Data Point

Used-Vehicle Inventory Increases, Prices Rise Above $27,000 in May but Remain Down Year Over Year

Friday June 16, 2023

Article Highlights

- Used-vehicle inventory edged higher to 2.19 million units.

- Used days’ supply stood at 47 at the end of May.

- Average used-vehicle listing price climbed to $27,256.

Revised, July 14, 2023 – The inventory and days of supply of used vehicles edged higher at the end of May from April, and the average listing price climbed past the $27,000 mark, according to the Cox Automotive analysis of vAuto Available Inventory data.

2.20M

Total Unsold

Used Vehicles

as of May 29, 2023

49

Days’ Supply

$27,270

Average Listing Price

70,223

Average Mileage

The total supply of unsold used vehicles on dealer lots, both franchised dealers and independents, across the U.S. stood at 2.20 million units at the close of May. That was up from a revised 2.11 million at the end of April.

Total days’ supply at the end of May stood at 49, compared with 46 at the start of the month. The days’ supply was unchanged from year-ago levels.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, ending May 29, when sales were 1.41 million units, down 8% from a year ago. The sales pace had been making healthy gains through most of May but dipped at the end of the month.

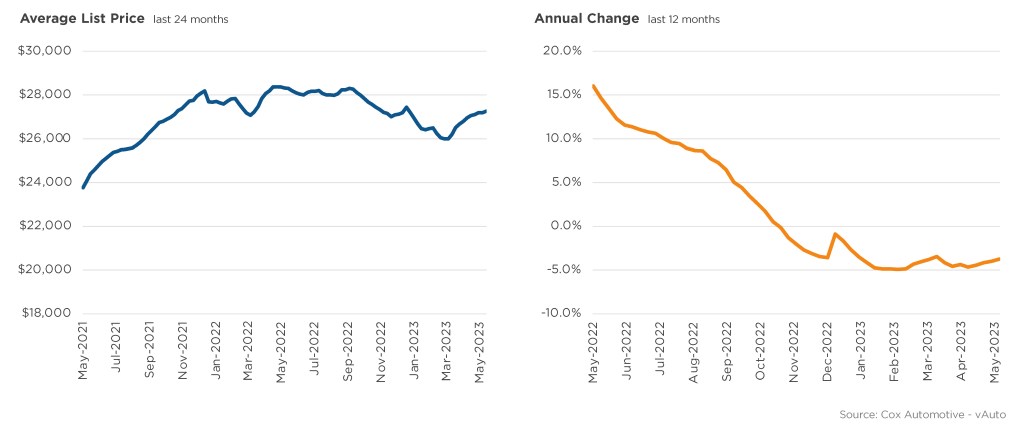

MAY 2023 AVERAGE USED-VEHICLE LISTING PRICE

Pattern appears to normalize but below last year’s level.

For the full calendar month of May, used retail sales based on the Cox Automotive analysis of vAuto data indicate sales were flat from April when they normally would have grown. Sales volumes were down 11% from a year ago and the worst year-to-year performance so far this year.

The average used vehicle listing price steadily rose every week through May, closing the month at $27,270. The end-of-May listing price was the highest since early January.

According to the Manheim Used Vehicle Value Index, wholesale prices continue to decline, suggesting retail prices may dip as well. However, the average price likely will stay relatively high since few new vehicles have been sold in recent years, and little leasing was done, so newer used vehicles are in short supply and high demand.

As with new cars, and as has been the case for months, the lower the price segment, the tighter the inventory. The days’ supply for under $10,000 vehicles was 31, increasing with every higher price segment to the over $35,000 category with the highest days’ supply of 58.

Among the non-luxury used vehicles with the lowest inventory were Honda, Subaru, Toyota and Mazda. Luxury used vehicles with the lowest were Acura, Infiniti and Lexus.