Data Point

CPO Sales Increase Slightly in September

Monday October 11, 2021

Article Highlights

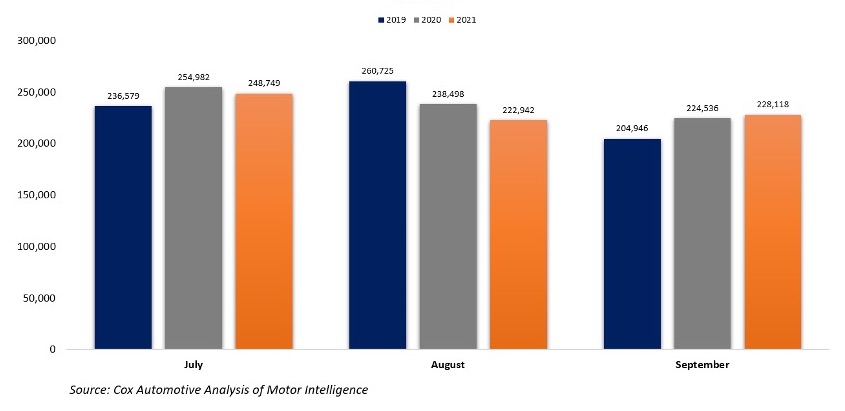

- Certified pre-owned (CPO) sales reached 228,118 units in September, up 2% month over month and 1% year over year.

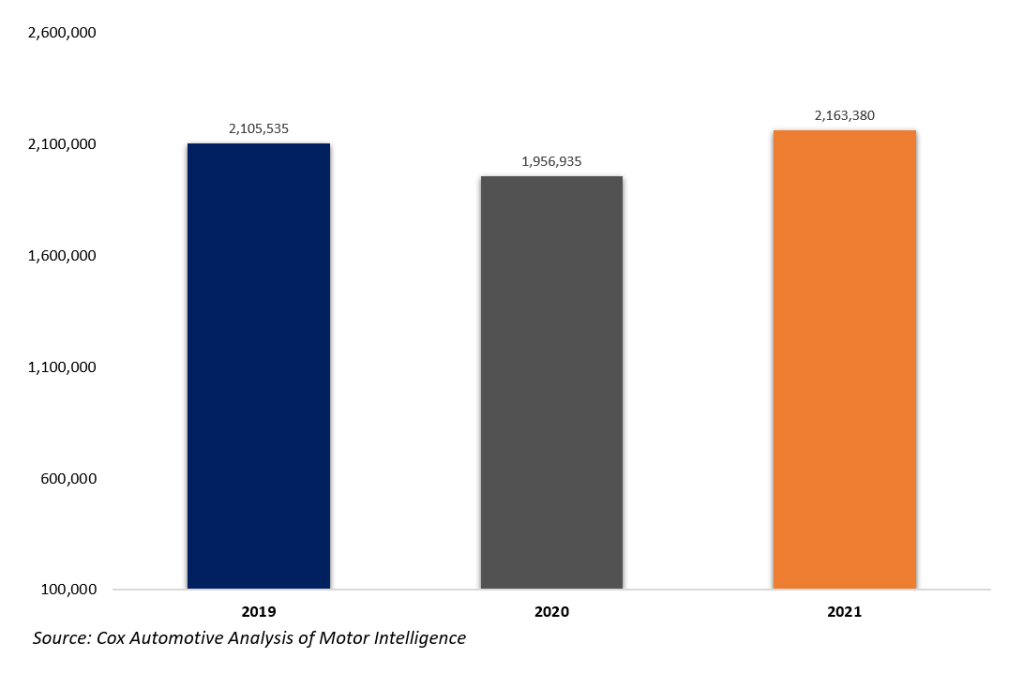

- With 2,163,380 units sold through September, year-to-date CPO sales are up 11% compared to the same period last year and up 3% compared to September 2019.

- After rounding out the third quarter, reaching the Cox Automotive CPO sales forecast of 2.80 million units – and matching the record-setting 2019 level – remains within reach.

Certified pre-owned (CPO) sales reached 228,118 units in September. This sales level reflects a 2% month-over-month increase and a 1% year-over-year increase when CPO sales continued their strong performance in September 2020 as an important part of the used-vehicle market recovery.

CPO Sales

With 2,163,380 units sold through September, year-to-date CPO sales are up 11% compared to the same period last year and up 3% compared to September 2019.

Current Year-to-Date CPO Sales

After rounding out the third quarter, reaching the revised Cox Automotive CPO sales forecast of 2.70 million units – and possibly matching the 2.80 million record-setting 2019 level – remains within reach.

Speaking about CPO on the recent Manheim Used Vehicle Value Index call, Kevin Chartier, vice president at Manheim Consulting, noted: “In today’s market, everything is selling so quickly and at such high prices, that I think that in many cases the dealers are selling cars before they get a chance to pull them into their shops to spend the time to recondition them up to full CPO standards. So, this is why we haven’t seen massive growth in CPO. But with that said, CPO has been pretty good and continues to be right up there with the historic highs that we have seen over the past few years. And as we see new-vehicle inventories drop, CPO presents a great opportunity for the dealers to have something to sell to people coming in looking for a new car.”

According to Cox Automotive estimates, total used-vehicle sales were down 13% year over year in September. We estimate the September used SAAR to be 36 million, down from 40.9 million last September and down compared to August’s 36.5 million SAAR. The September used retail SAAR estimate is 19.5 million, down from 21.7 million last year and flat month over month