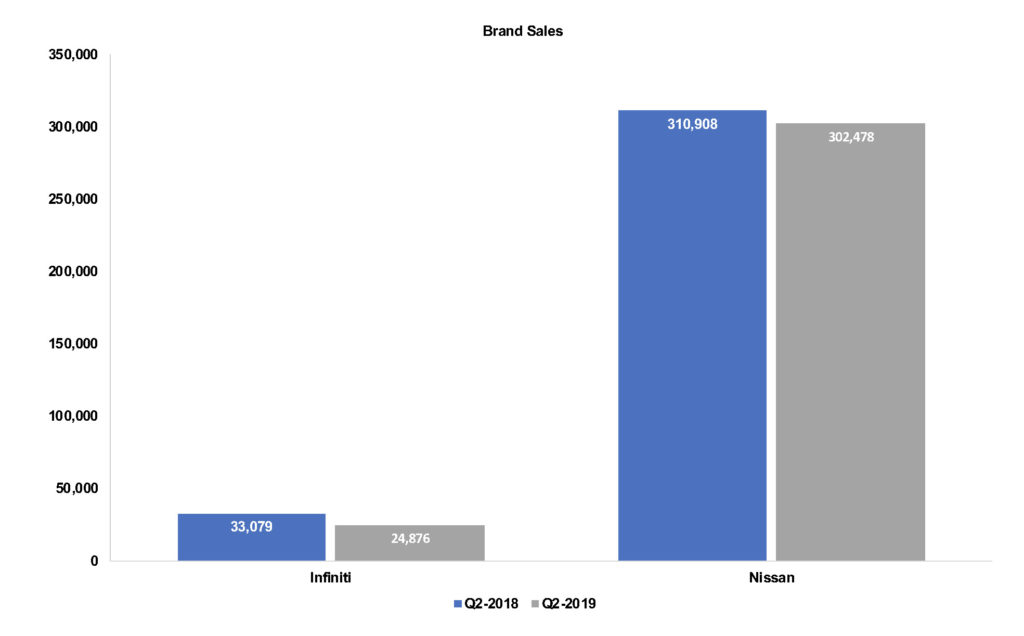

Nissan USA’s sales, which include the Nissan and Infiniti brands, fell 5% to 327,354 vehicles from the year-earlier quarter, according to Kelley Blue Book, while industry sales slipped 1%.

Nissan brand sales fell 3% to 302,478 vehicles, its lowest level in five years, according to Kelley Blue Book. U.S. luxury sales rose 2% in the quarter, but Infiniti sales plummeted 25% to a scant 24,876 vehicles, the lowest for the quarter in at least five years.

Nissan slipped in shopping consideration with non-luxury buyers from sixth to seventh most-shopped brand, according to the Q3 Kelley Blue Book Brand Watch, which surveys consumers for brand perception and weaves in shopping consideration.

Falling sales resulted in the weakest market share in five years of 7.57%, well off the highest 8.61% for Q3 2016 and off the 10% goal, a level Nissan was unable to achieve.

The lower sales were not for a lack of incentives, which soared in the quarter to record amounts despite Nissan’s new management insisting they would ratchet them back. Unfortunately, in an attempt to hit the 10% market share goal, Nissan cranked up incentives to some of the highest levels in the industry over the past five years while other automakers kept them in check.

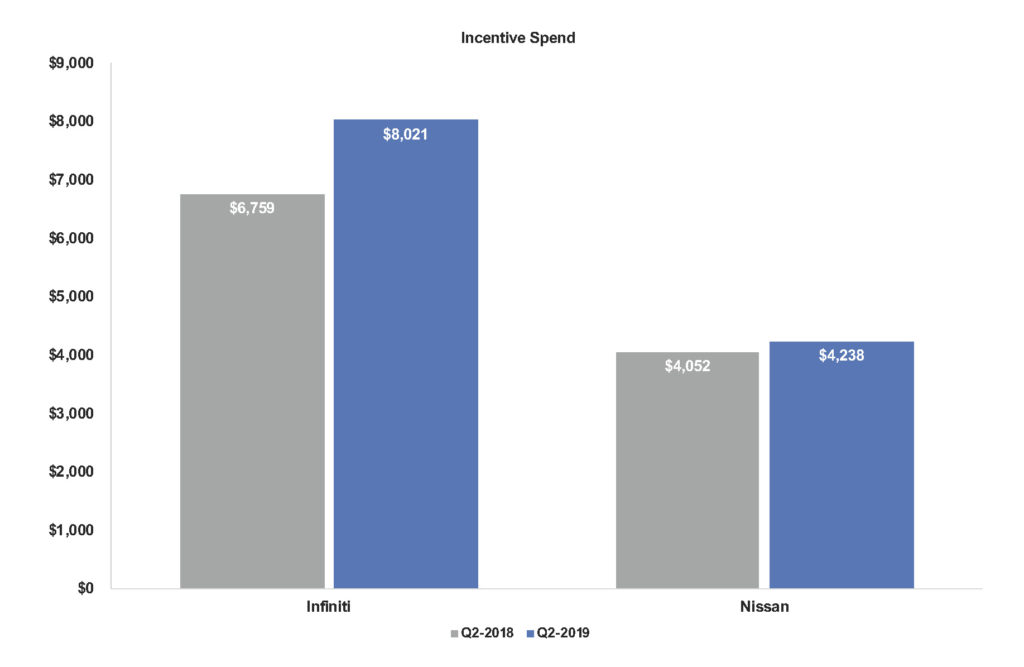

Nissan USA’s overall incentives for the quarter rose 5% to an average of $4,525 per vehicle, surpassing even the five-year high of $4,483 in Q3 2017, according to Kelley Blue Book. Infiniti, which faces a lack of new product for a couple years, boosted incentives by 19% to a whopping $8,021 per vehicle, according to Kelley Blue Book. The quarter marked the first time Infiniti surpassed the $8,000 per vehicle mark in the past five years, beating any level of incentive for the quarter in the last five years by about $1,000.

Infiniti, which faces a lack of new product for a couple years, boosted incentives by 19% to a whopping $8,021 per vehicle, according to Kelley Blue Book. The quarter marked the first time Infiniti surpassed the $8,000 per vehicle mark in the past five years, beating any level of incentive for the quarter in the last five years by about $1,000.

Infiniti is among the bottom half of luxury brands for shopping consideration, according to Kelley Blue Book Brand Watch.

Nissan brand’s incentives gained 5% to an average of $4,328 per vehicle, its highest in five years, according to Kelley Blue Book.

Average Transaction Prices were roughly flat from a year ago: $30,242 for the automaker overall; $28,833 for the Nissan brand; and $47,249 for Infiniti, according to Kelley Blue Book.