Commentary & Voices

Q3 2021 Kelley Blue Book Brand Watch Report: Lexus Challenges BMW for Most-Shopped Luxury Brand

Monday November 8, 2021

Article Highlights

- BMW barely maintained its spot as most-shopped luxury brand as Lexus rode its bumper.

- Lexus RX overtook Tesla Model 3 as the most-considered luxury vehicle.

- Shopping for luxury cars falls to all-time low of less than half of all shoppers.

BMW retained its spot as the most-shopped luxury brand, but Lexus is closing in on the German brand, according to the Kelley Blue Book Brand Watch™ report for Q3 2021.

The Kelley Blue Book Brand Watch report is a consumer perception survey that also weaves in consumer shopping behavior to determine how a brand or model stacks up with its segment competitors in a dozen factors key to a consumers’ buying decision. Kelley Blue Book produces a separate Brand Watch report for non-luxury and luxury brand each quarter.

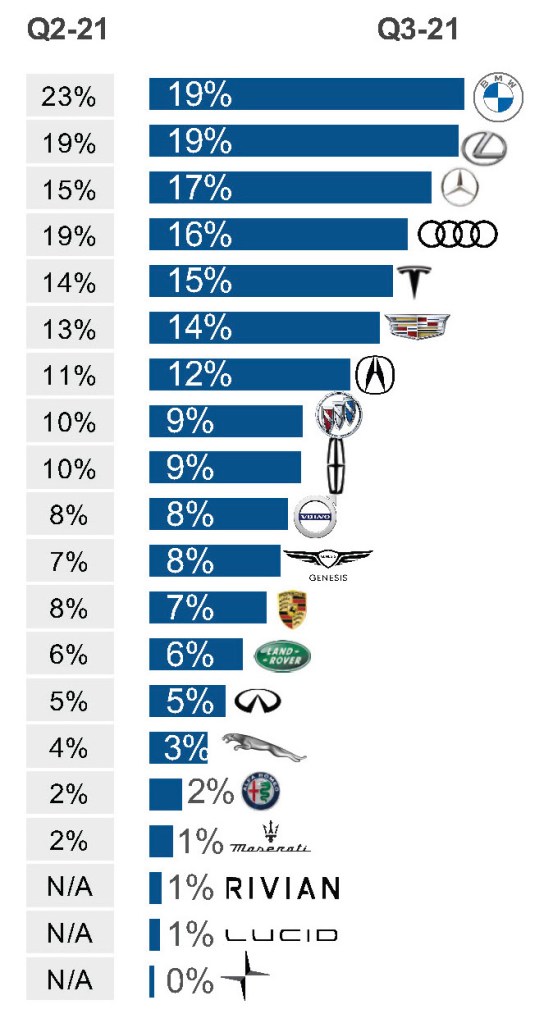

BMW has dominated its competitors in shopping consideration for 13 quarters. However, in the third quarter, BMW barely held onto the top spot. Shopping consideration for the brand tumbled by a hefty 4 percentage points from the previous quarter, the biggest drop among luxury brands. Of all luxury vehicle shoppers, 19% considered a BMW, down from 23% in the previous quarter and down from 22% in the year-ago quarter.

Quarterly Brand Consideration

The BMW 5 Series, 3 Series and X5 fell off the list of Top 10 most-shopped luxury vehicles after gains in the second quarter. The X3 also lost steam, losing 5% of shopping consideration.

At the same time, Lexus held steady in shopping consideration despite being intensely inventory constrained. Like BMW, Lexus had 19% shopping consideration, trailing BMW by less than a tenth of a percentage point. Throughout the quarter and months before that, Lexus has had the lowest inventory among luxury brands due to the computer chip shortage. BMW, while not having an overabundance of supply, has been in better shape than most luxury in terms of inventory. Lexus’ volume-leading, but inventory-constrained RX sport utility gained even more traction, overtaking the Tesla Model 3 as the most-considered luxury model in the quarter. RX shopping consideration soared by 23%. The last time RX was No. 1 was the last quarter of 2020.

Mercedes-Benz gained 2 percentage points of shopping consideration, helped by the GLE, C-Class and E-Class, which was up 29% in shopping. Tesla regained momentum after declining in Q2 on higher shopping consideration for the Model Y, up 7%, and Model S, up 14%, though shopping for the Model 3 plummeted by 18%, the biggest decline among the most considered models.

