Data Point

The Inflation Reduction Act of 2022: Study Reveals Consumer Perception of Revamped EV Tax Credits

Monday November 14, 2022

The Inflation Reduction Act (IRA) of 2022 is a far-reaching collection of legislation that was signed into law by President Biden on August 16, 2022. The IRA will impact everything from health care to drug prices, from manufacturing to corporate taxes, and IRS enforcement to climate change. For the auto industry, a key element of the act is a reshaping of electric vehicle (EV) tax credits in the U.S. and a collection of new sourcing requirements intended to advance battery mineral and component supply chains within North America and with countries with which the U.S. has free trade agreements.

As with much of what happens in Washington, D.C., it is complicated and the details have hardly been settled. The lobbying is well underway now, as some major players are less than happy with the direction here, and the IRS is working to better explain key elements of the tax credit rules to help close loopholes and provide clarity. This story will be ongoing.

Generally speaking, the new EV tax credits are intended to reward vehicles with final assembly in North America and with batteries sourced mostly in North America or through favored trading partners. Specifically, beginning in 2023, the full $7,500 tax credit available on assembled-in-North-America vehicles will be split into halves, with separate criteria on battery materials and battery components, complicating matters further:

- Critical battery minerals: To qualify for this $3,750 credit in 2023, at least 40% of the critical minerals in the battery must have been either recycled in the U.S. or extracted or processed in the U.S. or in any country that has a free trade agreement with the U.S. After that, the required percentage increases each year to ultimately reach 80% in 2027.

- Battery components: To qualify for the remaining $3,750 credit in 2023, at least 50% of the EV’s battery components must be manufactured or assembled in the U.S. or in any country that has a free-trade agreement with the U.S. After that, the percentage increases over time and eventually reaches 100% in 2029.

On top of the battery requirements, remember that price caps are part of the equation as well: Electric sedans, hatchbacks, and station wagons that cost more than $55,000, and electric SUVs and trucks that cost more than $80,000 will no longer be eligible for a tax credit.

Revised Scheme Introduces Income Caps and Used-Vehicle Tax Credits

For the first time, income caps go into effect. For buyers of new EVs, single filers earning $150,000 or less in adjusted gross income, head of household filers earning $225,000, and joint filers at the $300,000 level can potentially claim the full $7,500 credit. Those with higher household incomes cannot.

There are also used-vehicle tax credits for the first time, with a unique set of rules for both vehicle prices (sale price must not exceed $25,000) and buyer income ($75,000 for single filers, $112,500 for head of household and $150,000 for joint filers). The pre-owned tax credit, capped at $4,000 or 30% or the price of the vehicle, will work on both EVs and PHEVs, but the used vehicles must be at least two model years old to qualify. The credit can only be applied once per vehicle. Additionally, for the first time, battery-powered commercial vehicles will also be eligible for tax credits beginning in 2023. And, of course, there is a large set of criteria there as well.

Cox Automotive Mobility Surveys Consumers on New EV Tax Credits

There is a lot to learn about the new EV tax credits. And a lot we still don’t know. In September, our research team at Cox Automotive Mobility surveyed 1,000 consumers about the new EV tax credits. The survey participants were a wide set of EV owners, owners of traditional combustion-powered vehicles and some who did not own a vehicle at all. Here’s a high-level look at what they told us:

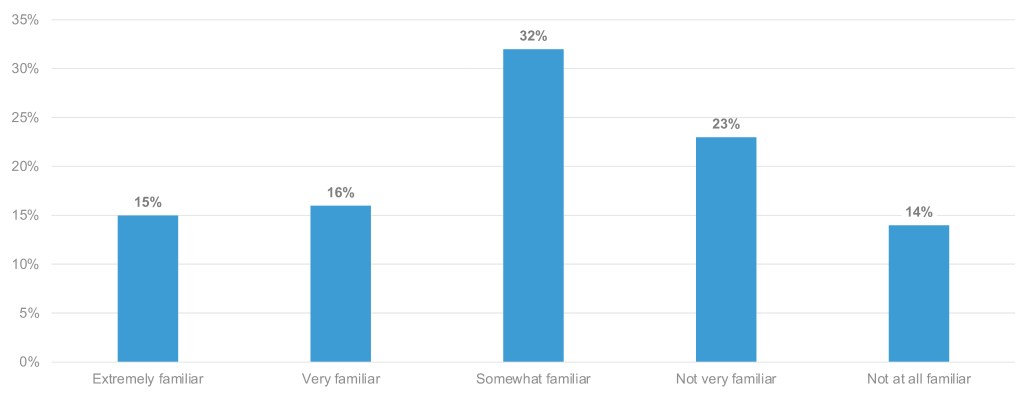

First, in September, familiarity skewed toward consumers being only somewhat familiar with the new Inflation Reduction Act.

