Data Point

Used-Vehicle Supply Holds Steady as Asking Prices Rise

Thursday May 19, 2022

Article Highlights

- The traditional spring sales bounce failed to lift retail sales notably, due in part to late tax refunds and worsening affordability for consumers.

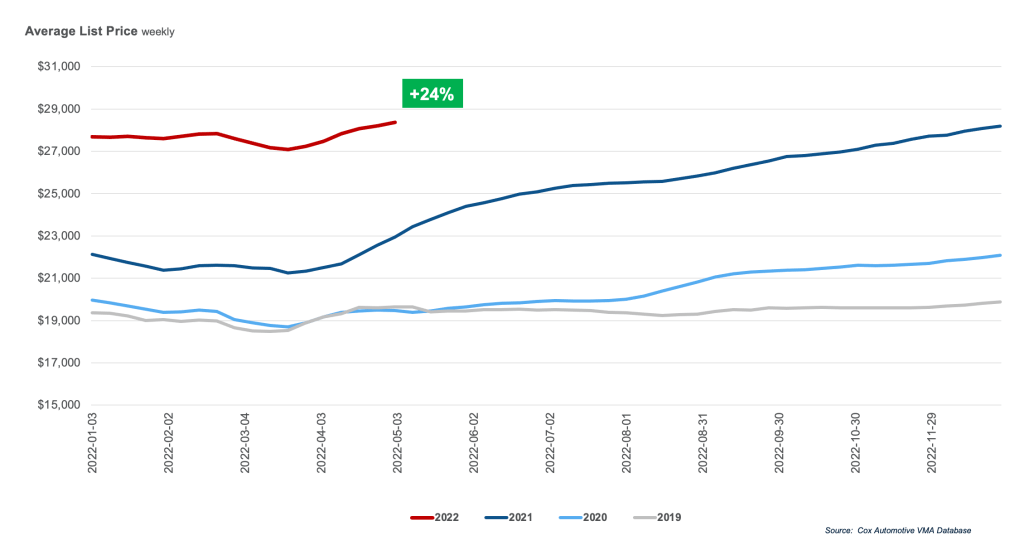

- The average used-vehicle list price climbed past $28,000, a first since December.

- Used-vehicle supply was slightly lower in April than March. Days’ supply was higher on softening retail sales.

Revised, June 16, 2022 – A spring sales bounce that has been late coming and more spread out than expected has now led to used-vehicle supply holding largely steady in April, according to the Cox Automotive analysis of vAuto Available Inventory data. The average retail list price, however, resumed its upward trajectory, surpassing the $28,000 mark again.

2.52M

Total Unsold

Used Vehicles

as of May 2

42

Days’ Supply

$28,372

Average Listing Price

68,370

Average Mileage

At the end of April, the total supply of unsold used vehicles on dealer lots across the U.S. stood at 2.52 million units. That compared with Cox Automotive’s revised number of 2.53 million at the end of March. Inventory opened May nearly 12% above year-ago levels.

Days’ supply at the end of April stayed steady at 42, compared with a revised number of 42 at the end of March. Days’ supply in April was 38% above year-ago levels. The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, in this case, ended May 2. Sales for that period were down 19% from the same time a year ago.

As is traditionally the case, used-vehicle supply had been building in the early part of the year until mid-February, the kick-off of the tax refund season when consumers often use an influx of cash to buy used vehicles. Though inventory levels remained above year-ago levels, the supply began edging downward as spring approached and sales picked up.

But the traditional spring sales bounce failed to produce any notable retail lift in April. In fact, Cox Automotive estimates used retail sales declined 13% in April from March and were down 21% from a year ago.

Tax refund season started slowly this year. Critical mass was finally achieved in April, and more cash is coming in May. Through April 29, 71% of projected refunds for the year had been issued, when in 2019, 99% had been by the same week. However, the average refund is up 11% versus 2019 and up 5% from a year ago to the highest refund ever recorded at this stage of tax refund season.

Rising vehicle prices may have scared off some consumers as financial conditions of many households worsened due to inflation and high gas prices. The average listing price at the end of April was $28,372, surpassing the $28,000 mark for the first time since December 2021. The average list price was $27,475 at the end of March.

“Prices remain high, but the growth rate for prices should begin to slow as the anniversary of the global computer CHIP shortage arrives,” said Charlie Chesbrough, Cox Automotive senior economist.

Wholesale used vehicle values, according to the Manheim Index, declined 1.0% in April on a seasonally adjusted basis. The decline left the Index at 221.2, which was up 14.0% from a year ago. The non-adjusted price change in April was an increase of 2.9% compared to March, leaving the unadjusted average price up 16.4% from a year ago.

The price categories from $15,000 to $30,000 represented the bulk of supply. More than 1 million of the 2.52 million vehicles available are in that range, according to Cox Automotive’s analysis of vAuto Available Inventory data. Days’ supply for those categories ranged from 43 to 51. The lowest priced segments – up to $15,000 – had the lowest supply and the lowest days’ supply of 30 to 36. Vehicles priced above $30,000 had at least 60 days of supply.

Average Used-Vehicle Listing Price

For more insights on used-vehicle inventory using a 30-day rolling sales methodology to calculate days’ supply, reach out to the Cox Automotive Public Relations team.

Michelle Krebs is executive analyst at Cox Automotive.