Data Point

Certified Pre-Owned Sales Drop Below Record Level in November

Tuesday December 14, 2021

Article Highlights

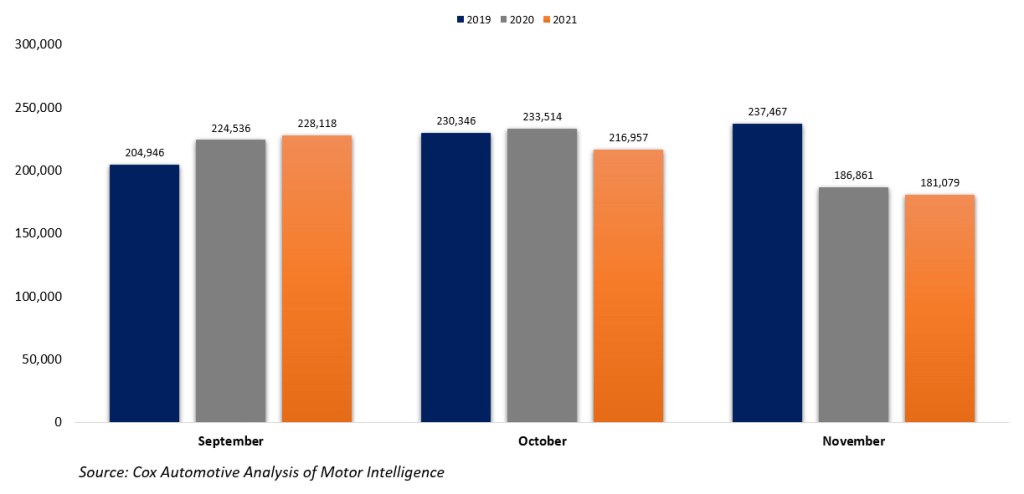

- Certified pre-owned (CPO) sales fell to 181,079 units in November, a 17% month-over-month decrease and a 3% year-over-year decrease.

- With 2,561,416 units sold through November, year-to-date CPO sales are up 8% compared to the same period last year but are down .5% compared to 2019.

- Reaching the Cox Automotive CPO sales forecast of 2.80 million units is only possible if more than 240,000 units are sold in December.

Certified pre-owned (CPO) sales fell to 181,079 units in November. This sales level reflects a 17% month-over-month decrease and a 3% year-over-year decrease. November CPO sales slowed for the second consecutive month, following a strong performance during the first three quarters of the year.

CPO SALES

With 2,561,416 units sold through November, year-to-date CPO sales are up 8% compared to the same period last year but are down .5% compared to 2019, and down 24% compared to November 2019.

With one month left in 2021, reaching the revised Cox Automotive CPO sales forecast of 2.80 million units – and matching the record-setting 2019 level – is only possible if more than 240,000 units are sold in December 2021.

According to Cox Automotive estimates, total used-vehicle sales were up 3% year over year in November. November used seasonally adjusted annual rate (SAAR) is estimated to be 39.1 million, up from 38.1 million last November but down compared to October’s upwardly revised 40.7 million SAAR. The November used retail SAAR estimate is 21.4 million, down from 20.2 million last year and 22.2 last month.