Data Point

November Fleet Sales Up Nearly 55% Year Over Year

Tuesday December 6, 2022

Article Highlights

- Sales into large fleets, not including sales into dealer and manufacturer fleets, increased 8.2% month over month in November to 160,989 units, according to an early estimate from Cox Automotive.

- Combined sales into large rental, commercial, and government fleets were up nearly 55% year over year in November, the fifth consecutive month of double-digit, year-over-year increases.

- Among manufacturers, GM had the largest fleet gains over last November, followed by Stellantis and Ford.

Sales into large fleets, not including sales into dealer and manufacturer fleets, increased 8.2% month over month in November to 160,989 units, according to an early estimate from Cox Automotive.

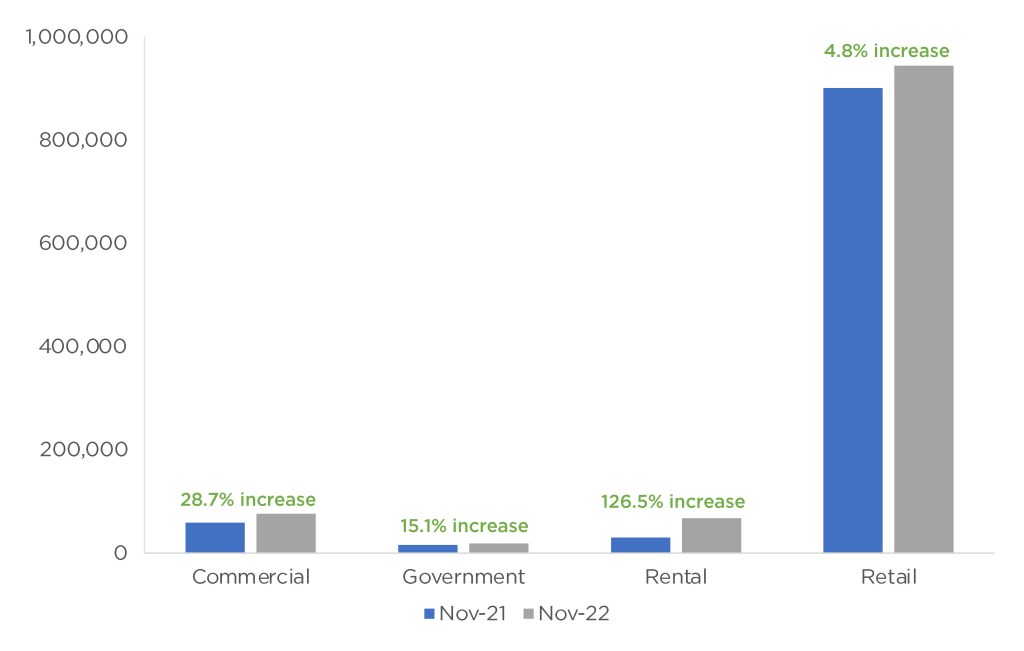

Combined sales into large rental, commercial, and government fleets were up nearly 55% year over year in November, the fifth consecutive month of double-digit, year-over-year increases. Sales into rental fleets were up over 126%, while sales into commercial fleets were up nearly 29% year over year and government fleets were up over 15%.

November 2022 Fleet Sales

Fleet Share of Retail Sales Increases

Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail new-vehicle sales were estimated to be up 4.8%, leading to an estimated retail sales pace, or seasonally adjusted annual rate (SAAR), of 12.5 million, down 0.3 million from last month’s pace, or 2.3%, but up 0.9 million, or 7.6%, from last year’s pace. The fleet share of 15.7% was up 1.6% from last month and was up 4.5% from last year. For context, fleet sales volume was 238,288 units in November 2019, representing a 17% share of total retail sales.

“We are finally seeing some upward momentum in fleet sales, which is positive for the overall auto market,” said Charlie Chesbrough, senior economist, Cox Automotive. “This shows that new-vehicle inventory capacity is improving to the point where manufacturers are beginning to shift some sales into fleet. Plus, we know fleet vehicles eventually supplement the used-vehicle market, so it is a win-win when fleet sales are moving in this direction.”

Among manufacturers, GM had the largest fleet gains over last November, followed by Stellantis and Ford. Meanwhile, Subaru had the largest fleet decline compared to a year ago.

Manufacturers’ Sales by Fleet Channel Change Significantly Compared to Same Time in 2019

Interesting changes are seen when comparing the manufacturer’s fleet sales by channel through November 2022 to the same time in 2019. GM has overtaken Ford as the leader in the commercial channel with a 35.3% share. Ford remains on top in government fleet sales with a 62.1% share, while Stellantis’ share dropped from over 22% to only 10%. Toyota overtook Stellantis in sales into rental fleets by increasing its year-to-date fleet share in November 2022 to 26.2% from 10.9% for the same time in 2019. It’s worth noting that Nissan has revamped its fleet strategy. Compared to 2019 when it was No. 2 in rental fleet share, Nissan dropped 81.7% to 11.0% and is now below Toyota, Stellantis, GM and Ford.