Data Point

Remarkable Decline in Fleet Sales Continues in June

Friday July 10, 2020

Article Highlights

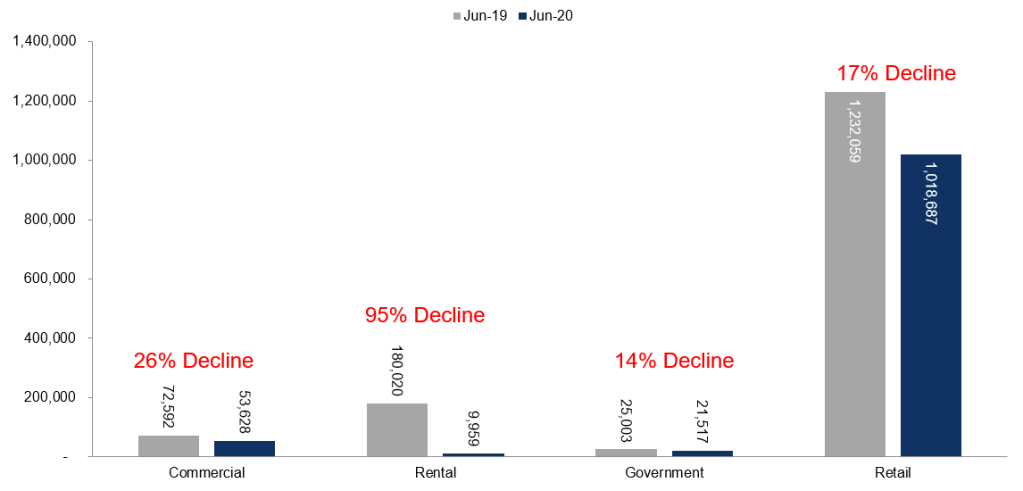

- Year-over-year fleet sales continued its remarkable decline as the combined rental, commercial, and government purchases of new vehicles were down 69% in June.

- Total fleet volume was 85,104, down significantly from 277,615 in June 2019.

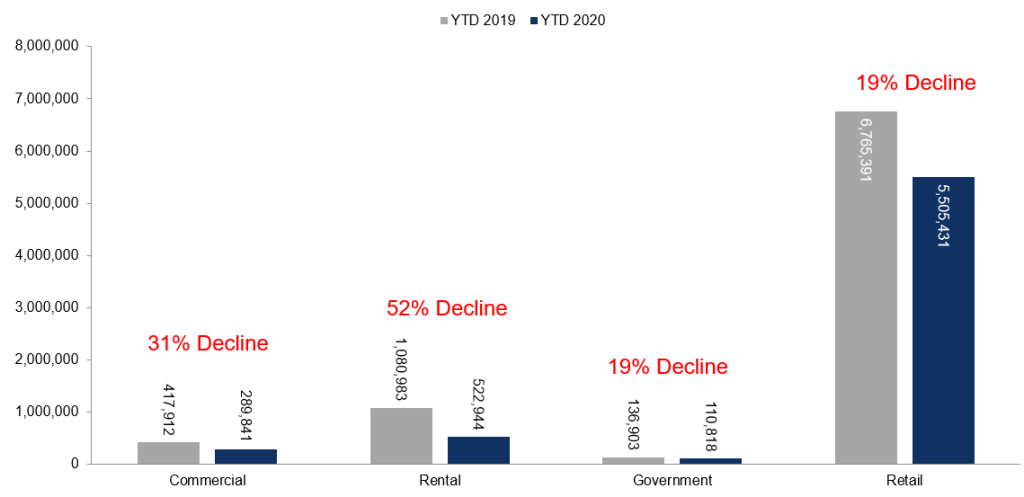

- For the first half of 2020 fleet sales are down 44%.

Year-over-year fleet sales continued its remarkable decline as the combined rental, commercial, and government purchases of new vehicles were down 69% in June. Total fleet volume was 85,104, down significantly from 277,615 in June 2019.

Rental units continue to lead the drop with a 94.5% decrease year over year in June. The dismal June rental result follows drops in March (-34%), April (-77%) and May (-91%).

Retail sales of new vehicles were down 17% year over year in June, leading to a retail SAAR of 12.0 million, down from 14.0 million last June but up from May’s 11.8 million rate.

Total new-vehicle sales were down 27% in June year over year, with one less selling day compared to June 2019. The June SAAR came in at 13.0 million, a decrease from last year’s 17.2 million but up from May’s 12.3 million rate.

For the first half of 2020 fleet sales are down 44%, and retail sales are down 19%, as the overall new vehicle market is down 23% so far this year. Cox Automotive estimates a 2020 fleet forecast of 1.3 million, subject to change during these volatile times. Looking at automaker’s mid-year performance, all manufacturers saw large year-over-year declines in fleet sales year to date ranging from -62.5% to -91.8% due to the impact of the COVID-19 pandemic. Nissan saw the largest decrease in fleet sales this year, according to our data analysis, compared to year-ago levels.

Lower fleet demand may be a positive for some companies, as it allows them to more quickly replenish low retail inventory at dealerships to meet rising consumer demand. At the same time, fleet sales – and particularly rental fleet sales – are often used as a safety valve to reduce pressure on rising dealer inventory, when customer demand is waning. OEMs have to consider their fleet sales when thinking about production. As purchases of new vehicles by fleet companies have fallen, some automakers are struggling with too much inventory at a time when the overall industry-wide inventory level is low.

Read more: With Inventory Tight, It’s a Market of Haves Versus Have-Nots