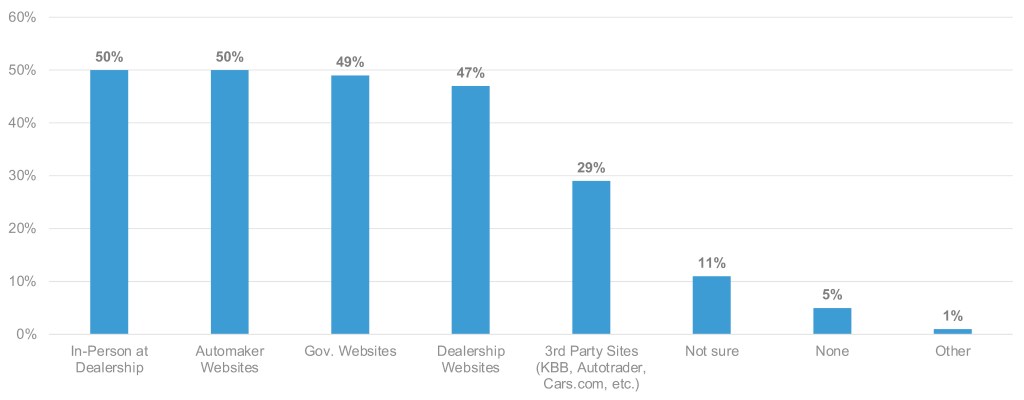

When asked about their sources for information specifically about the new EV tax credits, consumers seem to indicate a preference toward reputable, established sources: automakers, dealerships and government websites.

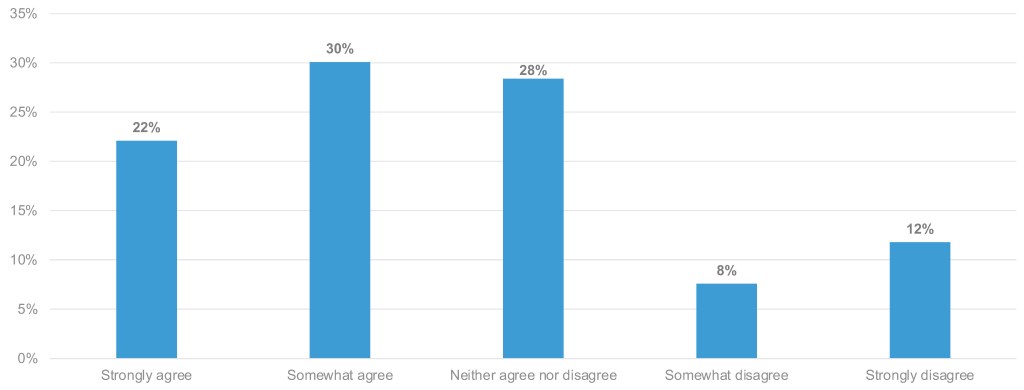

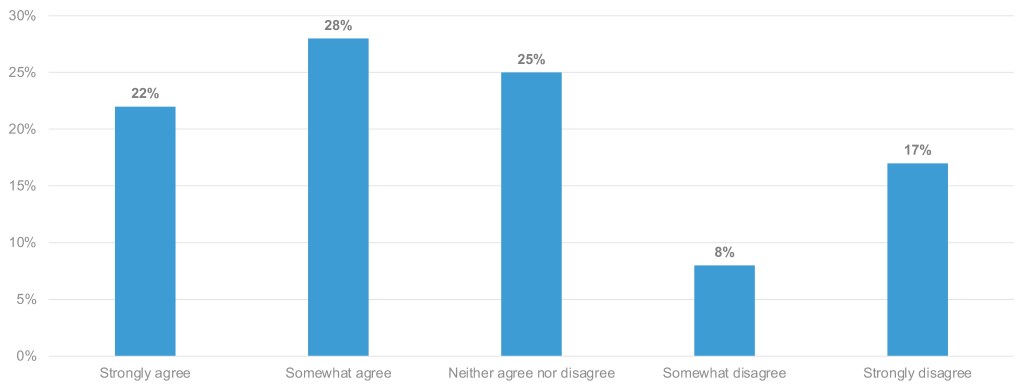

Consumers believe the new EV tax credits are generally easy to understand. And that a tax credit would have a positive influence (graph) on the decision to purchase an EV.