Cadillac, Acura and Genesis each gained a percentage point. Cadillac got a boost from a 58% increase in XT5 shopping. Acura’s two volume models had hefty increases in shopping. RX shopping climbed 23%; RDX rose 15%. Genesis may see a rise in the fourth quarter, after the launch of the GV70, which received high praise from the editors at Kelley Blue Book.

Next to BMW, Audi had the biggest loss in shopping, down 3 percentage points.

Buick, Lincoln, Porsche and Jaguar each lost a percentage point. Buick’s Encore tumbled by 13% in shopping, as it is being displaced by the longer Encore GX.

EV startups Rivian, Lucid and Polestar were added to the list, though they garnered minimal shopping consideration – so far.

Luxury Vehicle Sales Race

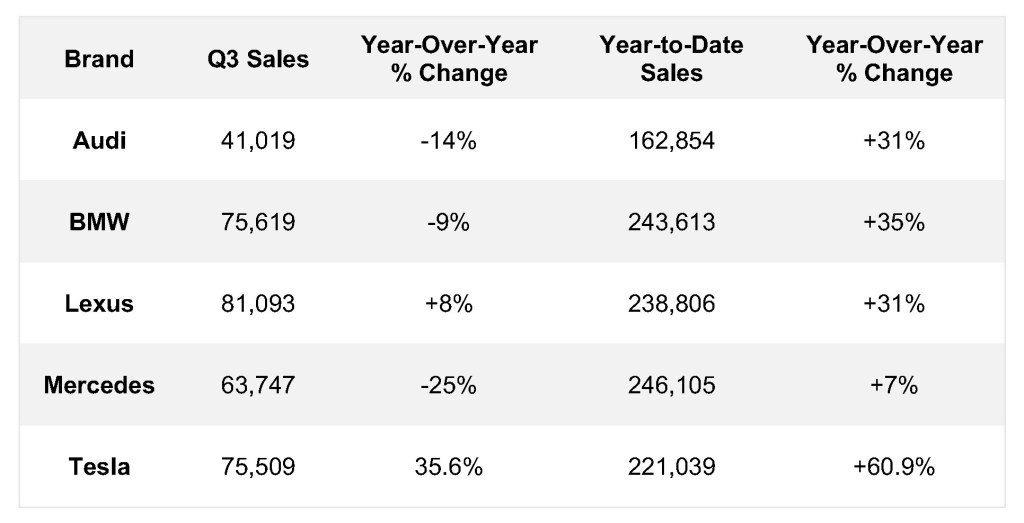

Luxury vehicle sales in the third quarter outpaced the overall market. The total market was down 13%; luxury sales were off only 5%. Lexus outpaced the other top luxury brands in sales. Lexus was the only brand of the top four luxury brands to post a sales increase. Its sales surpassed 81,000 units, up 8%, according to Kelley Blue Book data. Mercedes-Benz fell 25%, Audi dropped 14% and BMW slipped 9%.

Always closely watched, the race for the luxury sales crown in the U.S. will be a tight one for 2021. For the calendar year to date at the end of the third quarter, Mercedes-Benz remained ahead, but BMW and Lexus, respectively, were not far behind. The 2021 winner may on which brand has inventory.

In terms of inventory, BMW and Audi may be better positioned than Mercedes-Benz, according to Cox Automotive’s analysis of vAuto Available Inventory data. While Lexus inventory is low, it appears that Lexus production is being prioritized over Toyota production to take advantage of luxury vehicle sales that are strong at year-end.

