Data Point

September Gains Contribute to Large Year-to-Date Increases in Rental and Government Fleet Sales

Tuesday October 10, 2023

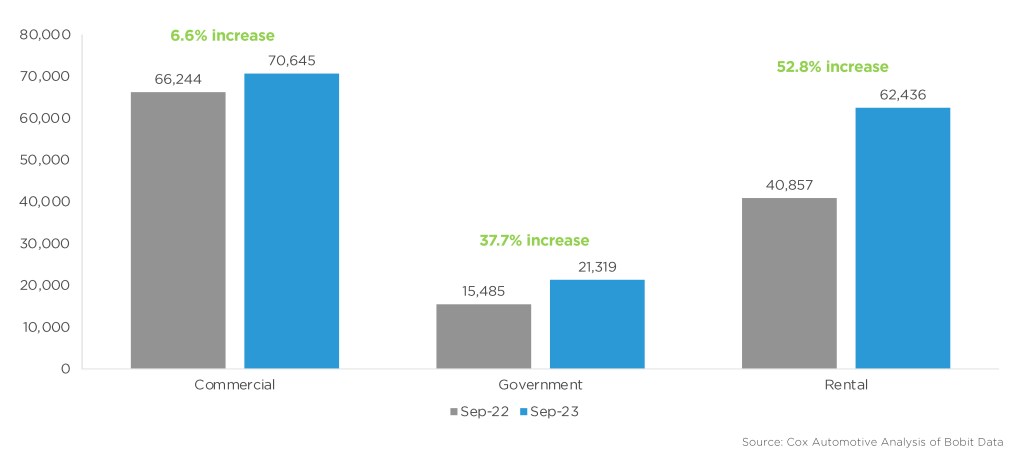

In September, sales into large rental, commercial, and government fleets increased compared to the previous year. According to a Cox Automotive analysis of Bobit data, there was a 26.0% rise in sales to large fleets (excluding dealer and manufacturer fleets) in September, with 154,400 units sold. Sales to rental fleets saw a 52.8% increase, while sales to government fleets rose by 37.7%, and sales to commercial fleets increased by 6.6%.

According to Cox Automotive Senior Economist Charlie Chesbrough, “The success of the new-vehicle market this year and the increase in our full-year forecast is mainly due to the return of fleet sales.”

September 2023 Fleet Sales

In consecutive months, General Motors had the largest increase in sales into fleet of large-volume automakers in September, and Ford had the largest decrease.

Fleet Sales Continue Outpacing Retail

Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 17.7%, leading to a retail seasonally adjusted annual rate (SAAR) of 12.9 million, up 1.1 million from last year’s 11.8 million pace and down 0.3 million from last month’s 12.6 million pace. The fleet market share was estimated to be 13.8% in September, a gain of 0.6% over last year’s share but a 1.8% decrease from August’s 15.6% market share.

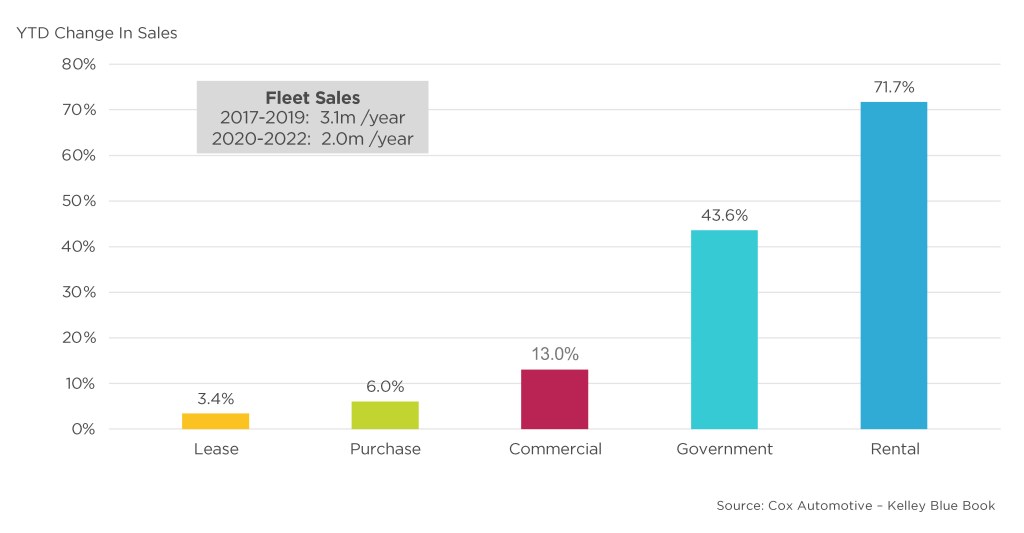

Year-to-Date Fleet Sales Driven by Huge Increases in Rental and Government Channels

Overall, through the end of Q3, sales into fleet channels are up 38.8% year to date. The improvement is affected by significant year-to-date increases in rental and government fleet sales – up 71.7% and 43.6%, respectively.

Year-to-Date Change in Fleet Versus Retail Sales

“Pent-up rental and commercial demand, rather than consumer demand, is particularly key to the new-vehicle market’s success,” Chesbrough noted. “In the early stages of the post-COVID market, manufacturers prioritized keeping products available for dealerships, leading to fewer new vehicles sold for rental and commercial purposes. However, as vehicle production began to recover last year, fleet sales have continued to rise.”