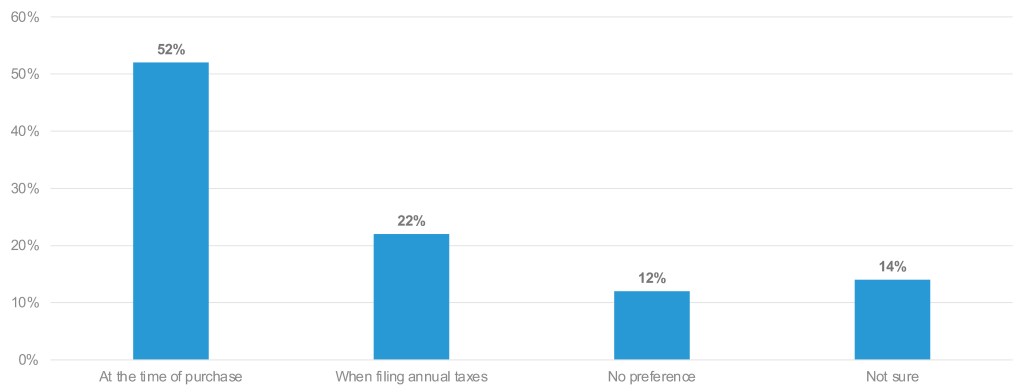

Consumers also indicate that the EV tax credit benefit should be applied at the time of purchase, not later as a tax deduction during the annual filing process. (Good news: Beginning in 2024, this is a new provision.)

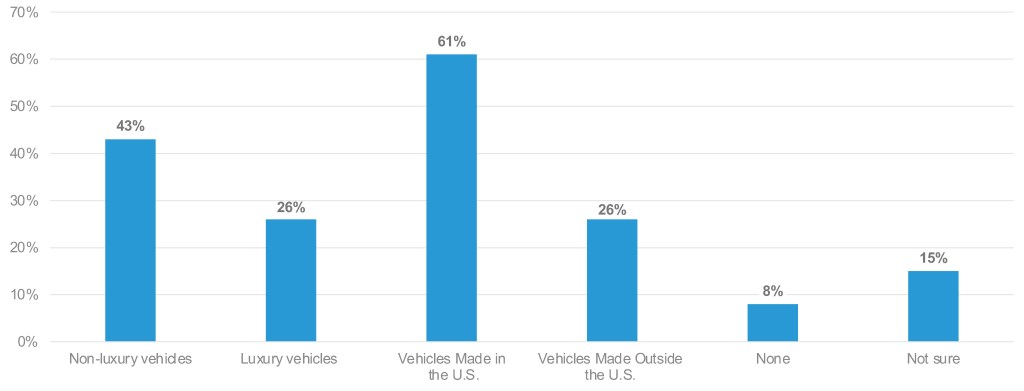

Many consumers believe EV tax credits should be available only on non-luxury EVs and particularly EVs made in the U.S.

And tax credits should only be available to buyers within a certain income range, which is another provision in the new code.

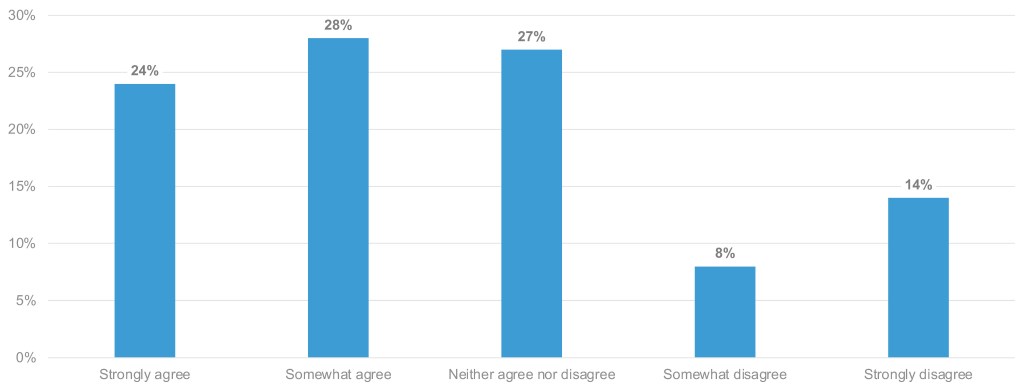

Overall, of the 1,000 consumers in our survey, more than half agree that EV tax credits are ultimately good for the U.S. economy. A similar number agrees that tax credits will help grow EV sales in the U.S.