Data Point

CPO Sales Rise Slightly in October, Remain On Track to Reach Forecast

Friday November 11, 2022

Article Highlights

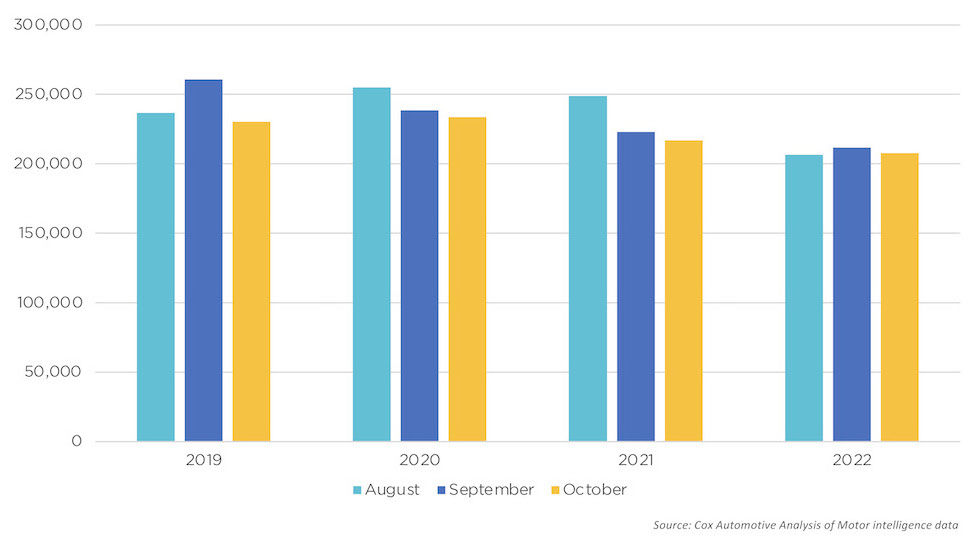

- Certified pre-owned (CPO) sales in October rose 2.5%, just over 5,000 units, from September to finish at 207,547.

- This total is down over 9,000 units from last October.

- Year to date, CPO sales are down over 335,000 units, or 14.1%, and Cox Automotive expects them to finish near 2.4 million for the full-year 2022.

Certified pre-owned (CPO) sales in October rose 2.5%, just over 5,000 units, from September to finish at 207,547. This total is down over 9,000 units from last October. Year to date, CPO sales are down over 335,000 units, or 14.1%, and Cox Automotive expects them to finish near 2.4 million for the full-year 2022.

October CPO Sales

Leveraging a same-store set of dealerships selected to represent the country from Dealertrack, we initially estimate that used retail sales declined 9% in October from September and that used retail sales were down 13% year over year.

According to the latest Dealertrack Credit Availability Index, most loan types saw loosening in October, but certified pre-owned loans loosened the most month over month and year over year.

Chris Frey, senior manager of economic and industry insights at Cox Automotive, notes: “As we enter the holiday season, the Asian brands have historically held 50% share of CPO sales, with European and the Detroit Three making up about 18.8% and 31.2%, respectively. Last year, Asian brands slipped to 47% while the others gained about 1.5% of share each. That has turned around so far this year, with Asian makes’ share at 51%, European share flat with history, and Detroit losing 0.8% to history. With new prices still at record highs and little incentives available, CPO looks in good shape to hit or exceed our 2.4 million estimate.”