Data Point

Used Retail Vehicle Sales Pick Up in January

Friday February 23, 2024

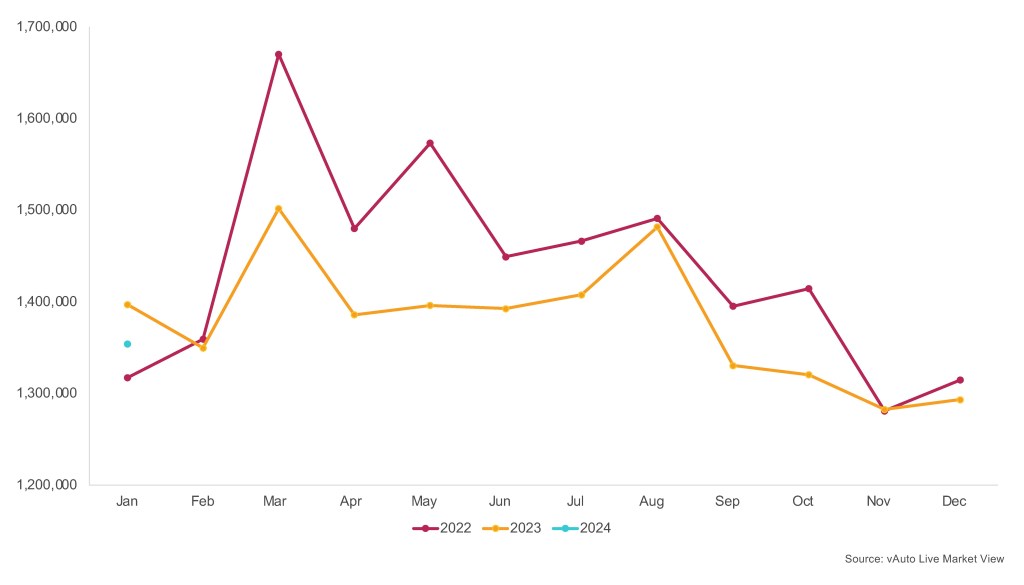

According to estimates based on vAuto Live Market View data, retail used-vehicle sales in January increased from December but were down by 3.1% compared to January 2023. A total of 1,354,075 used vehicles were sold at retail – from both franchised and independent dealers – during January, up 4.7% from December and the highest volume since August 2023. The higher sales last month reduced inventory levels at retail and pushed days’ supply at the start of February to 49 days, down from 58 at the beginning of January.

Monthly Used-Vehicle Retail Sales Volume

“The year-over-year decline in sales last month may have been caused in some part by the harsh cold snap over much of the country,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “But auto loan rates remain elevated as well, and that is holding down used-vehicle sales volumes. The good news for buyers: Retail prices are down roughly 4% versus 2023, and that can help with affordability as the tax-return season begins to accelerate in 2024.”

The retail used-vehicle sales estimates are based on observed changes in units tracked by vAuto, a Cox Automotive company specializing in inventory management. Retail used-vehicle sales typically increase month over month in January and often peak in the months of March or April of a given year as tax-return season injects money into the economy. January’s sales total of 1.35 million was higher than the total in January 2022 (1.32 million) but down from 2023 and below totals seen in 2019 to 2021, when January retail used-vehicle sales averaged 1.82 million.

CPO Sales in January Stronger than One Year Ago

While overall retail used-vehicle sales declined year over year in January, sales of certified pre-owned (CPO) vehicles were flat, according to data reviewed by Cox Automotive. CPO sales last month are now estimated at 201,621, down from 228,237 in December, a decline of 12%.

CPO sales, which are a subset of total retail used-vehicle sales, improved through most of 2023 as used-vehicle inventory levels increased and some automakers expanded the eligibility of CPO units. Toyota, Ford and Chevrolet, respectively, continue to be the CPO leaders. A total of 2.64 million CPO units were retailed in 2023, up 7% from 2022, and Cox Automotive is forecasting CPO sales in 2024 could reach 2.7 million. Over the past decade, CPO sales in the U.S. have averaged 2.62 million units annually.