Press Releases

Cox Automotive Forecast: Auto Sales Recovery Continues on Track in August

Wednesday August 26, 2020

ATLANTA, August 26, 2020 – As summer winds down in the last week of August, the auto industry’s slow recovery appears to remain on track, at least for another month. According to a forecast released today by Cox Automotive, the seasonally adjusted annual rate (SAAR) of auto sales in August is expected to finish near 14.9 million, up from last month’s 14.5 million pace. Sales volume in August, forecast at 1.30 million, will increase 7% from July.

Compared to year-ago levels, however, vehicle sales in August are forecast to be down nearly 330,000 units. On the upside, seasonal adjustments for August suggest the volume drop isn’t as noteworthy as it may appear. There were two additional selling days in August 2019, and the Labor Day holiday, usually a big sales weekend, was included in the August results last year, but not this year. Even though unadjusted sales are expected to decline nearly 20%, the adjusted volume will decline only about 12% from August 2019.

August is another step forward in the market’s recovery, although the pace of sales improvement now appears to be slowing. According to Charlie Chesbrough, senior economist at Cox Automotive, “While the market continues to slowly improve, there are a number of factors preventing more robust gains. Limited inventory for some brands, as well as the ongoing high unemployment and low confidence from the pandemic, continue to keep sales from rebounding more quickly. There’s been a noticeable pull-back in incentives as well. These problems will likely persist, at least in the near term.”

Available inventory continues to plague much of the market and was the key story in August. Some brands were wrestling with significant shortages. Toyota, Lexus, and BMW all had less than 40 days of available inventory in the latter part of the month, far below the current industry average of 60.

“Obviously, you can’t sell what you don’t have,” added Chesbrough. “The lack of inventory likely kept some potential buyers out of the market.” Low inventory means less choice when it comes to vehicle color or trim package. It also means higher prices. Recent research from Cox Automotive notes nearly 20% of dealers have raised retail prices since the start of the pandemic. A similar percent of consumers admit they are putting the vehicle purchase on hold, waiting for a better deal.

August 2020 Sales Forecast Highlights

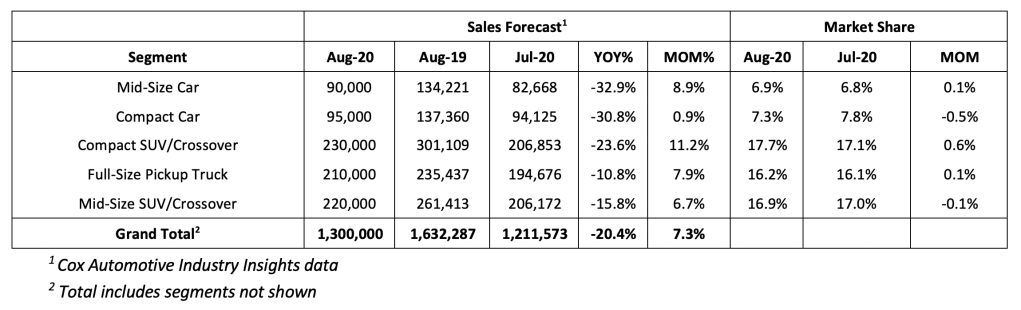

- New vehicle sales are forecast to finish at 1.30 million units, down nearly 20% compared to August 2019. When compared to last month, sales are expected to rise nearly 90,000, an increase of 7%.

- The SAAR in August 2020 is forecast at 14.9 million, far below last year’s 17.1 million level, but an improvement from last month’s 14.5 million pace.

- While all major segments are expected to see increased sales compared to last month, SUVs and pickup trucks will continue to outperform.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using cars easier for everyone. The global company’s 34,000-plus team members and family of brands, including Autotrader®, Clutch Technologies, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five countries and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with revenues exceeding $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com