Luxury vehicle sales

New Peak for Luxury SUVs

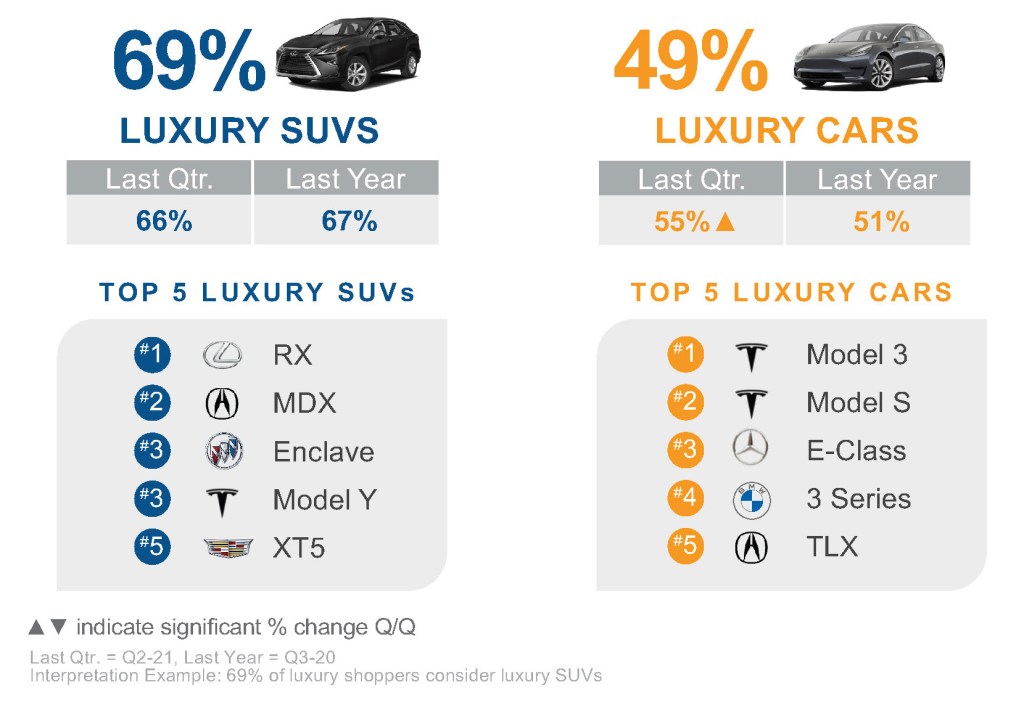

Shopping consideration for luxury SUVs recovered and returned to the peak level hit in the fourth quarter of 2020. Of all luxury vehicle shoppers, 69% considered an SUV. Yet, not a European model was among the most-shopped SUV list.

Quarterly Luxury Segment Consideration

Lexus RX ranked No. 1 for the seventh consecutive quarter, despite its low inventory due to the chip shortage. Acura MDX advanced to No. 2 from No. 5. The Buick Enclave and Tesla Model Y tied for third most-shopped SUVs. The Cadillac XT5, freshened in 2020, nudged the BMW X5 from the Top 5 most-shopped SUV list.

At the same time, shopping for luxury cars tumbled to an all-time low of less than half of shoppers. Only 49% of all luxury shoppers considered a car in the third quarter, down from 55% in the previous quarter and 51% in the year-ago quarter.

Tesla Model 3 and Model S, respectively, were the most-shopped luxury cars. The Mercedes-Benz E-Class and Acura TLX climbed back on the Top 5 list at No. 3 and No. 5, respectively. The BMW 3 Series ranked No. 4.

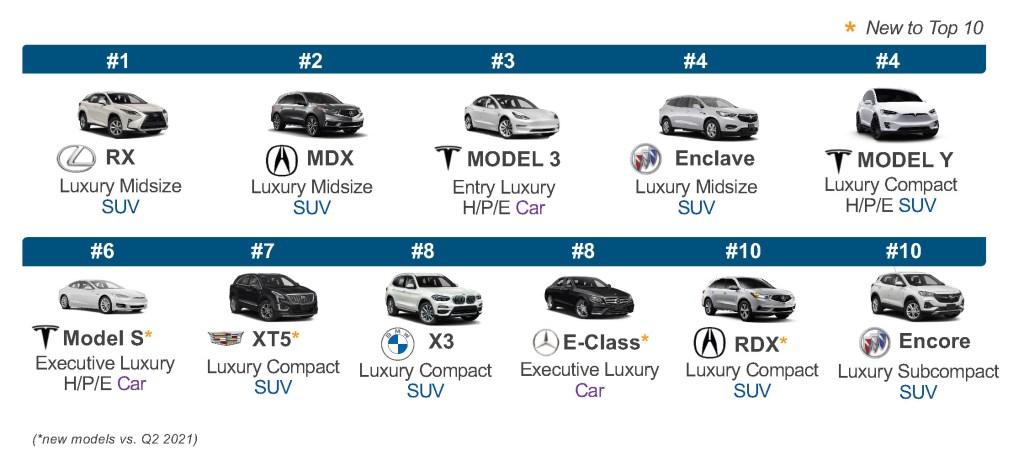

The Rich Mix of Top 10

The list of Top 10 most-shopped luxury vehicles had a rich mix of domestic and import brands and car and SUV entrants. It also had a mix of old standards and newcomers. Tesla Model S, Cadillac XT5, Mercedes-Benz E-Class and Acura RDX were new to the list.

