Data Point

New-Vehicle Affordability Declines Again in October, Monthly Payment Hits Another Record High

Tuesday November 15, 2022

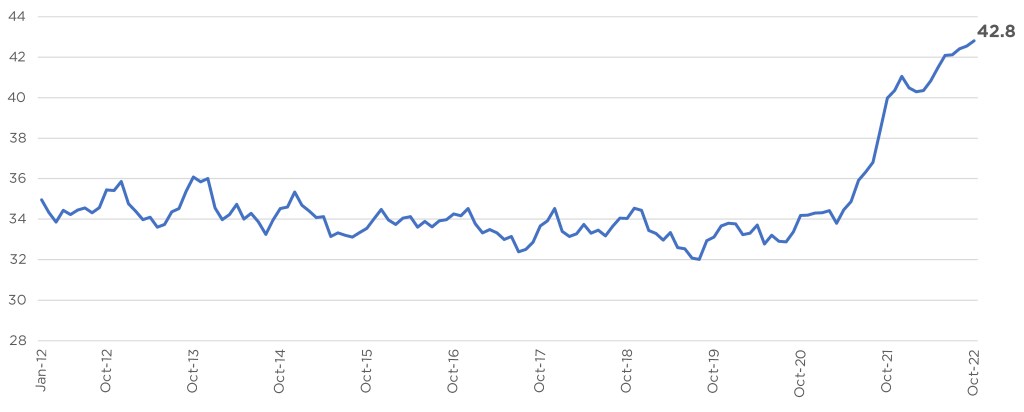

New-vehicle affordability declined again in October with auto loan rates reaching a 20-year high as prices increased slightly, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index. The number of median weeks of income needed to purchase the average new vehicle in October increased to 42.8 weeks from an upwardly revised 42.6 weeks in September.

Cox Automotive/Moody’s Analytics Vehicle Affordability Index

October 2022

Weeks of Income Needed to Purchase a New Light Vehicle

Average Monthly Payment for New Car Hits Another Record High

Supporting affordability, median income grew 0.4%, and incentives from manufacturers increased. All other factors moved against affordability. The average price paid for a new-vehicle in October increased by 0.2% to $48,281, according to Kelley Blue Book. The average interest rate increased another 30 basis points. As a result of these moves, the estimated typical monthly payment increased by 1.1% to $748, which was a new record high.

“Higher rates are already shifting access to vehicles and financing towards wealthier consumers,” said Cox Automotive Chief Economist Jonathan Smoke. “Affordability will be challenged for years to come in both the new and used markets. It’s not the Fed’s fault, but it will impact consumer access to transportation.”

New-vehicle affordability in October was much worse than a year ago when prices were lower, incentives were higher, and interest rates were much lower. The estimated number of weeks of median income needed to purchase the average new vehicle in October was up 7% from last year when the index stood at 40 weeks.

Click here for the full methodology for the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on Dec. 15, 2022.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book, a Cox Automotive company. This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.