Data Point

September Fleet Sales Drop Slightly, Remain Up Nearly 25% Year Over Year

Thursday October 6, 2022

Article Highlights

- Sales into large fleets, not including sales into dealer and manufacturer fleets, decreased 4.6% month over month in September to 122,586 units, according to an early estimate from Cox Automotive.

- Combined sales into large rental, commercial, and government fleets were up nearly 25% year over year in September.

- Among manufacturers, GM had the largest increase over last year, followed far behind by Toyota. Meanwhile, Kia and Hyundai had the largest fleet declines.

Sales into large fleets, not including sales into dealer and manufacturer fleets, decreased 4.6% month over month in September to 122,586 units, according to an early estimate from Cox Automotive.

September 2022 Fleet Sales

Fleet Sales Up Nearly 25% Year Over Year

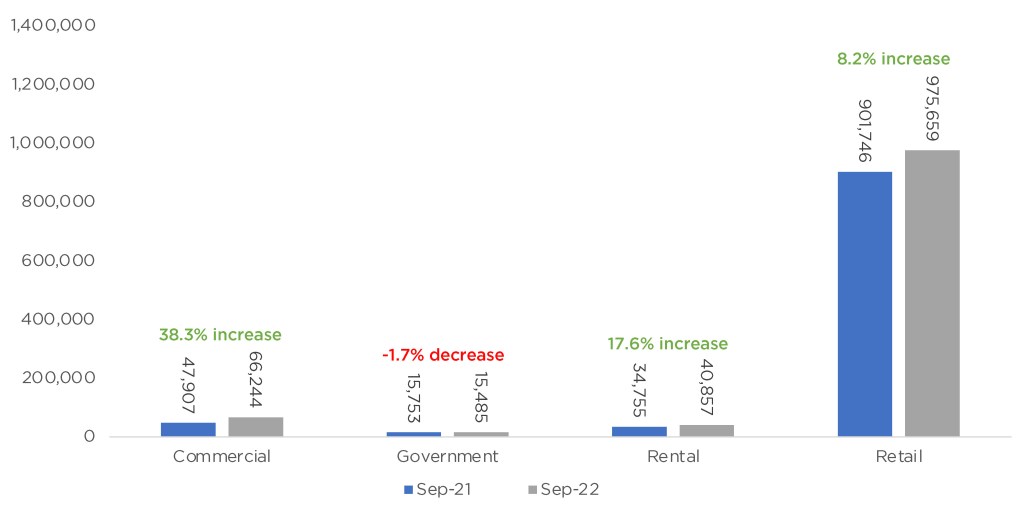

Combined sales into large rental, commercial, and government fleets were up nearly 25% year over year in September. Sales into rental were up 18% year over year, while sales into commercial fleets were up 38% and sales into government fleets were down 2%.

Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 8.2%, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 11.8 million, up 0.3 million from last month’s pace, or 2.6%, but up 0.9 million from last year’s 10.9 million, or 8.5%.

“If retail sales start to wane, we do believe the industry has other options besides increasing incentives,” said Charlie Chesbrough, senior economist, Cox Automotive. “They could move sales through the fleet and lease channels. In February 2020, fleet share was nearly 25% of all sales. Of late, fleet share has been roughly half of that, so we see upside potential for fleet, should retail slow further.”

Among manufacturers, GM had the largest increase over last year, followed far behind by Toyota. Meanwhile, Kia and Hyundai had the largest fleet declines.