Data Point

November CPO Sales Up Year Over Year, Remain on Pace to Hit Year-End Target

Tuesday December 13, 2022

Article Highlights

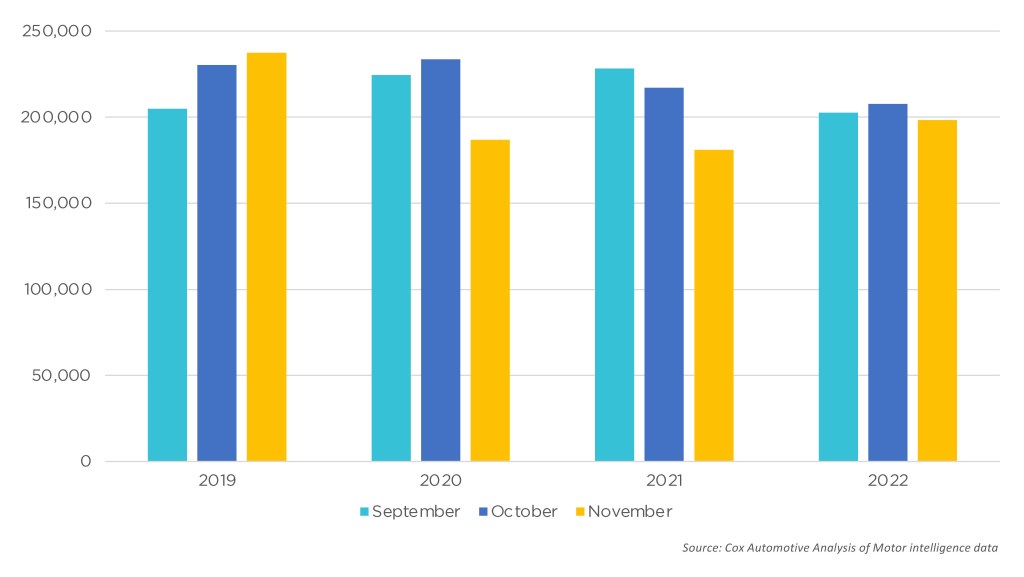

- Certified pre-owned (CPO) sales in November fell 4.4%, just over 9,000 units, from October to finish at 198,313.

- This total is up more than 17,000 units from November 2021.

- Year to date, CPO sales are down over 318,000 units, or 12.4%, compared to the same time last year. Cox Automotive expects CPO sales to finish near 2.45 million for 2022, an 11% decline from 2021.

Certified pre-owned (CPO) sales in November fell 4.4%, just over 9,000 units, from October to finish at 198,313. However, this total is up more than 17,000 units from November 2021. Year to date, CPO sales are down over 318,000 units, or 12.4%, compared to the same time last year. Cox Automotive expects CPO sales to finish near 2.45 million for 2022, an 11% decline from 2021.

November CPO Sales

Leveraging a same-store set of dealerships selected to represent the country from Dealertrack, we initially estimate that used retail sales declined 1% in November from October, and that used retail sales were down 10% year over year. Compared to November 2019, sales were down 22%, which was an improvement from October. Credit transactions heavily influence the same-store data series, and growth in cash purchase activity is likely causing the estimates to decline more than actual market sales.

Used Retail Sales Challenged by Multiple Factors

Used retail vehicle sales have been challenged throughout 2022 as multiple factors, including COVID, inflation in the broader economy, delayed tax refunds, and increasing interest rates, have weighed on demand. Of biggest concern is higher interest rates, which have been the principal cause of the slowing in sales. As we near the end of the year, interest rates for used loans have increased more than 3 percentage points and are likely to rise by another percentage point by year-end, given the plans from the Fed. As a result, the interest rate change alone produces a 12% higher payment, pushing payments to a level that is out of reach for many traditional used-car buyers.

The used-car market has benefitted from a shift in the composition of buyers as scarcity and affordability in the new market have pushed many to consider used instead. CPO benefits from being positioned as the best alternative to a new vehicle. Meanwhile, consumers benefit from average interest rates on certified units being more than 2 percentage points lower than average used loan rates. According to the Dealertrack Credit Availability Index, on a year-over-year basis, most channels were little changed in November regarding credit access except used loans through franchised dealers and certified pre-owned (CPO) loans having loosened the most.

According to Chris Frey, senior manager of economic and industry insights at Cox Automotive: “Current year-to-date CPO sales hit 2.24 million at November’s end. To match or exceed our call of 2.4 million, CPO sales would have to be 160,000 or more. The last time they were at or below this level was in the March to April 2020 selling period. Given the sales pace this year and barring any major impacts from interest rates or other unforeseen events, we should hit our target – and then some.”