Top 10 Luxury Models Considered

Tesla had the most models on the list at three. Acura and Buick had two each. Cadillac, Mercedes-Benz and BMW each had one.

The Lexus RX made a strong comeback, claiming the No. 1 spot. The Acura MDX, which was redesigned as a 2022 model in February, jumped six rankings to land the No. 2 spot. Buick Enclave and Tesla Model Y tied for No. 4.

Driven by the steep decline in luxury car shopping, however, only three spots among the 10 were held by cars. Two were Teslas – Model 3 at No. 3 and Model S at No. 6. Mercedes-Benz E-Class ranked No. 8.

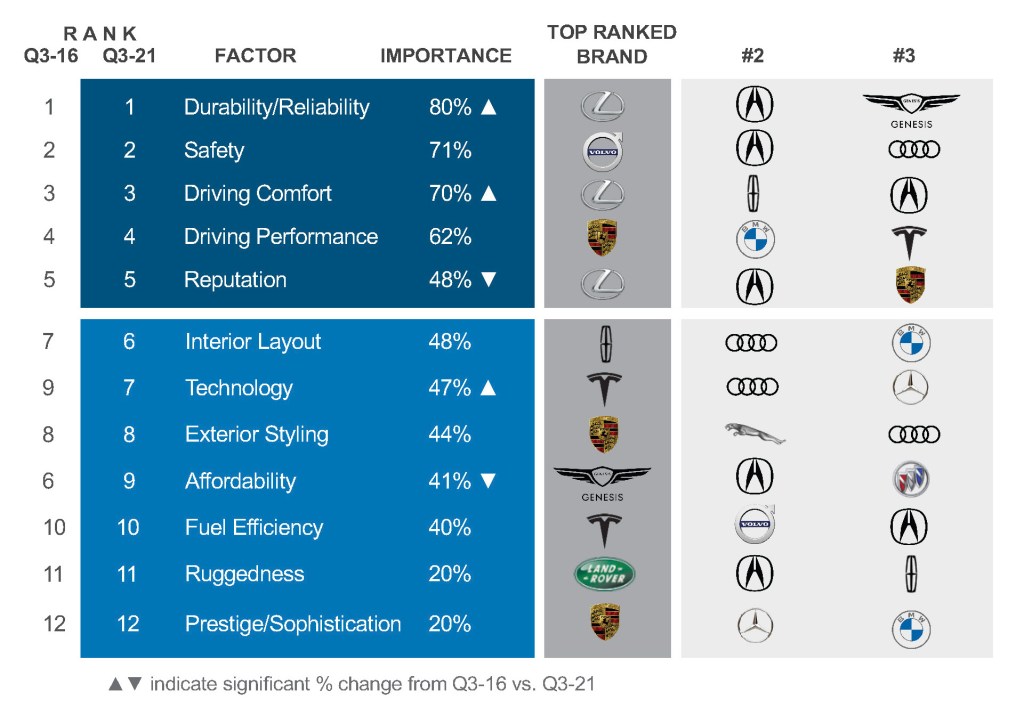

Factors Important to Luxury Shoppers

Durability/Reliability, always most important to all shoppers by a wide margin, became even more important in the third quarter as did Driving Comfort and Technology. Affordability and Reputation became less essential. Shoppers scrambling to find available inventory have said in Cox Automotive surveys that they are willing to switch brands, which may have tarnished the importance of brand reputation.

Factors Driving Luxury Consideration

Lexus and Porsche were the stars of the third quarter, each nabbing top spots in three categories.

Lexus has long had a stronghold on Durability/Reliability and Reputation. It also took the lead in Driving Comfort for the first time in three years. Porsche grabbed top spots for Driving Performance, Exterior Styling and Prestige/Sophistication.

Like Honda on the non-luxury side, Acura regained momentum, achieving four No. 2 spots and two No. 3 spots. Four of those were among the top five most important factors.

Tesla held on to its top spots for Technology and Fuel Efficiency, which it has owned for more than four years. The all-electric brand, however, is far less dominant in 2021 than it was just two years ago, in Q3 of 2019, when it was rated No. 1 in 7 of the 12 attributes that matter most to shoppers.